There Bitcoin sat, hovering around $66,400 like a nervous party guest clutching a warm glass of chardonnay, trying to pretend it wasn’t sweating through its blockchain. Days of volatility had left it rattled, but now, thanks to the looming specter of a U.S. military strike on Iran, it was contemplating whether to flee to the safety of a USB drive or just self-immolate on the spot.

According to reports-you know, the kind that make you wonder if the world is being run by a particularly sadistic toddler-U.S. military officials have assured President Donald Trump that their strike options against Iran are “ready to go,” possibly as early as this weekend. Because nothing says “stable global economy” like a last-minute war plan.

BREAKING: Axios reports that there is evidence that US war with Iran is “imminent” and Israel is preparing for a scenario of “war within days,” which is expected to include:

1. Weeks-long “full-fledged” war unlike the Venezuela operation, sources say

2. Joint US-Israeli…

– The Kobeissi Letter (@KobeissiLetter) February 18, 2026

The Pentagon, never one to miss a chance to flex, has already sent more aircraft to the Middle East than a Black Friday sale at Best Buy. Iran, meanwhile, has been conducting military exercises and issuing warnings that sound like a disgruntled ex: “You leave me alone, or you’ll regret it.” Charming.

All this follows the collapse of nuclear talks, which apparently went about as well as a blind date between a vegan and a butcher. The White House insists diplomacy is still on the table, but let’s be honest-that table is wobbly, and someone’s already knocked over the wine.

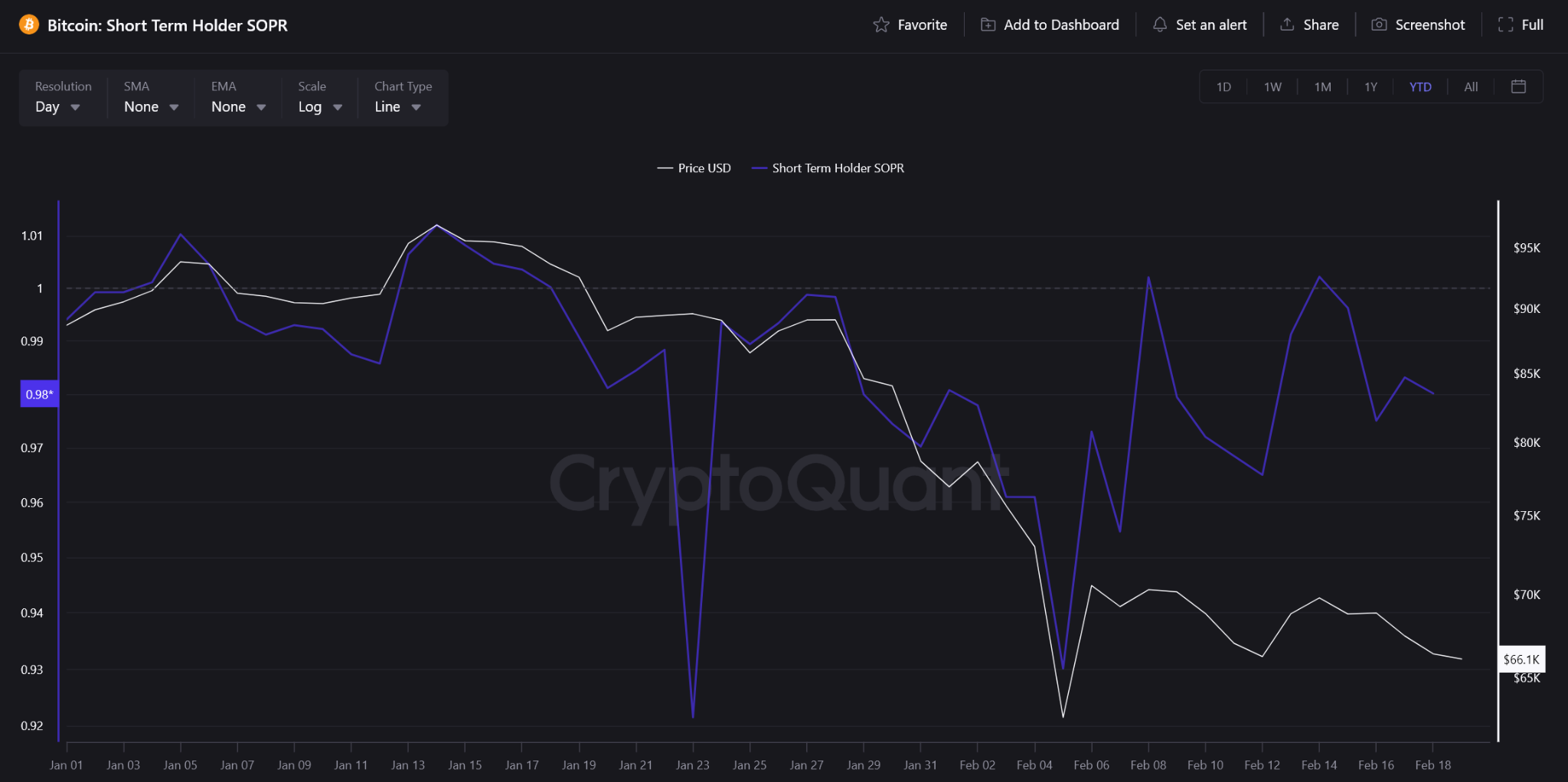

Bitcoin, poor thing, has been through the wringer. After peaking above $100,000-a height it will likely brag about at parties for years-it’s now languishing in the mid-$60,000 range, looking like it just got dumped by its long-term holder. Short-term investors are bailing faster than passengers on the Titanic, according to the Short-Term Holder SOPR indicator, which is basically a fancy way of saying, “Everyone’s panicking.”

And let’s not forget Bitcoin’s short-term Sharpe ratio, which has plummeted to levels usually reserved for a bad Tinder date. It’s so negative, it makes Eeyore look like a motivational speaker.

If the U.S. does decide to drop bombs this weekend, Bitcoin’s reaction will likely come in two phases. Phase one: mass hysteria. Investors will flee to cash like it’s the last helicopter out of Saigon. Phase two: the realization that, hey, maybe Bitcoin isn’t such a bad place to hide when the world’s on fire.

Bitcoin’s Short-Term Sharpe Ratio Hit a Level Historically Reserved For Generational Buying Zones

“The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs.” – By @MorenoDV_

– CryptoQuant.com (@cryptoquant_com) February 19, 2026

Of course, geopolitical uncertainty is like catnip for Bitcoin. When the traditional financial system starts looking like a house of cards in a wind tunnel, people tend to seek out alternatives. It’s not instant-more of a slow burn, like realizing your ex wasn’t actually that great after all.

For now, Bitcoin’s sitting in the corner, nursing its wounds and wondering if it should have just stayed in gold. Fear is high, tensions are higher, and the only thing certain is uncertainty. Whether it survives the weekend depends entirely on whether the world decides to hit the brakes or floor it into chaos.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Single-Player Games Released in 2025

- Where to Change Hair Color in Where Winds Meet

2026-02-19 20:20