Markets in Turmoil: A Comedy of Errors 🎭

What to know (if you dare):

- Bitcoin, that capricious darling, flirted with $100,000 before remembering it had standards-rebounding to a princely $101,000. Oh, the tragedy! 😱

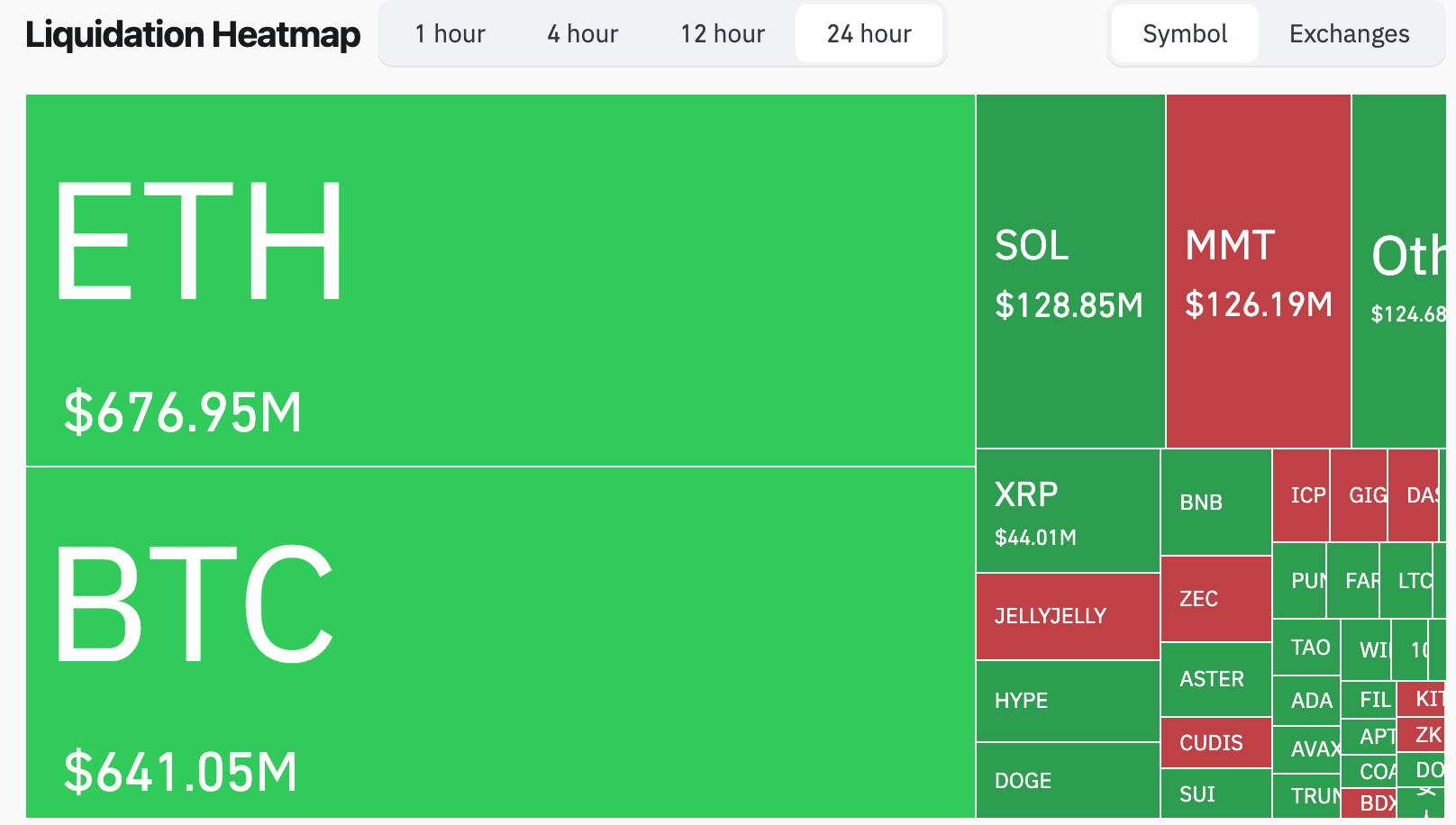

- A staggering $2 billion vanished faster than a nobleman’s patience at court-long traders wept into their silk handkerchiefs, losing $1.6 billion. Quelle horreur!

- Yet, like a stubborn court jester, analysts insist Bitcoin’s long-term prospects remain as bright as the king’s misplaced confidence. 🤡

Ah, what a spectacle! Bitcoin, that fickle coquette, tumbled late Monday, nearly kissing $100,000 before coyly retreating to $101,000. Meanwhile, leveraged traders-those reckless gamblers-found their fortunes erased quicker than a bad play’s reviews. 🎭

CoinGlass reports over $2 billion in futures contracts liquidated-long traders, ever the optimists, bore the brunt with $1.6 billion lost. Mon dieu! Such folly!

Liquidations-ah, the great equalizer! When traders borrow beyond their means, fate (or rather, the exchange) closes their positions with the swiftness of a guillotine. Such is the price of hubris! ⚔️

Large liquidations may signal capitulation-or, as we say in the theater, the moment before the villain’s downfall. Will Bitcoin rise like a phoenix, or is this merely Act I of a tragedy? 🎭

Traders, those ever-watchful gossips, track liquidation levels like courtiers tracking scandal. Where will forced selling strike next? The suspense! The drama! 🍿

This deleveraging-one of the grandest since September-reveals just how fragile the market’s nerves have become. After weeks of whipsawing, even the boldest speculators clutch their pearls. 😨

Bitcoin fell 5.5% in a day-quelle surprise! Ether plunged 10%, Solana and BNB stumbled 8% and 7%, while XRP, Dogecoin, and Cardano slid like courtiers on a freshly waxed floor. Down, down they go! 📉

The total crypto market cap? A mere $3.5 trillion-hardly enough to fund a king’s banquet, let alone a revolution. 🍽️

“Bitcoin danced around $100,000 today,” mused Gerry O’Shea of Hashdex, “as risk-off sentiment gripped markets tighter than a miser’s purse.” Ah, such poetry! 🎭

“FOMC rumors, tariffs, credit woes-oh my! And let us not forget long-term holders selling, as predictable as a bad actor forgetting his lines,” O’Shea added, ever the dramatist.

Bybit led the liquidation parade with $628 million, Hyperliquid followed at $533 million, and Binance-ever the supporting actor-chimed in at $421 million. The largest single loss? An $11 million BTC-USDT long on HTX. A true Shakespearean downfall! 🎭

Yet, analysts-those eternal optimists-still preach Bitcoin’s virtues. “$100,000 is but a number,” O’Shea declared. “The long-term case remains as sturdy as a king’s throne.” Or so he claims. 👑

With the Fed pausing and risk appetite thinner than a courtier’s patience, the next act awaits. Will Bitcoin rise in triumph, or shall another wave of selling crash the stage? Stay tuned, mes amis! 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2025-11-05 06:03