As a crypto investor, I’m thrilled to note that Bitcoin has bounced back from a dip that took its value down to around $89,000, sparking renewed optimism in the market once again. This recovery is certainly fueling my bullish sentiments.

Despite the concerning decrease, it didn’t greatly influence investor confidence. Bitcoins current position is robust, indicating a possible surge towards unprecedented peaks.

Bitcoin Investors Are Still In Profit

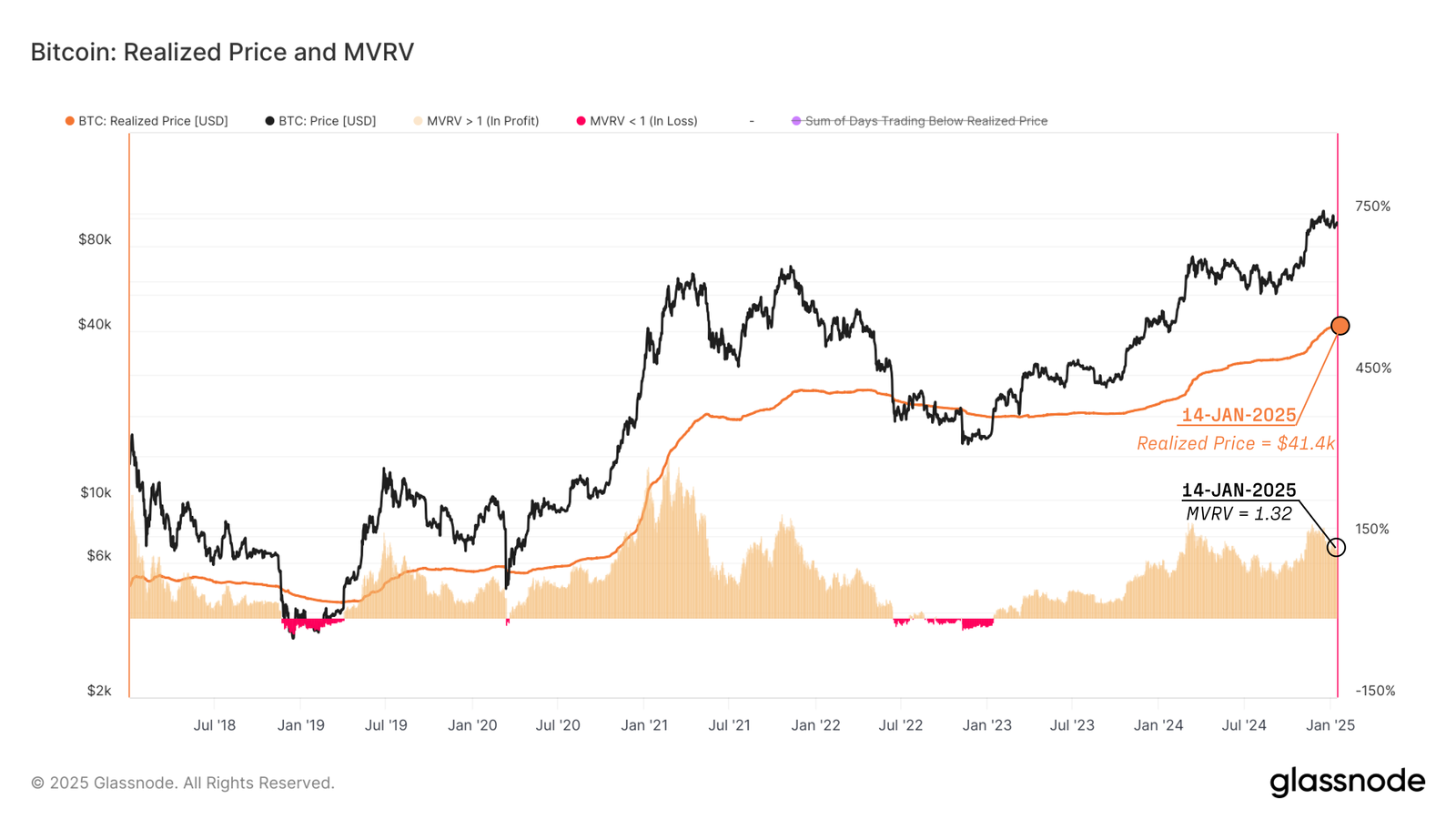

As an analyst, I find myself examining the Market Value to Realized Value (MVRV) Ratio, currently standing at 1.32. This ratio, which calculates Bitcoin’s current price against its realized price, suggests that the average Bitcoin holder is sitting on an unrealized profit of approximately 32%. This insight comes from a recent Glassnode report. The last time we saw such a ratio was during the period following the all-time high (ATH) in mid-April 2024. This parallel indicates a strong bullish sentiment, even after the recent market correction, suggesting that investors remain optimistic about Bitcoin’s potential future price increases.

Furthermore, the MVRV Ratio of Bitcoin aligns with the market’s recovery trend, signifying traders’ trust. After the recent dip, a positive outlook continued, implying that investors are still hopeful about Bitcoin’s long-term growth prospects. This indicator reinforces Bitcoin’s ongoing journey towards surpassing crucial resistance levels and initiating a new surge.

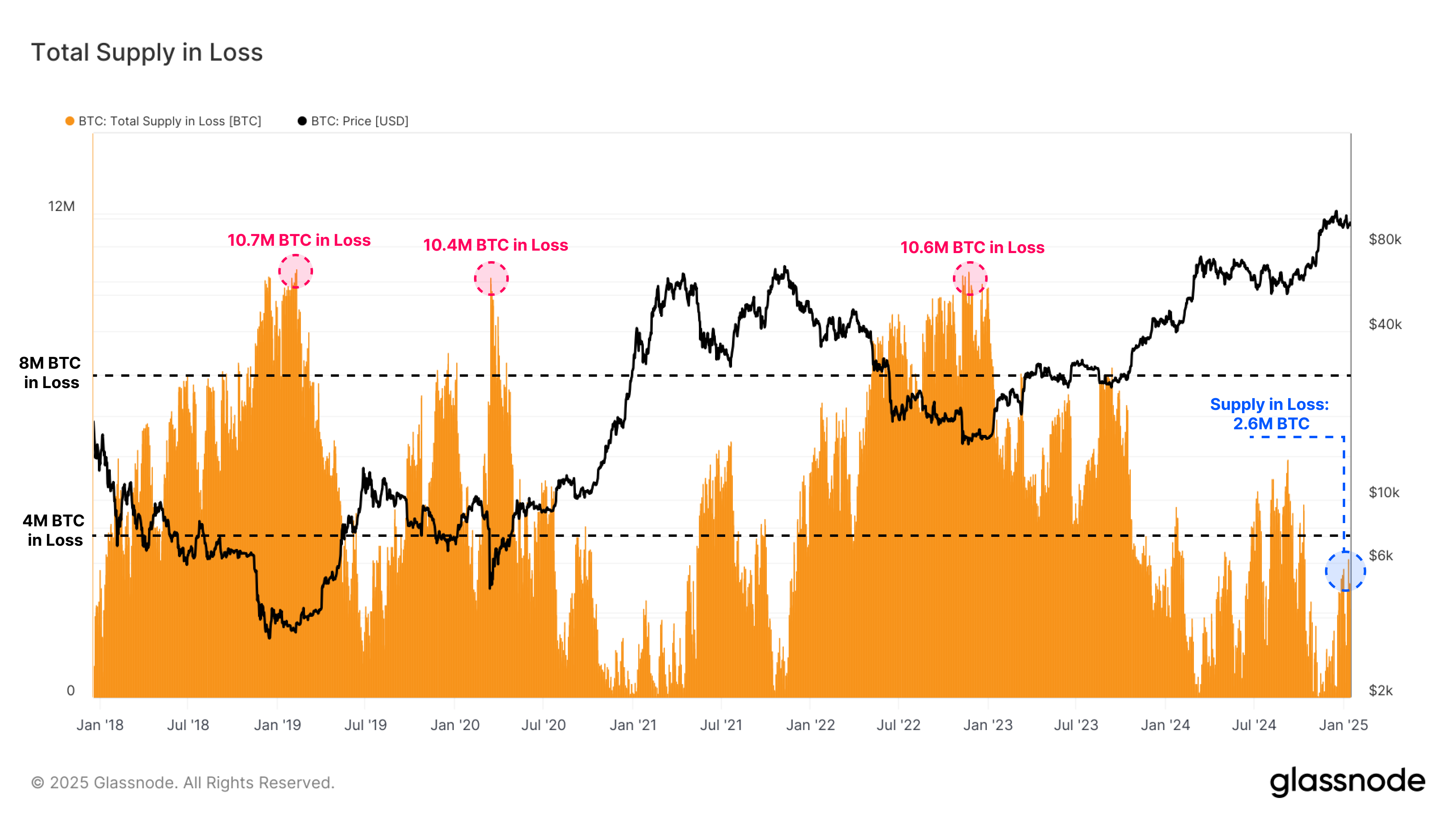

Bitcoin’s unrealized losses have proven surprising strength, even dipping as low as $89,000. Typically, unrealized losses over 4 million Bitcoins signal the start of a bear market. Yet, this latest correction kept unrealized losses below that level, suggesting that the bull market remains active.

This steadiness indicates that Bitcoin owners are standing firm against market forces, holding onto their investments even amid temporary market swings. This resilience suggests a positive long-term outlook for Bitcoin’s price, as it mirrors a bullish broader market scenario.

BTC Price Prediction: Rally Ahead

At present, Bitcoin’s value is approximately $101,394, and it’s getting close to the line (neckline) of a double-bottom chart structure seen on the daily graph. If Bitcoin manages to surpass this neckline at $102,235, it might initiate a 11% surge towards an estimated price of $113,428. This pattern underscores Bitcoin’s ongoing bullish trend and hints that another significant rally may be on the horizon.

To maintain this upward trend, Bitcoin needs to find support at either $106,193 or $108,341. These points are vital for continued growth and avoiding a downward shift. Firmly establishing these supports would strengthen the argument for Bitcoin’s bullish future, boosting investor confidence even more.

If Bitcoin doesn’t surpass $102,235, it may face difficulties. This could cause a fall below $100,000, with the next significant support at $95,668. In this case, the bullish prediction would be invalidated, potentially causing Bitcoin to take a substantial step back.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-01-17 13:24