As a seasoned researcher with years of experience analyzing market trends, I’ve seen my fair share of bull runs and bear markets. The recent decline in Bitcoin‘s price has caught my attention due to its rapidity and potential implications.

The falling BTC price has pushed it below the Leading Span A of its Ichimoku Cloud, a significant support level that indicates weakening momentum. This, coupled with the negative Chaikin Money Flow (CMF), suggests increased selling pressure and a potential bearish shift.

However, as history has taught us, markets can be unpredictable, and a resurgence in buying activity could potentially drive BTC’s price back above its dynamic resistance of $97,675. If that happens, we might just see another run at the all-time high of $108,230.

On a lighter note, let me remind you of an old saying in the market: “Markets can stay irrational longer than you can stay solvent.” So, always remember to manage your risks and never bet the farm on any single asset!

After experiencing a small increase during the holiday season, Bitcoin has more recently experienced a drop. It seems that investors are taking their gains, which is causing a push towards lower prices for the top-tier cryptocurrency.

Based on my years of observing and analyzing market trends, I believe that with decreasing buying activity, the price of Bitcoin (BTC) could soon dip below the crucial $90,000 mark. Here are some insights as to why I hold this view, drawing from my personal experiences in the ever-evolving world of cryptocurrencies.

First and foremost, it’s essential to acknowledge the cyclical nature of market trends. When buying activity weakens, it often signals a shift in investor sentiment, which can lead to a downward spiral in prices as sellers outnumber buyers. This has been observed numerous times in various markets, not only cryptocurrencies.

Secondly, recent developments in the broader economy and geopolitical landscape have created uncertainty, leading investors to reconsider their risk appetite. As a result, they may be less inclined to invest heavily in high-risk assets like Bitcoin, further exacerbating the weakening buying activity.

Lastly, it’s worth noting that while BTC has shown resilience in the past, its price performance is not solely dependent on its intrinsic value but also on market sentiment and external factors. In a bearish market environment, even strong assets can experience a temporary decline.

In conclusion, while I am optimistic about Bitcoin’s long-term prospects, it’s crucial to remain vigilant in the short term. As an investor with several years of experience in this space, I have learned that markets are unpredictable, and it’s always essential to be prepared for various scenarios. Keep a close eye on buying activity, broader market trends, and geopolitical developments, and adjust your strategy accordingly.

Bitcoin Bears Apply More Pressure

Recently, Bitcoin’s value has dipped enough to fall beneath its Ichimoku Cloud’s Leading Span A (represented by the green line). At present, it is trading at this level. This indicator follows the momentum of market trends for an asset and can pinpoint potential areas where support or resistance might occur.

As a researcher, when I observe that an asset’s price drops beneath the Leading Span A within its Ichimoku Cloud, it signifies a possible weakening of momentum and potentially a transition towards a bearish trend. The Leading Span A functions as a short-term support level; therefore, breaching this level indicates a potential lessening of the asset’s uptrend strength.

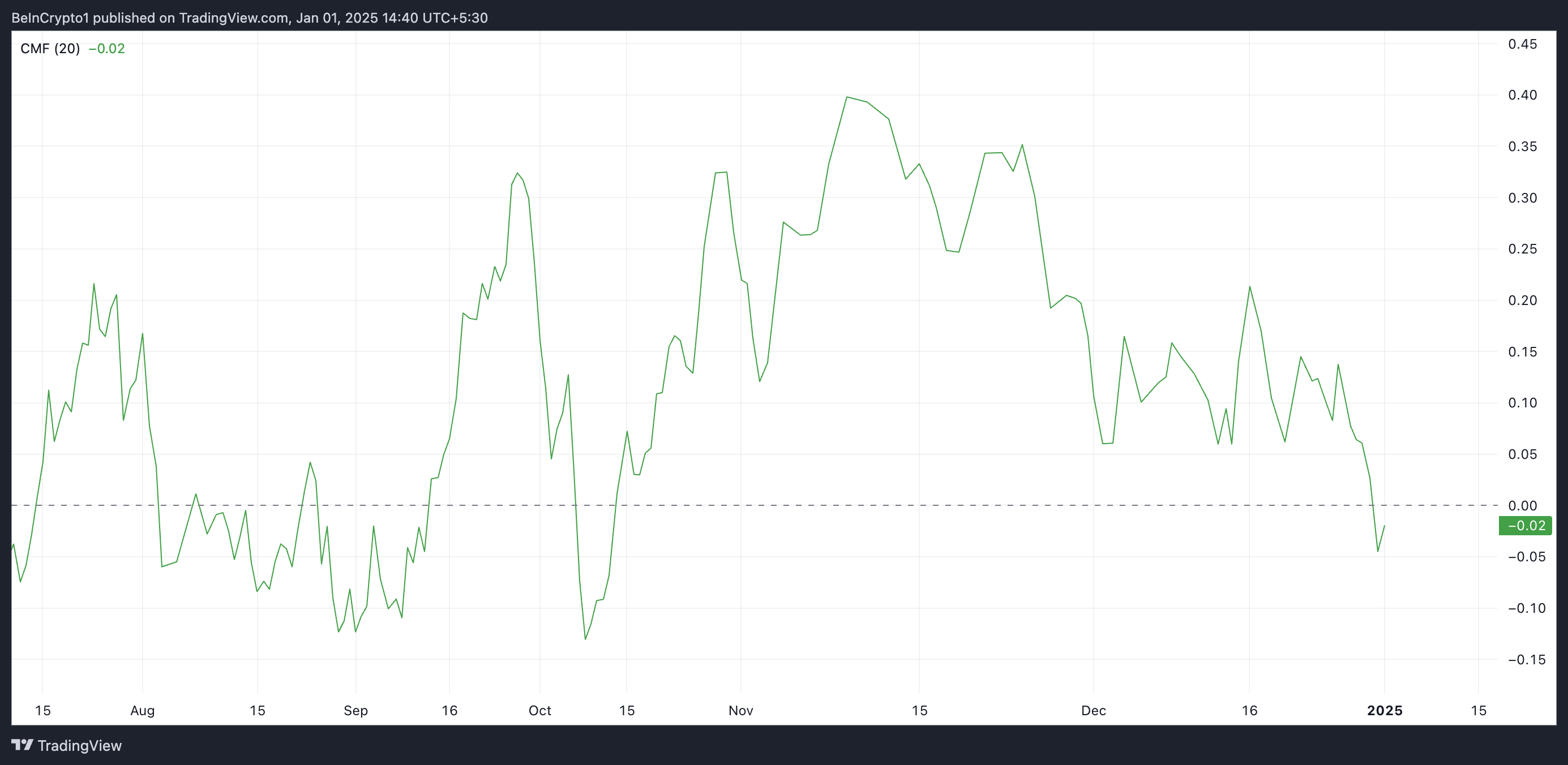

Additionally, the low Chaikin Money Flow (CMF) of the bitcoin coin indicates a decrease in its demand. At present, the CMF is sitting below the zero line at -0.02.

The CMF indicator, which gauges the intensity of money movement into or out of an asset over a defined time frame based on cost and volume, can be interpreted as follows: When Bitcoin’s value dips below zero, this signifies that sellers are exerting more pressure than buyers, indicating higher outgoing funds rather than inflows. This bearish signal suggests decreasing demand and potential for price decrease or downward trend.

BTC Price Prediction: Will $91,000 Support Hold?

If the demand for Bitcoin continues to decrease, it might not be able to maintain its current significant support level at around $91,488. In this case, the price of Bitcoin could drop below the $90,000 mark for the first time since early November, potentially trading at approximately $86,697 instead.

If Bitcoin (BTC) sees an increase in buying activity, it might surge past the dynamic resistance of approximately $97,675 set by the Leading Span A of its Ichimoku Cloud. Overcoming this barrier could potentially lead BTC’s price back towards retesting its record high of around $108,230.

Read More

2025-01-01 15:11