As a seasoned analyst with over two decades of market experience under my belt, I must say that witnessing Bitcoin’s meteoric rise to surpass $100,000 and achieve a market cap of $2 trillion is nothing short of breathtaking. It’s like watching the internet in its infancy evolve into the global phenomenon we know today – an unparalleled transformation that has forever changed our world.

For the very first time, the price of Bitcoin (BTC) surpassed $100,000, reaching an unprecedented level. With this leap, Bitcoin’s total market capitalization now stands at a staggering $2 trillion, making it more financially significant than Saudi Aramco and bringing it close to Alphabet in terms of market value.

Displaying robust upward pressure as indicated by its EMA lines and positive signs suggesting potential expansion, Bitcoin’s ongoing upward trend seems primed for continuation.

Bitcoin’s Current Trend Could Get Stronger

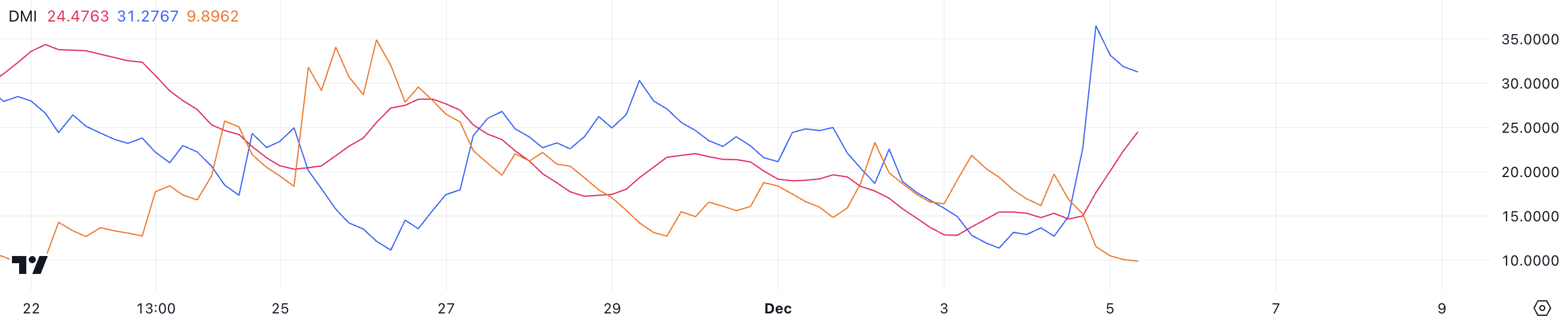

The Bitcoin DMI chart indicates that the ADX value climbed from 15 to 24.4 within a day, implying a growing strength in its trend. Essentially, this rise signifies that Bitcoin may be moving from a less certain market state towards a clearer, stronger trend pattern.

In conjunction with other indicators pointing upward, the rising Average Directional Index (ADX) suggests that momentum is gathering strength, potentially leading to additional price fluctuations.

The Average Directional Index (ADX) gauges the intensity of a trend, where values over 25 signal a robust trend and figures below 25 suggest either a weaker market or consolidation. Presently, Bitcoin’s ADX stands at 24.4, along with a Day Positive (D+) of 31.2 and a Day Negative (D-) of 9.8, indicating that buyers currently hold substantial control over the market.

Although the current trend’s intensity hasn’t yet matched the highs experienced during its $90,000 surge (when Average Directional Index surpassed 40), the existing upward movement hints at possible additional price increases if the momentum keeps growing.

Bitcoin NUPL Shows More Space For Growth

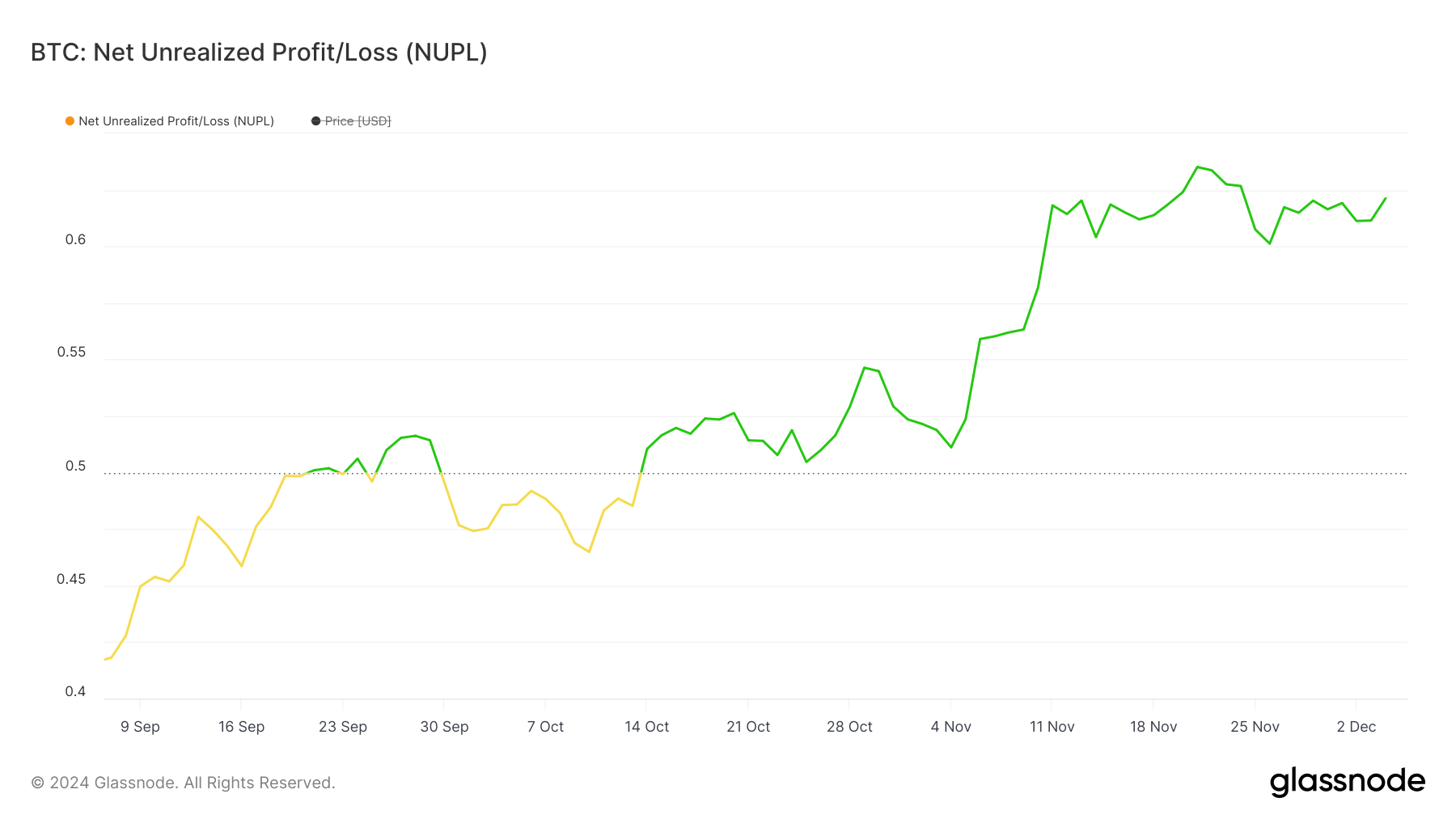

The Bitcoin NUPL graph indicates that its current reading is 0.62, which is slightly lower than the 0.63 it was just a few days ago. The NUPL (Net Unrealized Profit/Loss) ratio offers an understanding of the proportion of market participants who are currently in profit versus those who are still underwater, providing insights into the overall market mood.

In this phase, labeled as “Belief—Denial,” values ranging from 0.5 to 0.7 indicate a period where optimism gradually increases, though it has yet to reach its highest point.

Even though Bitcoin has seen a significant increase of about 49.65% over the past month, its Network Upvalution Point Level (NUPL) at 0.62 suggests that the market is not yet in the “Euphoria” phase. This phase usually occurs when NUPL hits 0.7 or higher.

It seems that despite a positive outlook, the Bitcoin price hasn’t yet reached a point of being excessively high or overvalued. Previously, when we’ve reached the Euphoria phase, it has often been followed by notable price drops – suggesting there may be more potential growth ahead before Bitcoin reaches such a level.

BTC Price Prediction: Can Bitcoin Reach $110,000 In December?

As a researcher studying Bitcoin’s market trends, I find myself observing an optimistic pattern in the BTC price chart. The Exponential Moving Averages (EMA) lines are arranged in a bullish fashion, with the short-term EMAs hovering above their long-term counterparts. Furthermore, the current trading price of Bitcoin is positioned above all these EMA lines, indicating a robust upward momentum.

This trend suggests a significant rise in value is likely. If the growth continues and the NUPL stays beneath the ‘euphoria level’, Bitcoin might reach around $110,000 very soon, which is now approximately 7% from its current position.

Before another potential increase, the Bitcoin price may revisit a significant support level at $99,000. If this point doesn’t prevent a fall, the price might decrease towards $90,000 before trying to establish new record highs again.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-05 19:15