There was a time, friend, when hope coursed through the veins of those longing for Bitcoin’s next moon shot. Dreams rode high atop the numbers—numbers so big they made bankers twitch and tech bros double-check their yacht orders. But dreams have a reputation for floating, and lately, they’ve been leaking faster than an overripe tomato at a summer picnic.

Binance Open Interest Takes a Hike—Downhill, That Is 🏔️

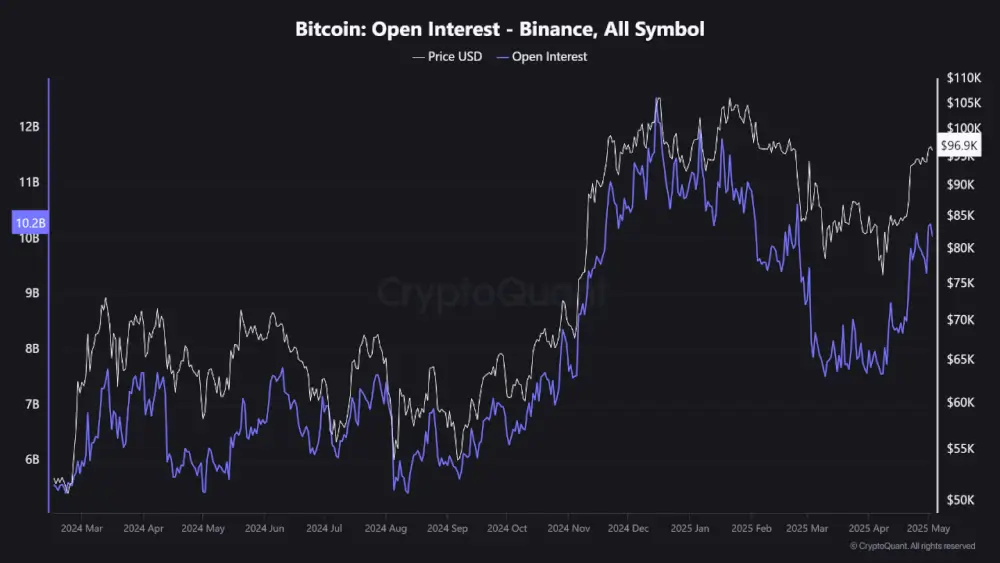

Once, Binance wore a $12 billion crown—a number to make lesser coins blush—from traders piling into long positions with all the grace of a herd of cattle smelling clover. You could feel the euphoria, right until it wasn’t there. Correction hit, like a hangover at a barn dance, and that open interest shrunk to $7.5 billion—just a 37% fall, nothing to write home about unless you’ve cashiered your farm.

Suddenly, the air was thick with shorts—traders betting against Bitcoin with the enthusiasm of a rooster at sunrise. The longs who’d gone in over their boots? Well, gravity sorted them out. Bless their leveraged little hearts.

Funding Rate Swings: Bear Market’s Favorite Soap Opera 🎢

CryptoQuant must get paid by the plot twist, because now the funding rate—sort of like paying rent if your landlord was a caffeinated octopus—peaked at 0.04%. Longs danced. Then Bitcoin tripped at $75K and the funding rate went negative. Shorts are bleeding coin to the longs, and you can almost hear the bearish laughter echoing off abandoned NFTs.

Here’s the kicker: when rates get this negative, history claims you might see a good old short squeeze. Picture stampeding bears running for the hills, forced to buy back coins they never wanted. If schadenfreude paid interest, we’d all be rich.

Spot Market: Where Hope Hides Under the Mattress 🛏️

The data sages nod and point to a strange fact: spot Bitcoin is selling for about $60 higher than its never-ending futures cousin. It’s not much, maybe lunch in San Francisco, but it’s enough to make a speculator wonder. Futures folks are shorting like the world’s ending, but down in the bowels of the spot market, they’re collecting coins like they own a gold pan and a bucketful of patience.

It’s the classic stand-off—bears in the futures, bulls in the spot, and someone’s about to blink. Maybe both… at once.

So, What Now? Flush, Reset, or Fire Up the FOMO Machine? 🤔

Let’s face facts like a man faces a hard frost with one good fleece jacket:

- Open interest has shrunk like wool pants in a hot wash

- Funding rates are as negative as my aunt at Thanksgiving

- Spot markets seem stubbornly hopeful

If you squint just right, it looks less like a breakdown, more like a market taking a breather—maybe getting ready to run again. Then again, that’s what the last bull said before the bear ate his lunch. Keep an eye out. And if you’re trading, try not to get too attached to your money… history says it rarely sticks around long enough to say goodbye.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-05-03 13:19