As a seasoned crypto investor with a decade of experience under my belt, I’ve learned to read between the lines when it comes to market indicators and trends. While a surge in Bitcoin futures volume might seem like a bullish sign to some, I believe it’s essential to delve deeper into the data before making any conclusions.

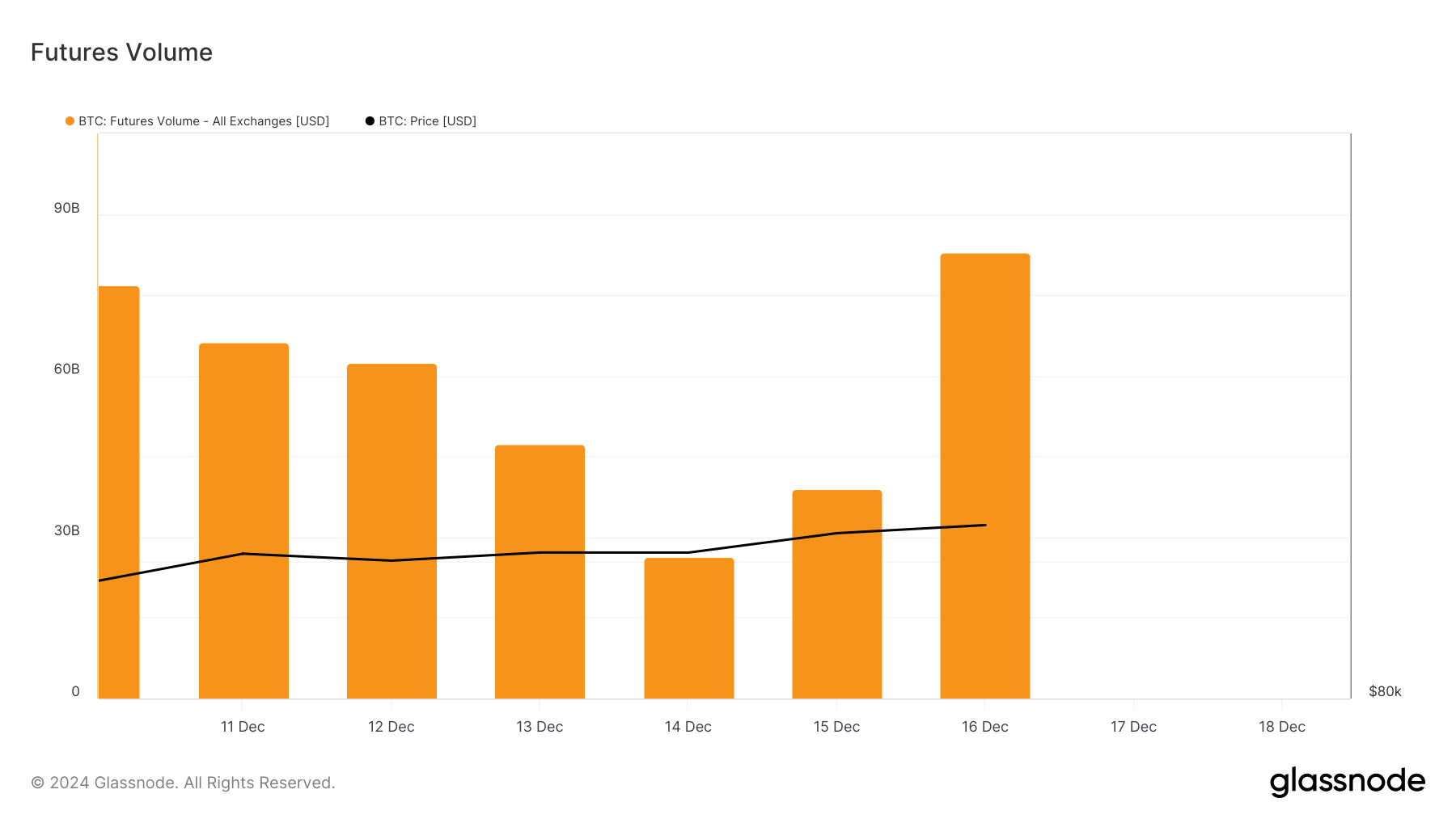

On Monday of last week, the trading volume for Bitcoin (BTC) futures surpassed $90 billion. However, this volume gradually decreased from December 10 to 14, dropping to approximately $26.39 billion by Sunday. Interestingly, as Bitcoin’s price reached a new record high, the futures volume also increased significantly and peaked at a seven-day high of $82.84 billion.

For some market observers, this resurgence implies a bullish outlook for the cryptocurrency. But Bitcoin traders seem to be choosing the other path.

Bitcoin Rising Liquidity in the Derivatives Market Is Not a Bullish Sign

The amount of Bitcoin futures trading over a certain timeframe represents the total value of both opened and closed contracts. As this value grows, traders can potentially expand their involvement with cryptocurrencies through either long positions (betting on price increase) or short positions (betting on price decrease).

In simple terms, Long positions are held by traders who anticipate an upward trend in prices. Conversely, Short positions are taken by traders expecting a decline. Notably, a reduction in the number of open contracts (futures volume) suggests that fewer trades predicting price changes have been made by traders.

Based on information from Glassnode, the latest record high of Bitcoin seems to have stirred Bitcoin traders out of slumber. Over the past week, trading volume had been gradually declining until it suddenly surged to approximately $82.84 billion.

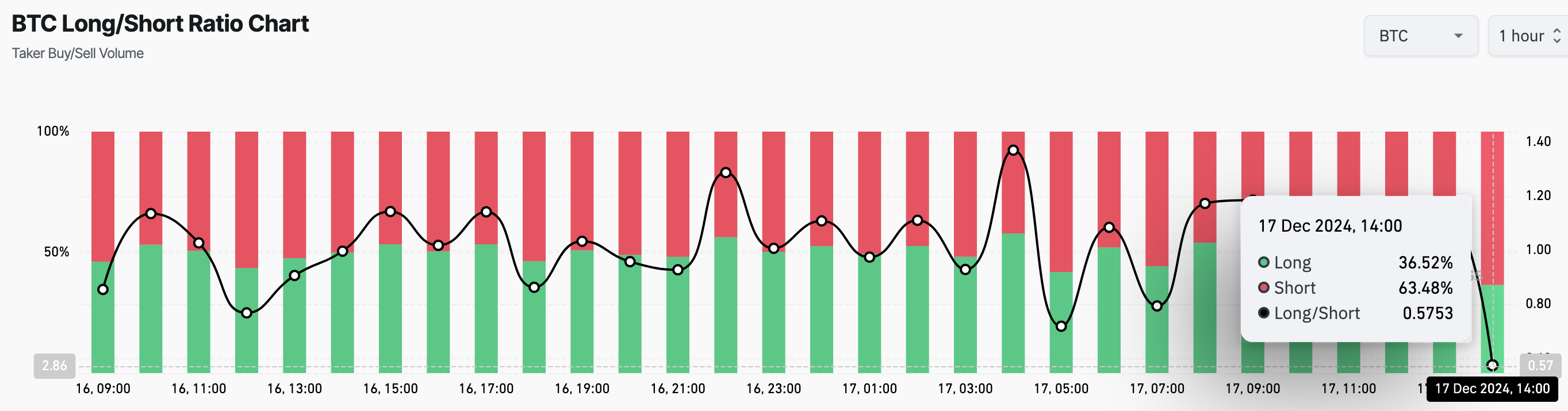

Even though Bitcoin’s trading volume has increased significantly, many traders are not optimistic that the cryptocurrency will reach $107,000 in the near future, as indicated by their cautious long/short positions.

The long-to-short ratio functions like a gauge for measuring investor attitudes. When the ratio exceeds 1, it suggests that there are more long positions compared to short ones. Conversely, if the ratio falls below 1, it means that short positions outnumber long ones.

According to Coinglass data, the balance between long and short positions on Bitcoin is heavily skewed towards shorts, with short positions holding 63.48% of the total open interest compared to just 36.52% for long positions. This imbalance suggests that many traders are expecting a drop in Bitcoin’s price in the near future.

BTC Price Prediction: Drop Below $100,000 Likely

On a day-to-day scale, the Bollinger Bands (BB), a tool for assessing volatility, have touched Bitcoin’s value at approximately $107,352. The BB provides insights into the level of market turbulence and indicates whether an asset might be excessively bought or sold.

Usually, when the top line of a particular indicator aligns with the price, it indicates that the market is overbought. On the other hand, if the bottom line coincides with the price, it suggests undervaluation. Given that the upper band has touched Bitcoin’s price, it seems like the price might be overextended and could potentially pull back.

According to the Relative Strength Index (RSI), this viewpoint is reinforced because its value exceeds 70.00, signaling that Bitcoin’s price is overbought. If this reading proves accurate, Bitcoin’s price could potentially drop to around $91,240. Conversely, if buying pressure intensifies, the coin’s worth might surge towards $116,000.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-17 21:09