As a seasoned crypto investor with a decade of experience under my belt, I’ve seen enough cycles to know that Bitcoin‘s dance between ATH and profit-taking is as predictable as the rising and setting sun. The current pullback, while a bit nerve-wracking for some, doesn’t shake my faith in its long-term potential one bit.

Earlier in the week, Bitcoin hit a record peak, momentarily soaring above $108,000. Yet, this digital currency, often referred to as the ‘crypto king’, has experienced a dip since then, falling below $96,000.

Even though a temporary drop suggests investors are cashing out for now, it doesn’t diminish the digital currency’s future promise; in fact, its long-term allure remains undiminished and captivating.

Bitcoin Is Changing Hands

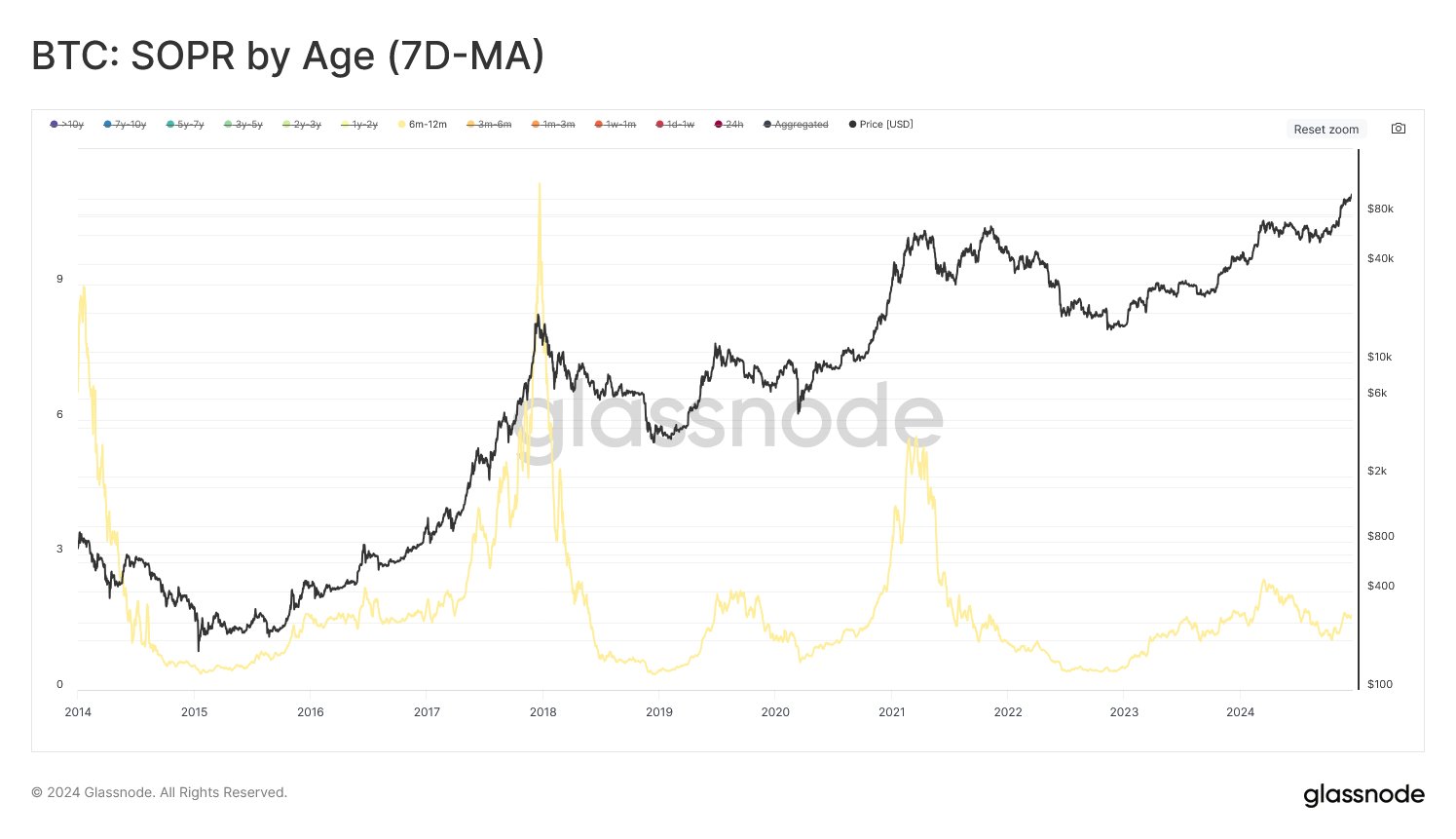

Investors who have owned Bitcoin for a period of six to twelve months are driving the current wave of cashing out profits. They amassed their holdings during previous market fluctuations, and are now capitalizing on this moment to secure their earnings.

During this phase, the behavior resembles that of the 2015-2018 bull run where the Spent Output Profit Ratio (SOPR) stayed consistently below 2.5 for a long time, eventually leading to a frenzied surge in prices.

In past bull markets, it’s probable that heavy selling from current investors will result in a period of decline. For Bitcoin to continue climbing, it’s essential that demand grows and new buyers enter the market. If these conditions aren’t met, the upward trend could struggle to remain consistent.

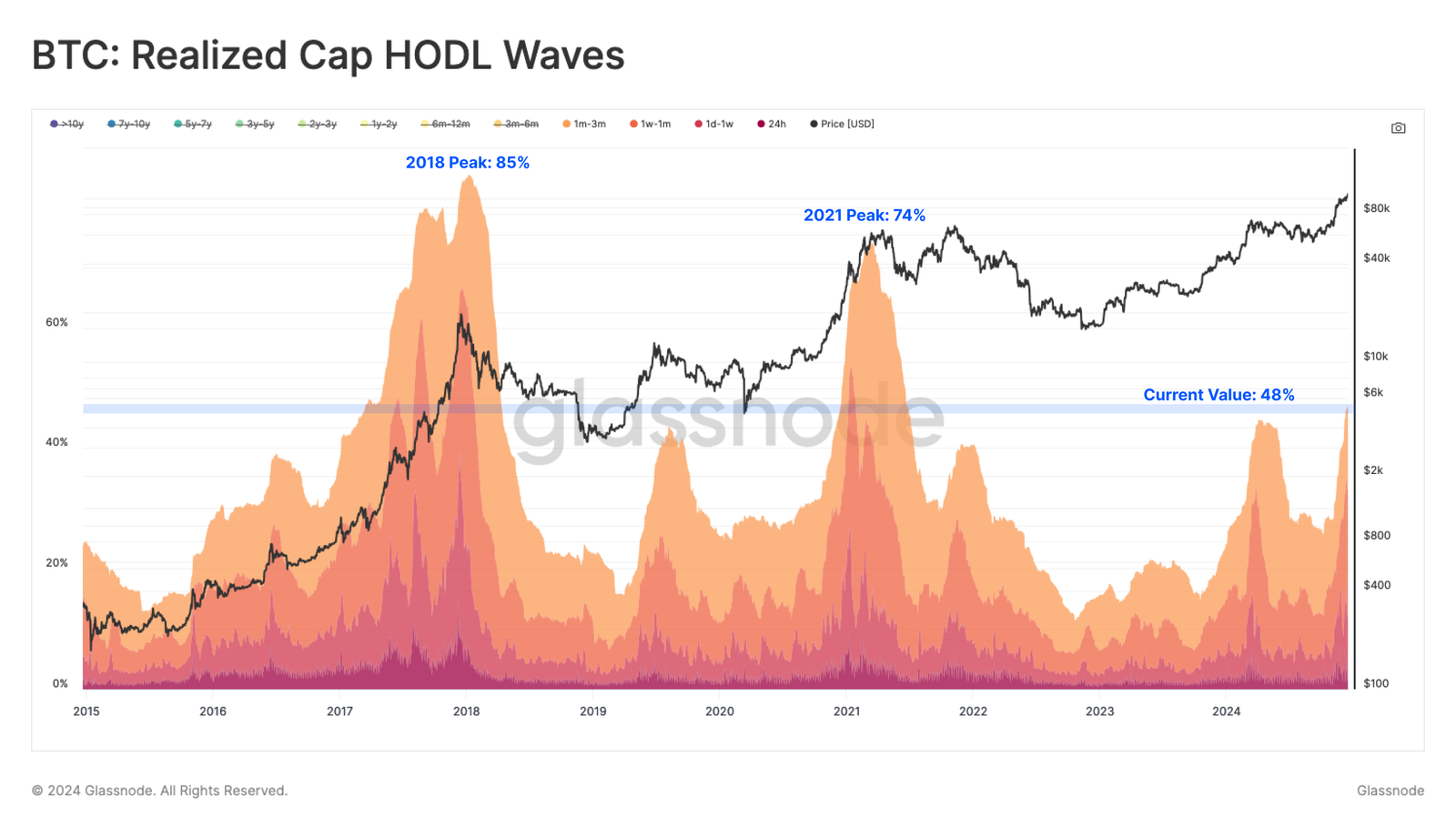

The surge in HODL waves signifies an uptick in Bitcoin wealth among newly active users, suggesting a heightened level of market activity driven by demand. Long-term investors are transferring their coins to new buyers, implying that fresh funds are being invested in Bitcoin. This pattern underscores the growing enthusiasm for Bitcoin amidst price volatility.

However, the proportion of wealth held by newer investors has not yet reached levels seen during the peak of prior ATH cycles. While the current metrics show positive signs, Bitcoin’s macro momentum hinges on whether this demand continues to grow. Sustained accumulation by new market participants will be key to driving future price rallies.

BTC Price Prediction: Recovery Ahead

It’s anticipated that Bitcoin might soon encounter support near $95,000. With its current price standing at $95,144, there’s a possibility it may rebound as long as the market remains optimistic.

The significant upcoming target for Bitcoin is converting $95,668 into a support level. If we manage to do that, it could open up possibilities for Bitcoin’s price to surge back over $100,000. Breaching this psychological hurdle would suggest renewed optimism and bullish power, possibly attracting more investors.

If Bitcoin fails to maintain its position within the $95,000 range or if there’s an increase in selling pressure (profit-taking), it might slide downwards. In such a case, the next substantial level of support can be found at approximately $89,800. A drop to this level could weaken the bullish outlook, potentially indicating a shift towards a bearish trend in the market.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-20 14:34