As a seasoned crypto investor with a knack for spotting trends and patterns, Aylo’s analysis has certainly piqued my interest. His historical data on Bitcoin’s performance around October 15th offers an intriguing perspective for both short-term and medium-term investors like myself.

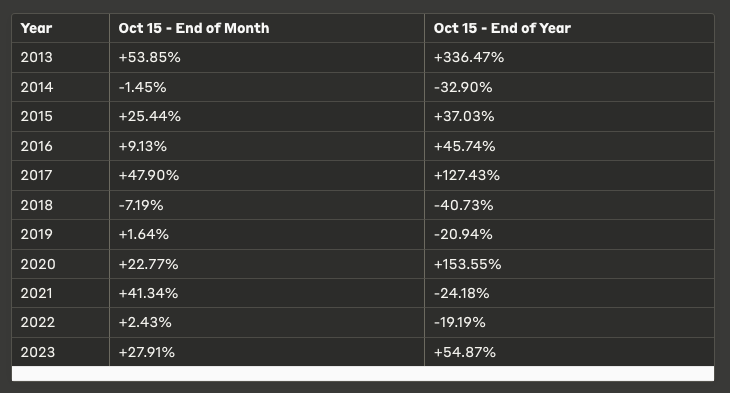

Cryptocurrency expert Aylo has offered insights on Bitcoin‘s past performance since mid-October, emphasizing interesting trends that could benefit both short-term and long-term investors. Specifically, Aylo noted that Bitcoin has produced profitable results from October 15th to the end of the month in nine out of the last eleven years, which suggests an attractive opportunity for short-term traders. Aylo believes that this historical trend offers additional reassurance for speculators, particularly considering Bitcoin’s strong track record during this time frame.

Aylo talked about the possibility for investors who bought Bitcoin between October 15 and the end of the year, but the results have been less consistent in this scenario. Interestingly, he pointed out that only six out of the last eleven years have shown positive returns during this time period, while five years saw negative results. However, Aylo emphasized the impressive gains Bitcoin made after previous halving events, specifically a +45.74% and +153.55% increase in the two years following these events. Additionally, he noted that these periods often occurred during U.S. election years, which could lend a bullish tone to the current cycle.

In his analysis, Aylo presented a comprehensive table which underscores the same findings, highlighting Bitcoin’s earnings from October 15 to the end of the month and to the end of the year, between 2013 and 2023. According to Aylo, these historical trends might be valuable for investors, as past events are often significant in investment circles. He opines that at present, short-term traders and medium-term investors could experience favorable returns due to this cyclical moment, based on the given historical data points.

Additionally, Aylo emphasized economic factors on a larger scale that might strengthen Bitcoin’s upward trend. He pointed out that we’re past the first non-recessionary interest rate reduction, with further cuts anticipated in the current quarter. In his view, this additional convergence provides investors with an extra motivation to lean toward a bullish perspective on Bitcoin in the coming days.

Aylo emphasized that while past data doesn’t always predict future results, it is crucial for investors when formulating decisions. In his perspective, the current blend of historical trends and advantageous economic conditions fosters a great deal of optimism among Bitcoin supporters, offering what he referred to as “hopeful optimism” or simply “hope” for those with a positive viewpoint on Bitcoin’s future price movements.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-10-16 18:21