As a seasoned researcher with over two decades of experience in financial markets, I’ve seen my fair share of volatility and market turmoil. Yet, the recent Bitcoin liquidation event has caught my attention for its sheer magnitude and parallels to past crises like FTX’s collapse.

Over the last day, Bitcoin (BTC) experienced significant price fluctuations, causing turbulence across the cryptocurrency sector. A sudden drop in prices led to approximately $1 billion worth of liquidations, representing one of the biggest market sell-offs since FTX’s 2022 financial downturn.

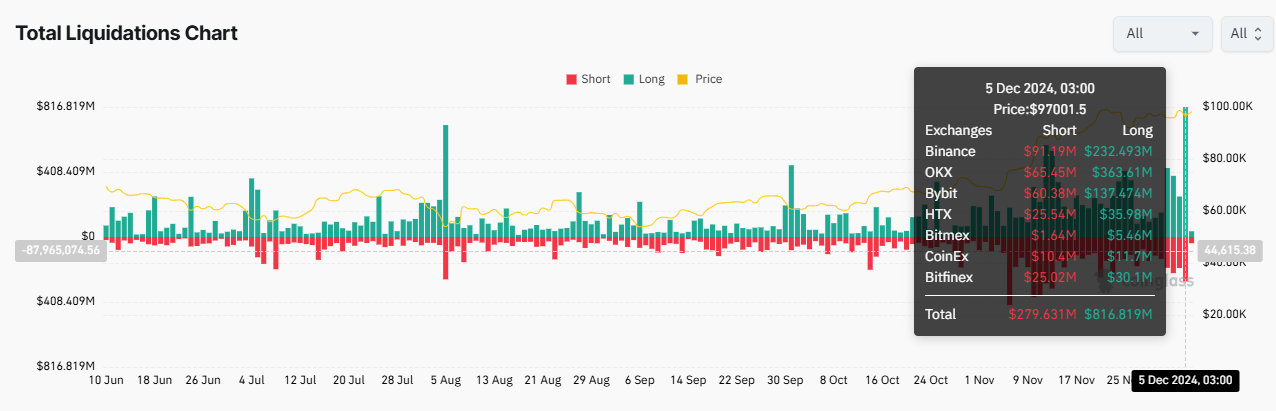

As a crypto investor, I recently witnessed a significant event: approximately $900 million worth of Bitcoin positions were liquidated when the price dropped from an impressive $100,000 to $90,000, only to bounce back up to $97,000. Data from Coinglass shed light on this dramatic shift in the market.

Bitcoin Marks Largest Multi-Year Liquidation Event

The significant sell-off event impacted approximately 156,000 traders worldwide, as positions worth a total of $816.819 million (longs) and $279.631 million (shorts) were forced to close. As reported by Coinglass, the most substantial individual liquidation, worth nearly $19 million, took place on the OKX trading platform.

Experts are finding similarities to the FTX incident. McKenna, a well-known figure in the cryptocurrency world, asserts that this recent event marks the largest liquidation since the bankruptcy of FTX. Many others within the community share this perspective.

“Spot buyers are now stepping in, hovering up the liquidation cascade,” McKenna noted.

Amidst the ongoing chaos, a Web3 data analysis tool called Lookonchain pointed out that Mt. Gox transferred 3,620 Bitcoins worth approximately $352.69 million to two new digital wallets. This transfer occurred shortly following Mt. Gox moving an astounding $2.43 billion in Bitcoin to unidentified wallets, a move that took place just hours after Bitcoin’s price surpassed the $100,000 mark.

Discussion about the possibility that the U.S. government sold Bitcoins during this timeframe has added to the instability and doubt in the market.

“Did the US government hit the sell button on the BTC they sent to Coinbase?” one user quipped.

Regardless of these transactions, various elements played a crucial role in causing the extensive liquidations. Among these factors, profit-taking, large sell orders at key points, and overleveraged positions were found to be substantial contributors. Numerous traders made wagers on Bitcoin’s ongoing ascent using borrowed funds, making them vulnerable when prices fell.

Financial analyst Jacob King from WhaleWire expressed his criticism towards retail investors who heavily leveraged their investments, as they were entering into long positions during the market’s record highs.

In simpler terms, King wrote that it’s common for retail investors to buy leveraged long positions (investments where they borrow money to invest more) when prices are at record highs, only to find that large investors (whales) are selling off their shares, leading to potential losses for the retail investors.

Whales Capitalize on the Bitcoin Dip

In the midst of the turmoil, some significant investors spotted a potential opening. According to blockchain analytics firm Lookonchain, a ‘whale’ (a term used for large investors) bought 600 Bitcoins worth approximately $58.85 million when prices were falling sharply. This purchase adds to their previous two-week accumulation of 1,300 Bitcoins, currently valued at around $127 million. This strategic buying underscores the attractiveness of Bitcoin, even in times of market instability.

Following Bitcoin’s (BTC) price drop from $100,000, a significant investor, known as a ‘whale’, capitalized on the situation and purchased approximately 600 BTC for around $58.85 million. Over the last fortnight, this whale has amassed a total of 1,300 BTC, which is currently valued at roughly $127 million, according to Lookonchain.

Although the liquidation occurred, certain experts interpret it as a required adjustment within Bitcoin’s ongoing bull market, potentially signaling a temporary low point. However, some counter that the long-term foundations of Bitcoin are unchanged, with evidence coming from increased activity among large investors (whales) and consistent accumulation.

In simple terms, the overall crypto market mirrored Bitcoin’s price fluctuations, causing Ethereum and other significant cryptocurrencies to see increased sell-offs as well. As traders adapt to these changes, attention is drawn towards Bitcoin regaining crucial support at approximately $97,000 and maintaining its historic surge.

As per the data from BeInCrypto, at the time of writing, Bitcoin’s value stood at approximately $98,404. This is a decrease of about 4% compared to the opening of the trading session on Friday.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-06 12:09