Well, hold onto your hats, folks! Strategy (formerly known as MicroStrategy, because why not?) has just splurged on a whopping 20,356 more Bitcoin, as announced by the ever-enthusiastic Michael Saylor. This marks the company’s largest purchase in over two months, which is a bit like saying it’s the tallest building in a town of bungalows—impressive, but not exactly a skyscraper. Meanwhile, their stock price is doing a rather impressive impression of a sinking ship. 🚢

Now, how is Strategy funding these extravagant acquisitions, you ask? Through multibillion-dollar stock sales, of course! Because nothing says “trust us” quite like selling off your own shares. If Bitcoin’s price continues to play hide and seek with the ground, it could spell disaster for the firm. Talk about a rollercoaster ride! 🎢

Saylor’s Bitcoin Shopping Spree

In a move that can only be described as “bold,” Strategy has once again solidified its position as one of the world’s largest Bitcoin hoarders. Earlier today, they completed a $2 billion stock offering, and Saylor has announced that the proceeds are being funneled straight into Bitcoin acquisitions. Because why not throw more money into the digital abyss? 💸

“Strategy has acquired 20,356 BTC for $1.99 billion at $97,514 per bitcoin and has achieved a BTC Yield of 6.9% YTD 2025. As of February 23, we hold 499,096 BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin,” Saylor proudly proclaimed. Sounds like a fun game of Monopoly, doesn’t it? 🎲

Today’s acquisition is indeed the firm’s largest in over two months. However, despite the outwardly bullish appearance, some clouds are gathering on the horizon. ☁️

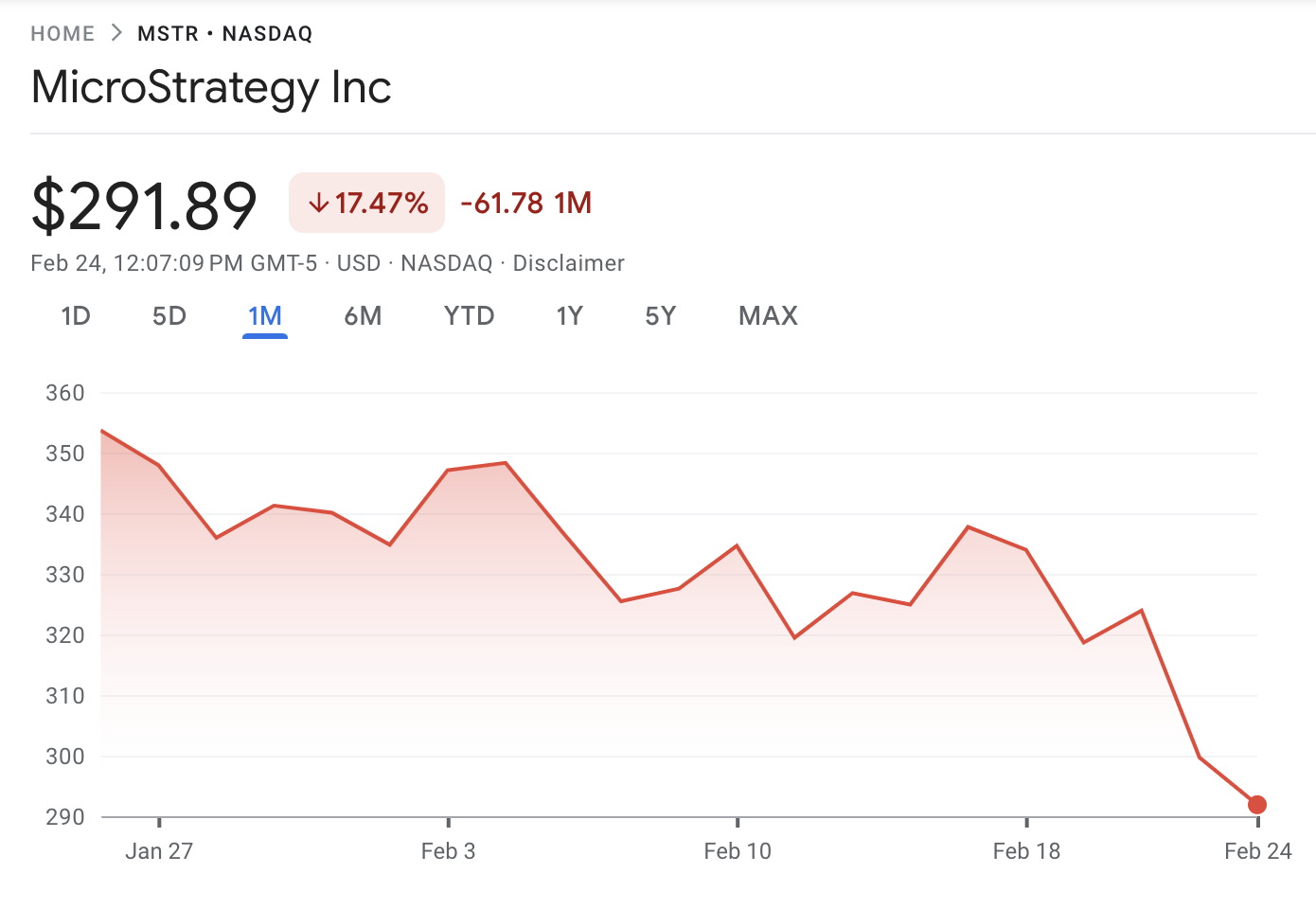

Saylor has been on this Bitcoin buying spree for months, but there were several significant pauses in February—perhaps he was waiting for a sale? Despite the latest purchase, the company’s stock MSTR has been underperforming this year, which is a bit like trying to run a marathon with a boulder in your backpack. 🏃♂️

There are likely a few reasons why MSTR has been taking a nosedive in the stock market. Last year, MicroStrategy’s stock performance was like a well-choreographed dance with Bitcoin’s market growth. But alas, Bitcoin’s price has recently been more of a wallflower at the dance, and this hasn’t done Saylor’s company any favors. 💃

To add to the drama, these massive stock sales are having a direct impact on Strategy itself. For instance, they executed another $2 billion sale in January, and today’s sale included an optional offering of up to $300 million. It’s like a never-ending yard sale! 🏷️

Strategy has also launched a new perpetual security, diversifying its offerings. BlackRock holds a tidy 5% of the company, which is a clear indicator of just how much stock the firm has been offloading. 📈

Rumors are swirling that these Bitcoin purchases might be creating a tax conundrum, but Saylor seems unfazed, plowing ahead with his acquisitions like a determined farmer in a field of gold. 🌾

Overall, Saylor is still playing the long game. Offloading huge quantities of shares is visibly impacting MSTR, but this could all change when Bitcoin decides to throw a party and enter another bullish cycle. 🎉

Previously, BeInCrypto analysts noted that BTC supply on exchanges has plummeted to 2.5 million, which means a supply shock is imminent. Strategy’s continued purchases could add to this pressure, making it a thrilling game of financial chicken! 🐔

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-24 22:00