As a seasoned crypto investor with a decade-long journey navigating the tumultuous seas of digital assets, I find myself intrigued by Bitcoin Cash (BCH) as it surges past the $10 billion market cap and inches closer to key resistance levels. The recent 10%+ spike in price is undeniably promising, yet I remain cautiously optimistic.

In the past day, the price of Bitcoin Cash (BCH) has increased by over 10%, pushing its market capitalization above $10 billion, suggesting a resurgence in bullish sentiment. This recent spike in value brings BCH near significant resistance levels, hinting at potential additional growth if the upward trend continues.

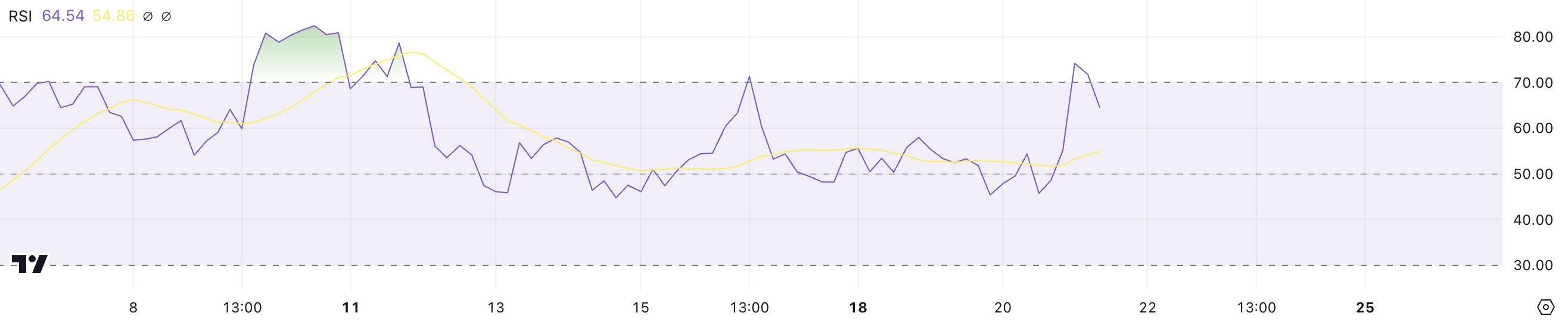

On the other hand, signs such as the Relative Strength Index (RSI) and Average Directional Index (ADX) suggest that the trend is moving forward, but it’s not yet at its maximum strength. The future trajectory of Bitcoin Cash could be either a continued climb or a potential dip, hinging on how it manages crucial resistance and support levels in the forthcoming days.

BCH Current Uptrend Is Getting Stronger

Currently, the ADX (Average Directional Movement Index) of BCH stands at 19.31, which is a rise from 12 recorded only yesterday. This upward trend suggests that the power behind the directional movement of BCH is growing stronger after experiencing some weakness.

Yet, as the ADX remains under 25, this implies that the current uptrend does not show a robust or prolonged degree of trend power yet.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or uncertain trend. While Bitcoin Cash is currently in an uptrend, the ADX at 19.31 suggests that the trend is still in its early stages of strengthening.

If the ADX consistently surpasses 25, it might signal a more robust upward trend; however, at this point, the fluctuations in Bitcoin Cash’s value are proceeding with caution, allowing for potential additional growth.

Bitcoin Cash Is Not In The Overbought Zone Anymore

As a researcher, I’ve observed a noteworthy shift in Bitcoin Cash’s Relative Strength Index (RSI), which currently stands at 64.5. Compared to yesterday’s figure over 70, this indicates a drop. This descent might signal a slowdown in the buying pressure, suggesting that while the asset continues to exhibit bullish momentum, the intensity of such growth may be easing off.

The drop below 70 takes BCH out of the overbought zone, indicating a more balanced market sentiment.

The RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 64.5, BCH remains in bullish territory, which supports the ongoing uptrend.

But, a minor drop in RSI might signal that the rate of growth for BCH is slowing down, which could cause the price to stabilize temporarily before any potential increase continues.

BCH Price Prediction: Will a New Surge Occur Soon?

If Bitcoin Cash (BCH) sustains its ongoing upward trend and gathers even more pace, it may persistently ascend further, having surged over 10% in just the past 24 hours.

This potent force might prompt Bitcoin Cash (BCH) to challenge its resistance at approximately $536.9. If it manages to breach this barrier, it would indicate the persistence of bullish energy and potentially stimulate additional purchasing enthusiasm.

Conversely, should the upward trend weaken and reverse, Bitcoin Cash’s price might retest its nearest support levels at approximately $424 and $403. If these supports prove insufficient, the price could potentially drop to around $364, indicating a possible 27% correction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-11-21 18:20