Ah, the price of Bitcoin, that fickle mistress! After a week of dazzling performances, it now finds itself in a rather unremarkable state, languishing a mere 4% from its recent peak. One might say it’s taking a leisurely stroll, reminiscent of the crypto market’s typical Sunday saunter in the year 2025.

Yet, as fate would have it, a band of investors appears to be the culprits behind this sudden lethargy. Their actions suggest that the bull cycle, much like a tired old horse, may be nearing its final gallop.

When Will BTC Price Experience a Dramatic Correction? 🎭

In a recent revelation on the social media platform X, the investment data firm Alphractal has uncovered that our dear short-term holders (STH) are beginning to part ways with their beloved coins. These short-term holders, known for their impulsive nature, have been seen trimming their holdings like a gardener pruning a rose bush after a rainstorm of price increases.

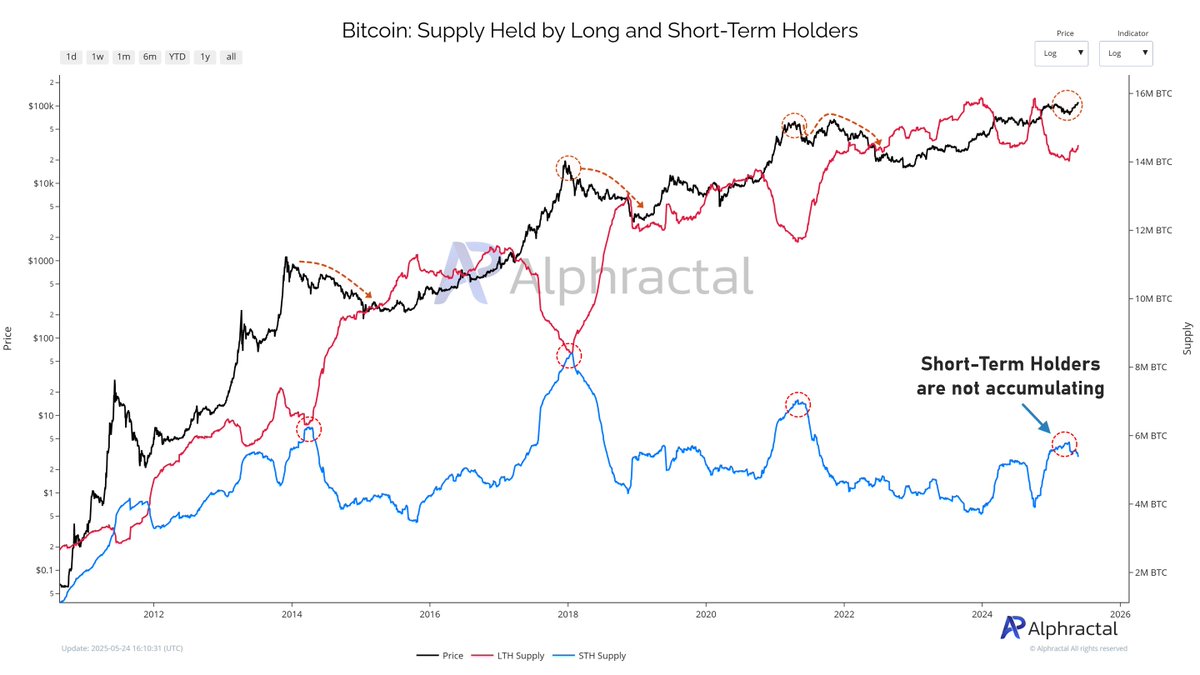

This on-chain drama unfolds through the Bitcoin Supply Held By Short-Term Holders indicator, which tracks the amount of BTC owned by investors for less than 155 days. The chart, if one were to gaze upon it, reveals a troubling decline, hinting at a mass exodus of short-term investors.

Historically speaking, when the supply held by STH takes a nosedive, it often signals that Bitcoin is perched precariously near its cycle peaks. These reactive investors, in their haste to offload assets as prices rise, inadvertently stifle demand. Alphractal has dubbed this a “classic sign” that the bull cycle may be nearing its curtain call.

Moreover, the on-chain analytics firm has pointed out that the Short-Term Holder realized price currently hovers around $94,500, acting as a lifebuoy for this group, preventing them from sinking into the depths of despair. In stark contrast, the Long-Term Holder realized price stands at a modest $33,000, highlighting a curious behavioral rift between the two factions of investors.

In a twist of irony, Alphractal reminds us that despite the STH distribution, Bitcoin managed to reach new heights in 2021. Thus, they maintain that there is still a glimmer of hope for BTC to rise, even as macro signals and the halving cycle pattern suggest a significant correction may be lurking just around the corner, post-October 2025.

Bitcoin Price Snapshot 📈

As of this moment, the price of BTC rests just below $109,000, reflecting a modest 0.4% increase over the past 24 hours. According to the ever-reliable CoinGecko, our flagship cryptocurrency has enjoyed a 5% rise over the last week. Who knew that digital coins could be so dramatic?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2025-05-25 19:19