The price of Bitcoin (BTC) has decreased by about 5.5% over the past day, dropping below $100,000. This drop occurred despite a significant increase in trading volume to around $67 billion. The reason for this decline is due to negative indicators in important metrics such as the 7-day MVRV Ratio and increased activity among large Bitcoin holders (whales), both suggesting an escalating wave of selling pressure.

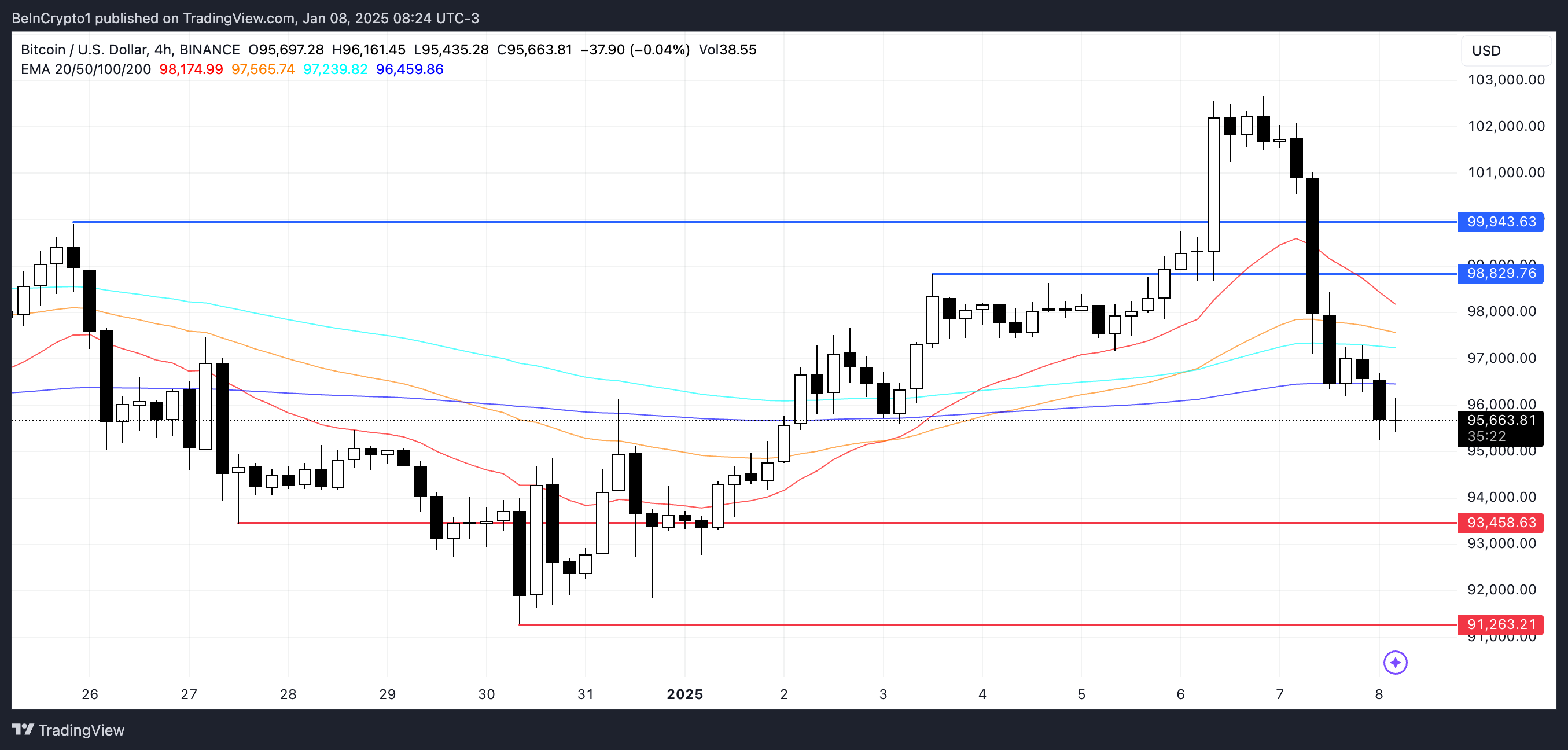

As the Exponential Moving Averages (EMAs) of Bitcoin (BTC) generally point to a positive trend, a swift drop in short-term EMAs might indicate a possible bearish reversal, should a death cross take place. The upcoming days are crucial since BTC is approaching significant support and resistance points. These critical levels could determine the direction of its future price action.

MVRV Ratio Shows BTC Could Continue Dropping

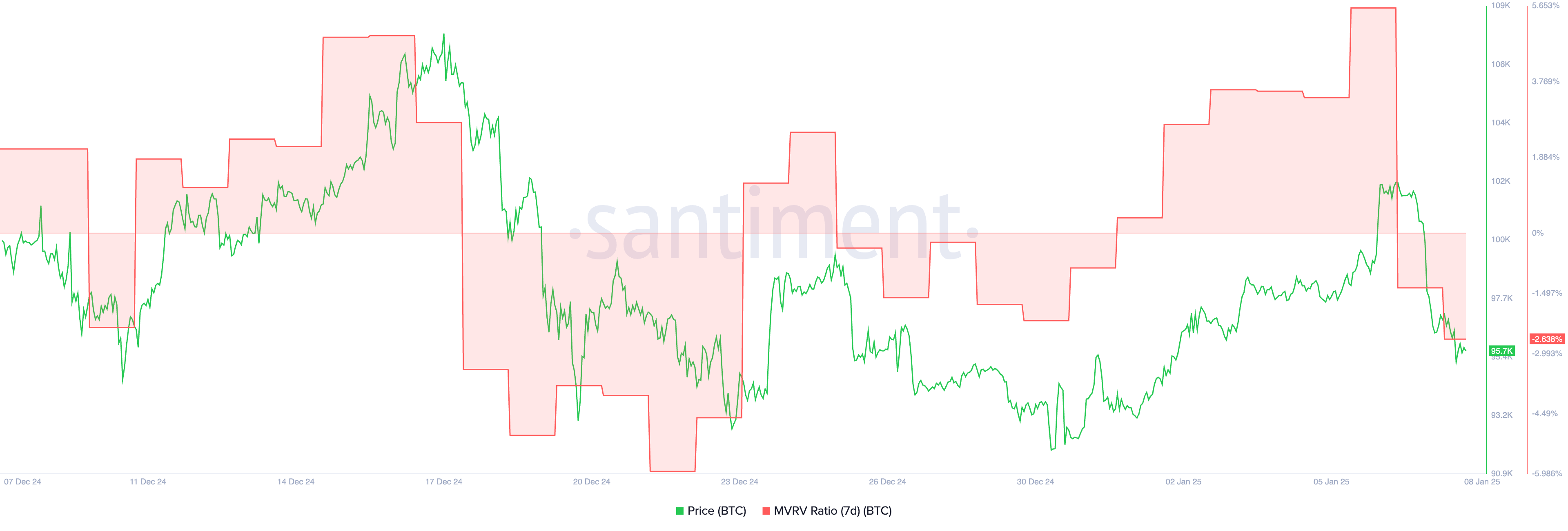

presently, the 7-day Market Value to Realized Value (MVRV) ratio for Bitcoin stands at -2.63%, representing a substantial decrease from the 5.6% reported just two days prior. This ratio assesses whether Bitcoin holders are currently experiencing a profit or loss by comparing the market value (the current price) with the realized value (an average acquisition cost).

As a crypto investor, I’ve noticed that when MVRV (Mempool Value Ratio) values dip below zero, like they are right now for Bitcoin, it often means that the average BTC holder is in the red. This could be an indication of a prolonged market downturn or perhaps an opportunity where the market is undervalued. It’s essential to keep a close eye on the situation and consider strategies accordingly.

Based on past patterns, it’s possible that the 7-day Market Value to Realized Value (MVRV) ratio of Bitcoin could drop down to approximately -5% or -6% before any potential recovery starts, similar to the period between December 20 and December 23.

Should this pattern persist, Bitcoin might face increased selling activity in the near future, possibly leading it to challenge lower resistance points.

Bitcoin Whales Are Accumulating at a Slow Pace

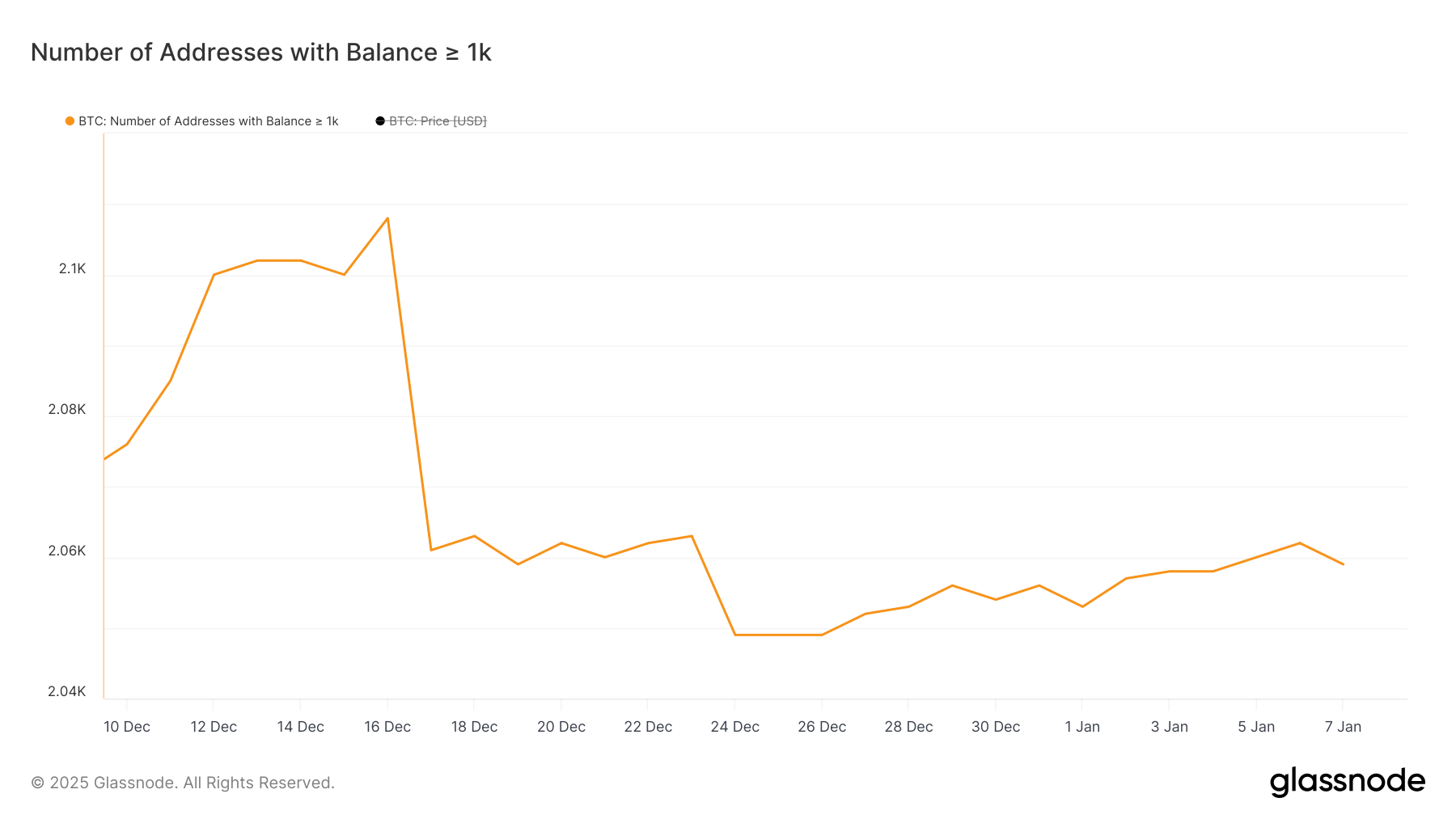

On December 16, the count of Bitcoin investors holding over 1,000 BTC peaked at a monthly high of 2,108. However, this figure dropped dramatically to 2,061 within a single day. Keeping tabs on whale activity is essential as these substantial holders can exert considerable influence on the market by their buying or selling actions.

As a researcher studying market dynamics, I’ve observed that a decrease in whale presence often signifies profit-taking or reduced confidence, which can lead to downward price pressure. On the flip side, an uptick in whale activity usually indicates accumulation, suggesting increased confidence and potentially contributing to price stability or growth.

Since dropping to a monthly low of 2,049 from December 24 to December 26, the number of Bitcoin whales has been steadily climbing back up. As of January 7, it stands at 2,059. This continuous rise indicates that large investors are once again accumulating Bitcoin, which is generally a positive indicator for market sentiment.

A rebound from the bottom might signify that large-scale investors (whales) are growing more optimistic about Bitcoin’s future growth prospects. However, their relatively slow acquisition of Bitcoin suggests they may be hesitant and prefer to observe Bitcoin’s price movement before making significant investments.

BTC Price Prediction: Can It Return to $100,000 Soon?

In simpler terms, the short (quick) and long (slow) moving averages of Bitcoin (BTC) are arranged in a way that suggests a continuing bullish trend, as the shorter ones are still above the longer ones. Yet, it’s worth noting that the speed at which these shorter lines are falling suggests a decrease in momentum, potentially indicating some weakness in the market.

If the current pattern continues and a ‘death cross’ occurs (when the short-term moving average drops beneath the long-term moving average), it may indicate a potential bearish shift in Bitcoin’s price trend. In such a situation, Bitcoin might approach the support level of $93,400. If the price falls below this point, it could potentially drive the value even lower to around $91,200.

Instead, if the ongoing bearish trend reverses and a bullish trend takes over, Bitcoin’s price may challenge the resistance at $98,800. If it manages to break through this level, it could potentially lead to further growth with $99,900 as the next potential milestone.

If the current trend continues, Bitcoin might strive to reach approximately $102,000 again, suggesting a possible bounce back from its recent drop. However, the final result will largely hinge on whether purchasing power manages to offset the increasing bearish signs indicated by the EMA lines.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-08 22:41