Hold onto your digital wallets, folks! Bitcoin has just jumped a thrilling 9.4% over the past seven days, with a wild single-day surge of 9.65% between April 21 and 22. And what’s this? A dramatic shift in on-chain behavior, reminiscent of the heady days before Bitcoin’s historic 2017 bull run. Déjà vu, anyone?

Fewer BTC Sent to Exchanges — A Bullish Signal? 🤔

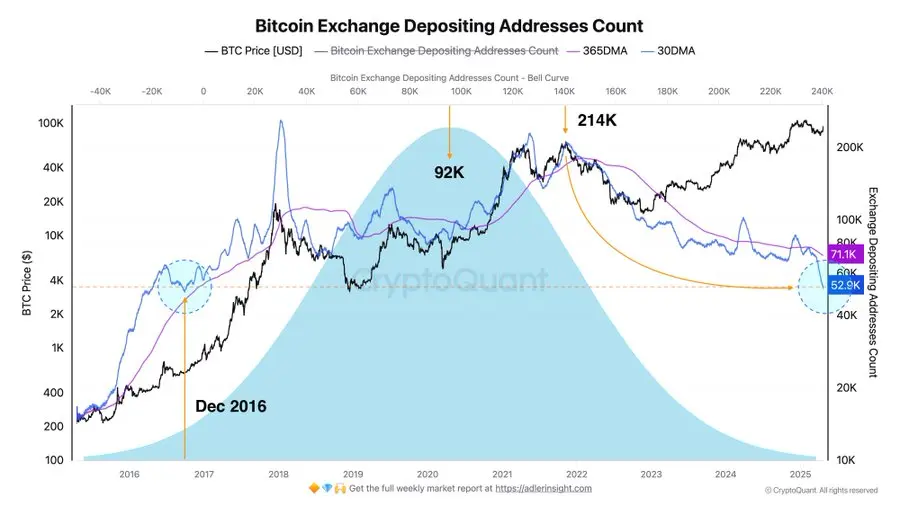

Enter Axel Adler Jr, crypto analyst extraordinaire. His astute observation shows that Bitcoin addresses depositing BTC to exchanges are on a steady decline—something that’s been brewing since 2022. Here’s a quick rundown of the stats, so take notes, or don’t, it’s your life:

- 30-day average: ~52,000 addresses 🧐

- Yearly average: ~71,000 addresses 📉

- 10-year average: ~92,000 addresses 🤯

This sharp drop hints at a serious cooling of selling pressure. Normally, when investors shuffle their BTC to exchanges, it’s a clear sign they’re looking to sell, so fewer deposits could mean they’re feeling pretty confident about holding on for dear life (HODLing). Intriguing, right?

Chart Flashback: December 2016 — A Blast From the Past! 📅

Now, let’s hop into the way-back machine! The current address count looks eerily similar to levels last seen in December 2016. Back then, Bitcoin saw a solid monthly gain of 29.2%, which was quickly followed by an absolutely bonkers 1,369% rally in 2017. Coincidence? Probably not. History might be knocking, and this time, it’s not asking for directions.

Adler seems to think history is indeed repeating itself, and he sees the decline in exchange deposits as a sign of one thing: more HODL-ing. Investors are deciding to hold their BTC like it’s the last packet of biscuits on the shelf.

- Also Read:

- Investors Still Skeptical About the BTC Price Rally—Is This a Calm Before the Storm or a Reversal Incoming? 💭

- ,

What Does This Mean for Bitcoin Price? 📈

With fewer coins heading to exchanges and Bitcoin seeing a 13.3% gain over the last two weeks, the price could be getting ready to take off like a rocket ship. If we follow the 2016 playbook, this might just be the early rumblings of a mighty bull run.

As more people HODL and selling pressure drops, Bitcoin’s path to new all-time highs could be closer than that last slice of pizza you’re eyeing. 🍕

Never Miss a Beat in the Crypto World! 🔥

Stay ahead with the latest news, expert analysis, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and more. Because who doesn’t want to be the smartest person in the room when it comes to cryptocurrency?

FAQs 🤓

How much will 1 Bitcoin cost in 2025?

According to Coinpedia’s BTC price prediction, 1 BTC could reach a peak of $168k this year if the bullish vibes hold strong. ✨

How much will 1 Bitcoin be worth in 2030?

If we all get on the Bitcoin train, 1 BTC could soar to a staggering $901,383.47 by 2030. 🚀

How much will the price of Bitcoin be in 2040?

According to the latest BTC analysis, 1 Bitcoin could be worth a jaw-dropping $13,532,059.98. Cha-ching! 💰

How high will Bitcoin go in 2050?

In 2050, a single BTC could top $377,949,106.84. At that point, you might just buy a small country. 🌍

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-24 14:29