As a seasoned analyst with over two decades of market experience under my belt, I’ve seen more than a few bull and bear cycles come and go. Having navigated through the 2017 Bitcoin boom and bust, the dot-com bubble, and the 2008 financial crisis, I’ve learned to read between the lines when it comes to market indicators.

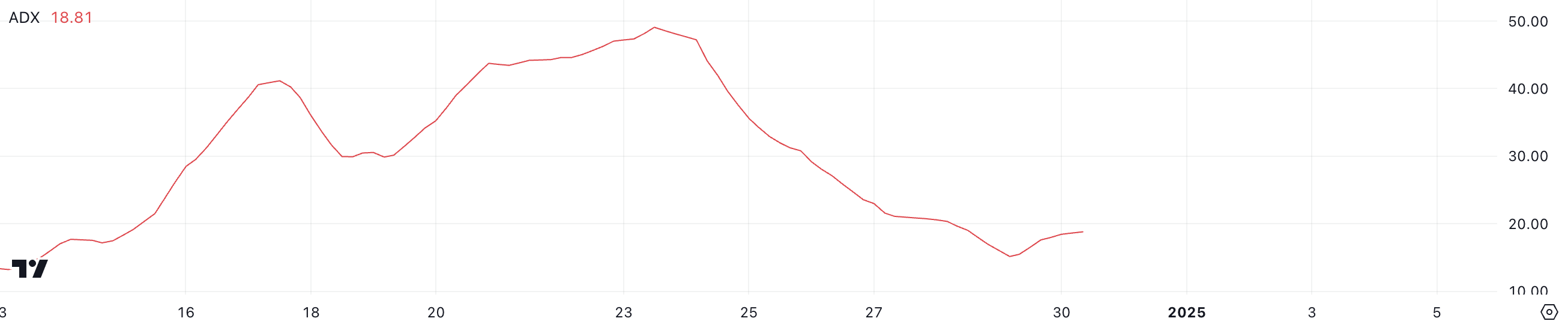

The recent drop in BTC‘s ADX from nearly 50 to 18.81, as well as the cautious whale activity we’re witnessing, suggests a weakening downtrend that could potentially lead to a short-term consolidation phase. This is not uncommon during market corrections, but it’s essential to keep a close eye on critical resistance and support levels for further clues about Bitcoin’s next moves.

While the possibility of BTC returning to $100,000 remains, I must remind myself (and others) that markets can be fickle, and past performance is not always indicative of future results. As the saying goes, “Bear markets climb a wall of worry,” so we should expect more turbulence before any significant upward momentum.

On a lighter note, let’s remember that Bitcoin was once worth just pennies, and it’s still early days in its life cycle. So, while we may be experiencing some growing pains now, I can’t help but think of the old joke: “How many analysts does it take to change a lightbulb? Just one, but they’ll write a 100-page report on why the bulb needs to be changed and how it could impact the global economy.” So, stay tuned for more market insights as we navigate this ever-evolving landscape together!

On December 17, Bitcoin (BTC) reached an all-time high, however, it has since dipped below $100,000. Important signals like the ADX and careful moves by ‘whales’ indicate a potential weakening of the downward trend.

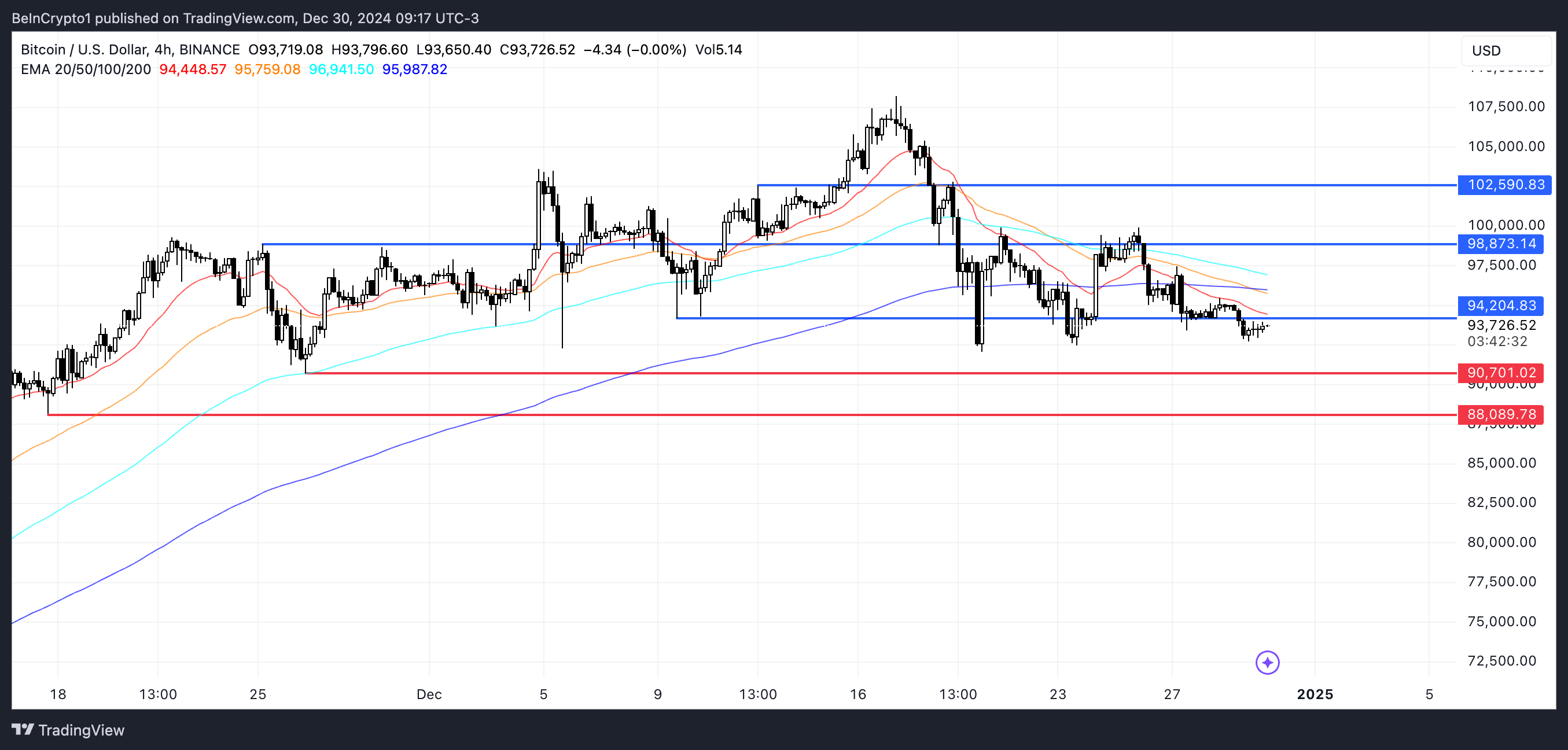

As Bitcoin nears crucial resistance and support points, its upcoming actions might strongly impact its potential price trends over the next few days.

BTC ADX Shows the Downtrend Is Weakening

Right now, the Average Directional Index (ADX) for Bitcoin (BTC) is 18.81, significantly lower than its previous level of almost 50 a week ago. This substantial drop suggests a strong lessening in the power driving Bitcoin’s current downward trend.

A significant drop in ADX indicates that the power behind Bitcoin’s recent price fluctuations may be dwindling, resulting in a weakened trend or indecision within the market.

The Average Directional Index (ADX) assesses the intensity of a market movement, whether it’s rising or falling, ranging from 0 to 100. Values greater than 25 generally suggest a robust trend, while numbers below 20 often indicate a weak or absent trend. Given that BTC’s ADX stands at 18.81, this low figure suggests that the current downward trend may be starting to fade away.

Consequently, Bitcoin might experience a temporary period of stability where its price fluctuates less dramatically and moves primarily horizontally rather than significantly up or down.

Bitcoin Whales Started Accumulating Again

Between December 16th and 17th, there was a noticeable decrease in the number of Bitcoin wallets containing at least 1,000 BTC, falling from 2,108 to 2,061. This drop suggests either a substantial selling off or reallocation of large-scale investments among major investors.

The measurement remained steady until December 24th, at which point it dipped lower to 2,049. Fluctuations in whale behavior could hold considerable weight in the Bitcoin market, as these accounts usually belong to entities wielding significant control over price fluctuations due to their capacity for large transactions.

Keeping tabs on these Bitcoin ‘whales’ is essential because their buying and selling activities frequently predict broader market movements. When whales are buying more, it typically means they have faith in Bitcoin’s potential price increase, while massive selling might signal caution or profit-taking, which could lead to market drops.

Following significant drops in whale populations, there has been a slow but steady growth, currently standing at 2,056. This growth, albeit slow, hints at a growing sense of optimism among major investors, which could potentially signal a period of stability for Bitcoin prices in the near future.

BTC Price Prediction: Can It Go Back to $100,000?

The price of Bitcoin is getting close to a crucial barrier around $94,200. If this barrier gets broken, it might lead to more positive movement, potentially pushing prices towards $98,700 and even $102,500 if the upward trend continues to grow stronger.

As an analyst, I’ve noticed that although there seems to be a potential for Bitcoin (BTC) to trend upwards, my analysis suggests a bearish outlook based on the Exponential Moving Averages (EMA). Specifically, my short-term EMAs are positioned below the long-term ones, indicating a downward momentum that could dominate the market in the near term.

As a seasoned trader with years of experience navigating the volatile world of cryptocurrency markets, I can tell you that this particular configuration suggests lingering bearish sentiment still lingers within the market. If the downtrend continues to gain momentum, Bitcoin could potentially revisit its previous support at $90,700. However, if that support fails to hold, we may see a further decline towards the next downside target of around $88,089. It’s crucial for investors to stay informed and adaptable in this fast-moving market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 18:07