As a seasoned researcher with over two decades of market analysis under my belt, I find myself constantly intrigued by the dynamics of Bitcoin (BTC). The current uptrend presents a fascinating blend of technical indicators that suggest we’re on the cusp of something significant.

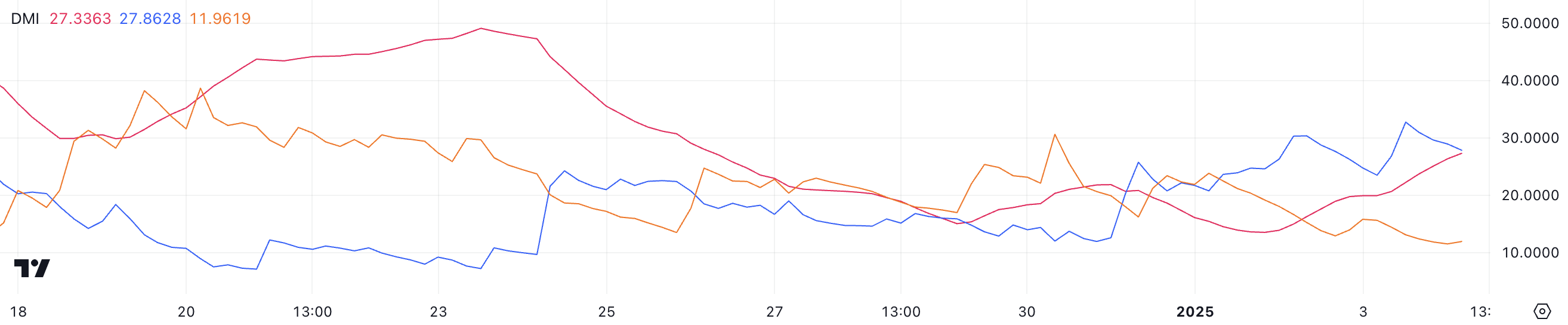

The DMI chart for BTC is particularly captivating, with its ADX crossing 25, signaling a strong trend and increased market confidence in the current price direction. The +DI remains significantly higher than the -DI, indicating that buying pressure continues to dominate selling pressure, albeit at slightly reduced levels.

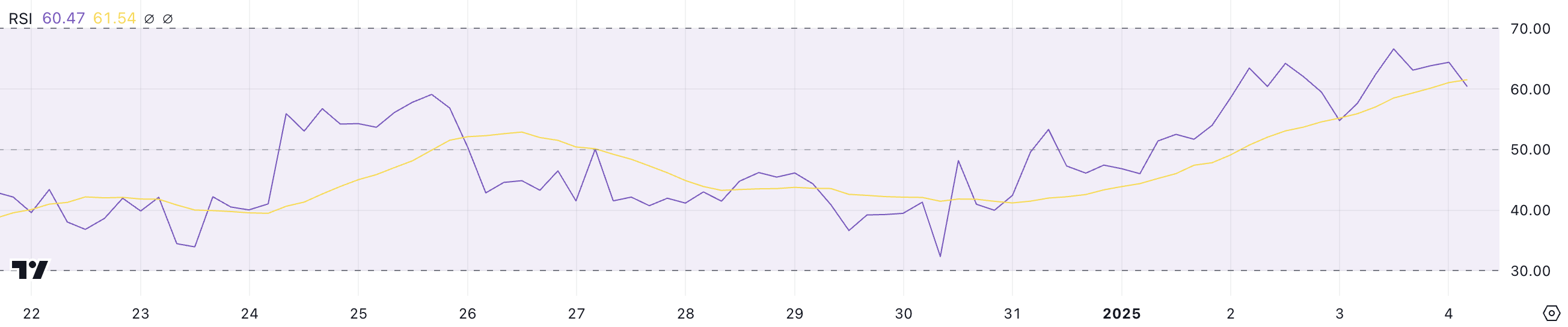

The RSI’s sustained position above 50 since January 1 is another bullish indicator, although a recent pullback suggests a need for fresh buying activity to push the price upwards. The potential golden cross hinted by BTC’s EMA lines adds further fuel to the bullish narrative, with a possible breakout to test critical resistance levels near $98,870 and beyond.

However, as someone who’s been around long enough to witness multiple market cycles, I can’t help but remind myself (and others) that the market never sleeps and neither does Mr. Volatility. So, while it’s enticing to speculate on BTC reaching $110,000, a failure to break these levels could result in a pullback, with key support zones at $90,700 and $88,000 coming into focus.

And as always, remember: the only certain things in life are death, taxes, and Bitcoin’s ability to surprise us!

Bitcoin (BTC) is making an effort to regain its $2 trillion market value, as optimistic sentiment continues to grow. Technical signals like the DMI and RSI imply that the upswing is becoming more robust; however, they also underscore the importance of consistent buying activity to keep the price moving upward.

Currently, Bitcoin’s EMA lines suggest the potential for a golden cross, which could push the price towards challenging significant resistance levels around $98,870 and potentially beyond. Yet, if these resistance levels aren’t breached, a retreat might occur, with attention turning to possible support areas at $90,700 and $88,000.

Bitcoin DMI Shows the Uptrend Is Here

In simpler terms, the DMI (Directional Movement Index) chart for Bitcoin shows that its ADX (Average Directional Index), which measures the strength of the trend, has increased significantly from 13.6 three days ago to 27.3 now. An ADX above 25 signals a strong trend, while values below 20 suggest weak or no momentum.

Crossing the 25 mark on BTC’s Average Directional Index (ADX) indicates a significant reinforcement of the ongoing uptrend. This suggests a growing market conviction about the current price trajectory.

The directional indicators offer additional details. Today, the Plus Directional Index (DI+) stands at 27.8, a small drop from 32.7 yesterday, and the Minus Directional Index (DI-) is at 11.9, a slight decrease from 13.1. This setup indicates that buying force continues to be more prominent than selling force, although the dip in the Plus DI suggests a potential slowdown in bullish energy.

For a while, it’s expected that Bitcoin’s price will continue its upward trajectory; however, for significant growth to persist, there needs to be increased purchasing activity to maintain the Positive Directional Indicator (DI) at high levels and see the Average Directional Index (ADX) keep climbing.

BTC RSI Has Been Above 50 Since January 1

Currently, Bitcoin’s Relative Strength Indicator stands at 60.47, indicating that it has been above the neutral 50 level since January 1st. The Relative Strength Index (RSI) gauges how quickly and intensely prices are changing, scoring between 0 and 100, giving clues about overbought or oversold conditions.

Bitcoin’s RSI is at 60.47 right now, which means it has been more than the neutral 50 level since January 1st. The RSI helps us understand how fast and much prices are moving up or down, with values between 0 and 100 suggesting whether they are overbought (above 70) or oversold (below 30).

As an analyst, I’d observe that figures surpassing 70 generally point towards overbought conditions, hinting at a possible correction or pullback. Conversely, readings dipping below 30 usually indicate oversold conditions, which could potentially signal a rebound or recovery.

Bitcoin’s Relative Strength Index (RSI) recently reached a high of 66.6, but has since dropped to 60.47, indicating a decrease in buying pressure following a stretch of intense momentum.

As a seasoned crypto trader with years of experience under my belt, I have come to understand that the Relative Strength Index (RSI) can be a valuable tool for predicting market trends. When the RSI remains above 50, signaling a bullish market, it’s important to keep an eye on potential pullbacks. These pullbacks could indicate that the Bitcoin price might consolidate or experience limited upward movement in the short term unless there is a surge in fresh buying activity.

In my personal trading journey, I have learned that such pullbacks can provide a moment of respite before the market picks up again. However, it’s crucial to be mindful of the risk of overextension, which could potentially lead to a correction. Thus, during these periods, I aim for moderate price gains while keeping my risk management strategies in check.

In summary, when the RSI remains in bullish territory but shows signs of a pullback, it’s essential to be cautious and look for fresh buying activity before making any aggressive moves. This approach has served me well throughout my trading career, and I believe it can help others as well.

BTC Price Prediction: Bitcoin Needs to Break These Resistances to Rise to $110,000

As an analyst, I’m observing a promising development in the BTC market: The short-term Exponential Moving Average (EMA) is moving above its longer-term counterpart, a phenomenon known as a ‘bullish crossover’. Historically, this event suggests a buildup of momentum that might propel Bitcoin’s price toward testing the resistance at $98,870.

If Bitcoin surges past this current level, it could signal more price increases ahead, possibly peaking at $102,590 or even attempting a new high of $110,000, contingent on the strength of the trend. This potential leap is expected to occur following Bitcoin’s 16th birthday celebration.

If Bitcoin’s price can’t push beyond its resistance and the trend shifts, it might encounter downward pressure instead. Under such circumstances, Bitcoin could potentially re-test the $90,700 support level. A fall below this point could suggest a continuation of declines towards $88,000.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-01-04 14:41