As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I must admit that the current surge in Bitcoin’s price and the predictions of it reaching $115,000 by Christmas have piqued my interest. The influx of stablecoin liquidity, the buying pressure on the BlackRock Bitcoin ETF options market, and the heightened trading activity all suggest a bullish trend for BTC.

Bitcoin has reached a new all-time high, briefly trading at $99,500 during Friday’s intraday session before pulling back slightly. As of now, the cryptocurrency is priced at $98,675.

As a market analyst, I’m observing an increase in trading activity as we approach the significant $100,000 threshold. According to our research at 10X Research, if this breakthrough occurs, we anticipate Bitcoin could surge to around $115,000 by Christmas.

Why Bitcoin May Touch $115,000 Soon

10X Research’s latest findings indicate an increase in liquidity within the Bitcoin market over the past couple of weeks. This development, considered crucial, might propel Bitcoin towards the anticipated price point of $115,000.

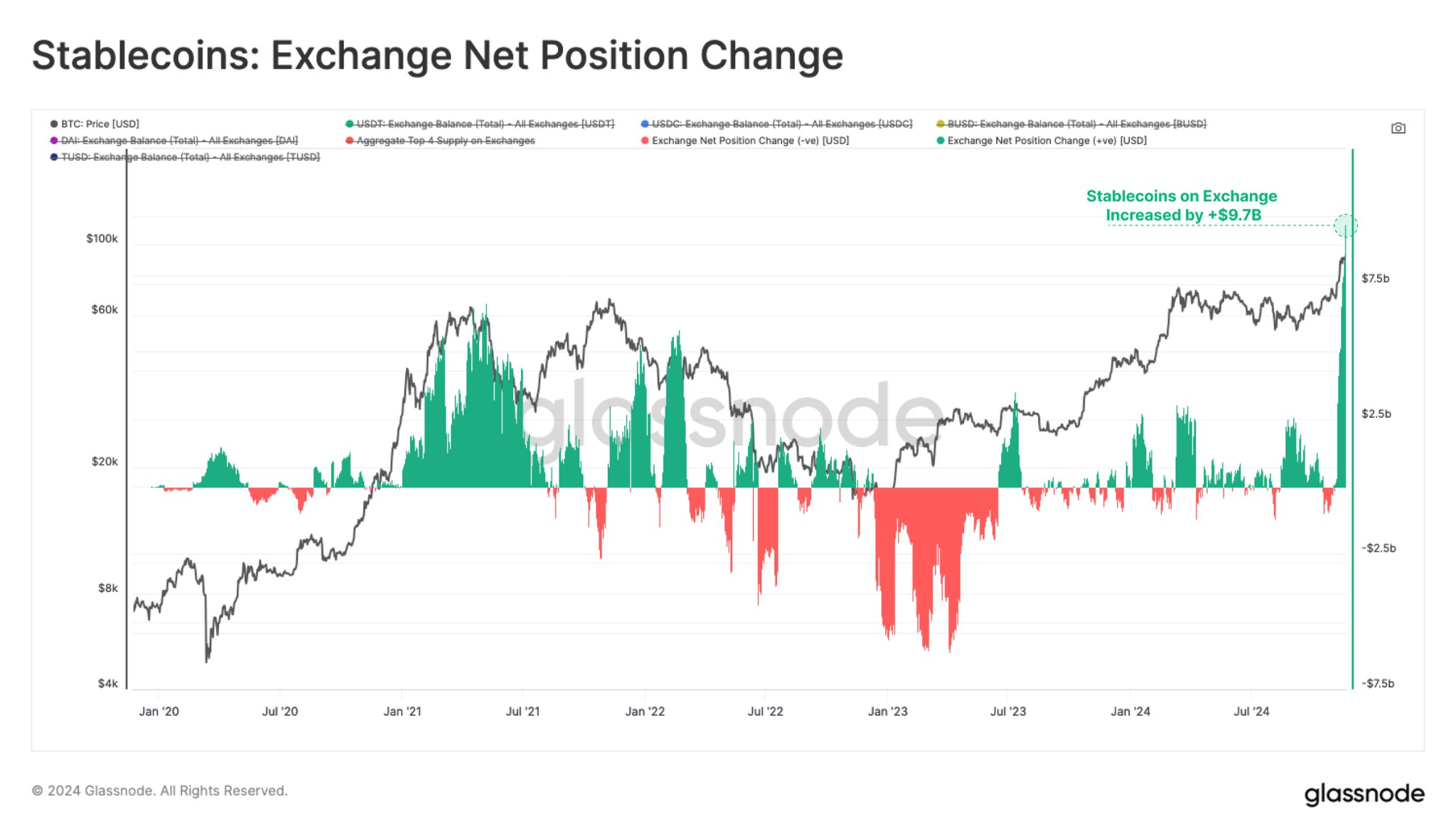

Over the past month, Tether, a stablecoin issuer, produced $10 billion, and Circle added an additional $3 billion. This influx has driven the market’s momentum and increased the flow of stablecoins to cryptocurrency exchanges significantly during that period. Recently, Leon Waidmann, the head of research at The Onchain Foundation, affirmed this in a November 21 post on X.

In just a month, stablecoin deposits into exchanges reached an astounding $9.7 billion – the highest monthly deposit amount ever recorded. This surge in stablecoins indicates a return of liquidity and fueled by escalating speculative interest.

An increase in funds moving into stablecoins on cryptocurrency platforms is typically a positive indication, as it often results in higher demand for crypto assets due to increased purchasing power, causing their values to rise.

10X Research stated that there is a huge influx of liquidity, as indicated by increased trading activity with daily spot volumes often surpassing $200 billion. Furthermore, they noted that the total value of the cryptocurrency market has risen significantly, reaching over $3.2 trillion – comparable to the size of the UK’s stock market.

The increased buying of call options for the BlackRock Bitcoin ETF (IBIT) by traders could potentially drive its price up to $115,000 by Christmas, as indicated by the data from 10X Research. As of November 22, the number of call options versus puts has risen to 5.5 to 1, compared to 3.8 to 1 on Thursday. These call buyers are aiming for strike prices in the range of 110-120%, implying that they anticipate Bitcoin’s price to surge past $100,000 soon.

The report indicates that investors are primarily looking at call options with strike prices between 110% and 120% of Bitcoin’s current value, which implies they don’t expect a quick halt at the psychological $100,000 mark. Instead, it seems the market anticipates a surge in Bitcoin’s price towards $105,000 or even $115,000 by Christmas, with the higher strike price showing the most significant interest in open options.

BTC Price Prediction: All Rests With the Buyers Now

Based on findings from the research company, this situation might lead to a small gamma squeeze, which could cause Bitcoin’s value to move towards those price points. Consequently, reaching $100,000 could just be another milestone in Bitcoin’s continuous rise.

I’m seeing BTC trading at around $98,675 right now. If the buying pressure continues, it could push the price back to its all-time high of $99,500, and maybe even beyond that. Hitting this level as support could signal a strong uptrend towards $100,000 and possibly more.

Conversely, should the driving force behind buying decrease, Bitcoin’s price could potentially fall to around $88,816. This level would serve as a significant point of support. If this happens, it would challenge the optimistic perspective presented earlier.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-22 23:09