As an analyst with over a decade of experience in the financial markets, I have seen my fair share of market volatility and unexpected events. The recent analysis by K33 Research on the potential short squeeze in the Bitcoin market caught my attention, given the parallels I see with some historical events.

According to a recent study by K33 Research and reported by Bloomberg, there’s an escalating possibility of a “short squeeze” happening in the Bitcoin market. This scenario could cause rapid increases in the price of the world’s leading cryptocurrency. This warning is issued due to noticeable signs of pessimism among speculators within the Bitcoin derivatives market, particularly the perpetual futures sector.

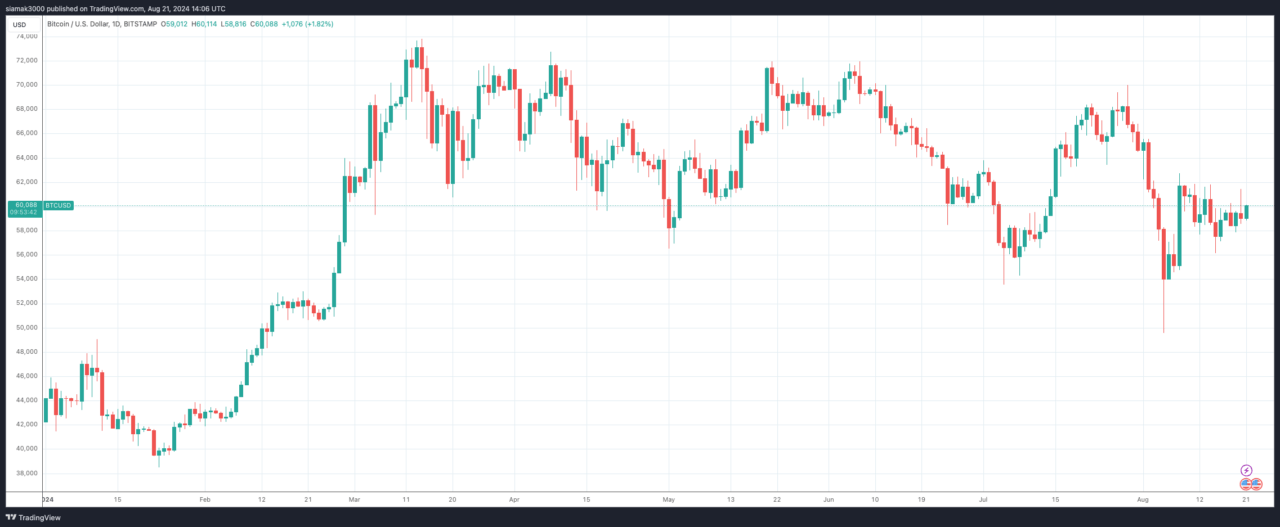

The key indicator behind this potential short squeeze is the funding rate for Bitcoin perpetual futures. This rate is a critical gauge of market sentiment, revealing whether traders are predominantly bullish or bearish. As of August 20, K33 noted, that the seven-day average annualized funding rate had dropped to its lowest level since March 2023, a time when the failure of several US banks shook investor confidence. This low funding rate suggests that many traders are betting on Bitcoin’s price to fall.

K33 analysts Vetle Lunde and David Zimmerman noted that the simultaneous occurrence of negative funding rates and a significant rise in open interest suggests intense short selling activity. In such a market condition, a sudden surge—often referred to as a “short squeeze” where sudden price hikes force traders to rapidly close their short positions—is quite possible. This abrupt buying demand could intensify any price uptrend, potentially leading to a swift rally.

Lately, the Bitcoin market has been tough going due to its persistent difficulties maintaining prices over $60,000 during August. Unlike other financial sectors like worldwide stocks and gold that are thriving, Bitcoin’s performance pales in comparison, as reported by Bloomberg.

In addition, the perceived total amount of outstanding contracts (open interest) for Bitcoin’s perpetual futures market has significantly increased by approximately 29,000 Bitcoins within the last week, indicating a large number of bearish wagers being made.

1. Cryptocurrency dealers often choose perpetual futures due to their lack of expiration, which enables uninterrupted speculation. According to Bloomberg’s analysis from K33, the current blend of increasing open interest and negative funding rates is rare and might signal an impending major market shift.

Apart from the derivatives market, other factors are affecting Bitcoin’s price, too. For instance, there’s speculation that the US government might be liquidating seized Bitcoins, which is contributing to its downward trend. Additionally, traders are keeping a close eye on comments by Federal Reserve Chair Jerome Powell regarding future monetary policies, as these could potentially introduce more market volatility.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-08-21 17:25