As a seasoned researcher who has closely monitored the cryptocurrency market for years, I must admit that the current bearish sentiment surrounding Bitcoin is making me feel a bit like Scrooge on Christmas Day – expecting the worst but hoping for a miracle. The recent failure of BTC to rebound and reach the $100,000 milestone has left me with a sense of unease about its near-term prospects.

On December 25th, Bitcoin (BTC) suggested a possible “Santa Rally” by trying to surpass the $100,000 mark. Yet, this rally didn’t reach its goal, causing concern among short-term holders about the possibility of a quick recovery in the immediate future.

Will the cryptocurrency’s price continue to trade below six figures?

Sentiment Around Bitcoin Is Bearish

The fact that Bitcoin hasn’t regained its value above $100,000 and instead dropped to around $97,000 has caused a decrease in its market influence as well. However, this pessimistic trend isn’t limited only to this; it seems to be spreading further.

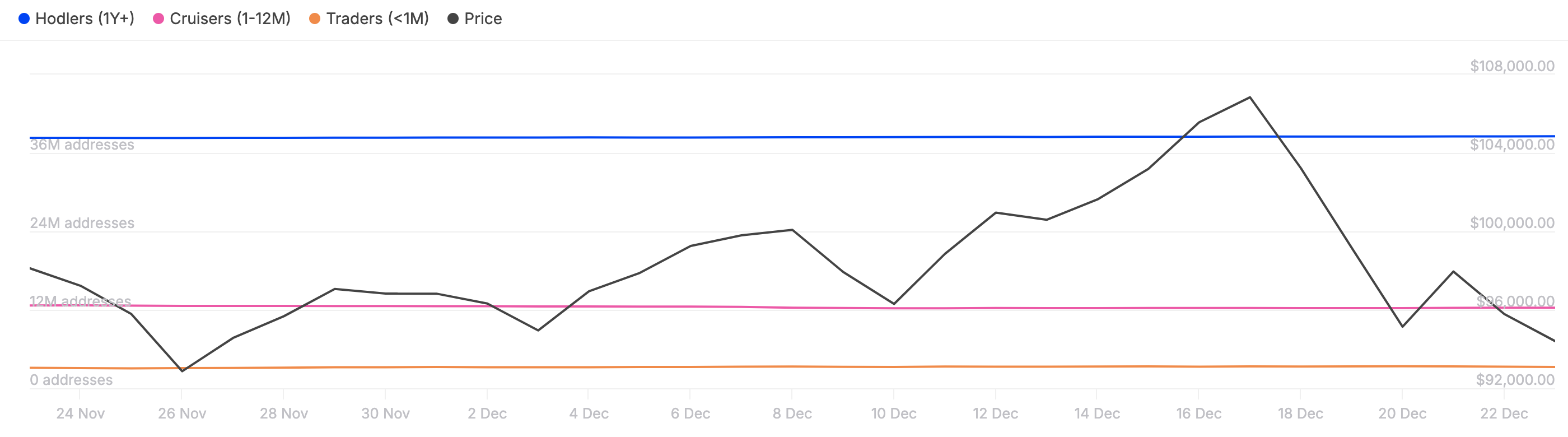

Based on data from IntoTheBlock, there’s been a significant drop in the number of Bitcoin holders keeping their cryptocurrency for periods ranging between one month (30 days) and one year (365 days), as observed over the past week.

This particular gathering of investors, frequently known as ‘short-term investors’, has a significant impact on showcasing market feelings. A rise in their number usually indicates expanding optimism, yet the current decrease implies decreasing confidence within this investor group.

Should this pattern continue, it might suggest an ongoing decrease in Bitcoin’s worth in the immediate future.

A supporting evidence for this idea comes from the Short-Term Investor Net Profit/Loss Ratio, often abbreviated as STH-NUPL. This metric focuses on analyzing the actions of investors who own a cryptocurrency for under 155 days.

Using this data, it’s possible to determine if short-term Bitcoin investors are feeling optimistic, fearful, or greedy. As per Glassnode, the indicator has moved into the area of uncertainty (orange), suggesting that investors are uncertain about a substantial Bitcoin rebound. If this trend continues, Bitcoin may find it challenging to generate enough demand to push its price upwards.

BTC Price Prediction: Sub-$90,000 Levels Next?

On a daily scale, the Bitcoin price encountered an obstacle at approximately $99,332. This hurdle was among the factors preventing the cryptocurrency from advancing towards $108,398. Given this resistance, it seems likely that the current downturn in Bitcoin’s rebound could persist for a while.

As a researcher observing the crypto market, I’ve noticed that the Relative Strength Index (RSI) for Bitcoin has dipped below the 50.00 neutral mark. This downturn suggests a shift in momentum towards bearishness. If this trend continues, it could potentially lead to a decrease in Bitcoin’s value, with a possible drop to around $85,851.

If bulls manage to push Bitcoin’s price beyond the current resistance at $99,332, there could be a shift in the trend and the value of Bitcoin might move towards approximately $110,000.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-27 01:29