As a seasoned crypto investor who has witnessed the highs and lows of this dynamic market since its inception, I find myself cautiously optimistic about the current state of Bitcoin. Despite the recent dip below the $97,000 mark, I’ve learned to view these moments as potential opportunities rather than causes for concern.

Despite numerous forecasts that Bitcoin’s (BTC) price could surge to $120,000 before year-end, the coin has encountered a setback, now trading below $97,000. However, historical data indicates that such pullbacks often present an opportunity for new Bitcoin buyers to accumulate.

If this pattern persists, it’s possible that Bitcoin’s price will end the year at a higher level. This in-depth analysis of blockchain data offers insights into how this outcome could materialize.

Bitcoin Presents a Rare Chance Again

The cost of a single Bitcoin has decreased by approximately 12% within the last week, possibly because of heightened selling activity as the festive period nears.

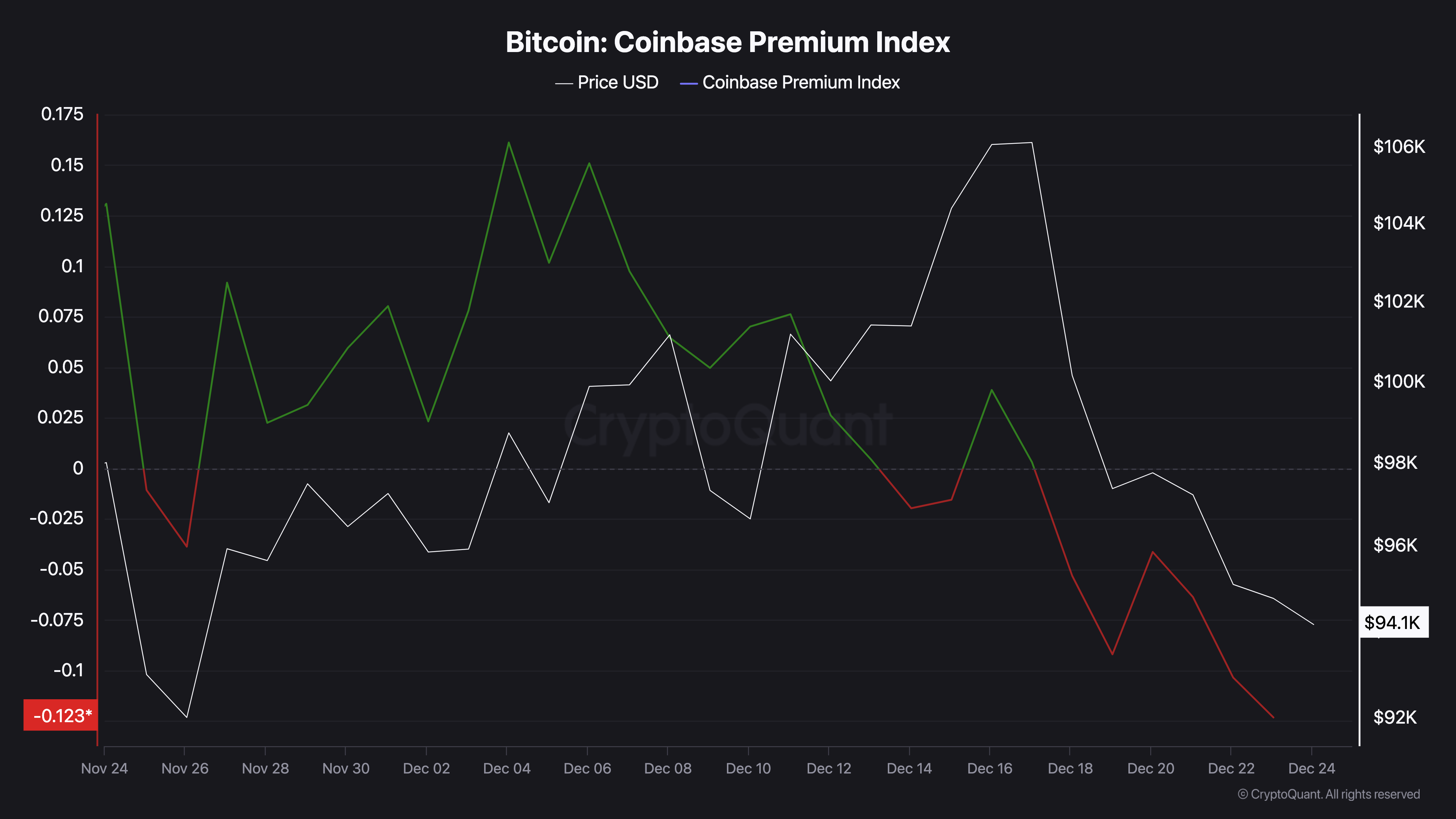

The falloff in this indicator can be interpreted as a reduction in the Coinbase Premium Index, a tool that measures the intensity of buying and selling actions within the U.S. market. An increase in the index suggests robust buying demand, whereas a decrease implies more sellers are active.

Presently, the index indicates strong signs of sellers offloading Bitcoin. Yet, history shows that increased selling tends to entice investors looking for bargains. If this trend continues, there might be a resurgence in buying activity, leading to further accumulation and potential price increases for Bitcoin.

It’s worth mentioning that crypto expert MAC_D shares this viewpoint, pointing out that there could be an imminent rebound in the value of the cryptocurrency.

In historical context, this occurrence typically occurs during a bull market and usually catches the attention of new investors who view it as an opportunity. However, whether the current price drop signifies the lowest point is uncertain, but if the bull market persists, a bottom could form soon, possibly triggering a resurgence. This observation was made by MAC_D on CryptoQuant.

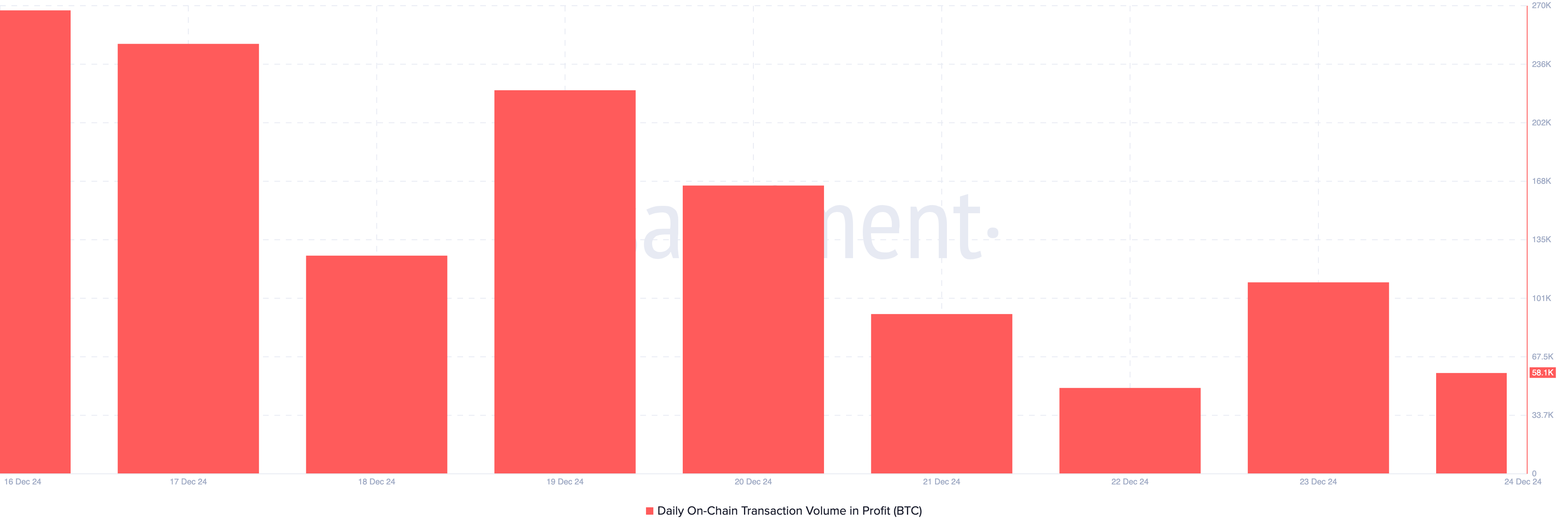

Additionally, the high level of profit-taking by Bitcoin owners is indicative of a bullish perspective. As of December 16th, the on-chain transaction volume for profitable trades exceeded 250,000 Bitcoins.

At present, I’m observing a drop in the value to 58,1000 units, suggesting that the downward trend in Bitcoin’s price has led investors to hold onto their Bitcoins rather than selling them off. If this trend persists, it’s plausible we might witness a Bitcoin rebound.

BTC Price Prediction: Back Above $100,000 Soon

According to the 4-hour analysis, Bitcoin’s value has been bolstered by a significant support level at approximately $92,888. Subsequently, it appears to have discovered an even stronger backing at around $95,871. Despite this, the Awesome Oscillator (AO) continues to indicate a bearish trend, suggesting that negative momentum is still present.

In contrast, as green bars represent BTC on a histogram, it might avoid another significant drop and climb instead. If this occurs, Bitcoin’s price may surge to $104,299 in the near future. In an extremely bullish market scenario, its value could peak at $108,386.

Conversely, if the price falls below the previously stated support level, it could challenge this forecast. In such a scenario, the Bitcoin price may potentially drop down to approximately $92,144.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-25 03:21