Ah, April! The month when everyone’s portfolio starts to behave like a whimsical character in a Bulgakov novel—unpredictable, madcap, and just a touch surreal. Our dear Bitcoin, that enigmatic beast, seems to have decided it’s had enough of dancing in Wall Street’s shadow and pirouettes away, tiptoeing alongside Gold while the American dollar sulks in the corner. Stocks? They’re tumbling like drunken revelers after a late-night brawl. But is this great financial decoupling a grand revelation or just another cosmic joke?

There’s always that one exuberant fellow in the market tavern proclaiming loudly that Bitcoin has abandoned the roguish gang of risk assets and joined the solemn ranks of Gold, the venerable fortress of wealth. Not hard to see why—while most assets hiccuped and staggered, Bitcoin and Gold waltzed on, heads held high. On April 21, 2025, Gold hit a dizzying $3,400, a number that has more zeros than a bureaucrat’s signature on government paperwork. The headlines say it’s a reaction to mounting investor unease, as stocks and altcoins artfully dive through liquidations like trapeze artists without nets.

Gold’s throne used to sit comfortably between $1,800 and $2,000 for much of this decade’s early innings, stubborn as an old mule not wanting to move. The fall of 2023 whispered promises of change, and soon the shiny metal began its ascent, hand-in-hand with the ever-growing U.S. national debt, which apparently flirts with gold prices like forbidden lovers. MacroTrends, the cryptic soothsayers of the markets, nod gravely at this connection.

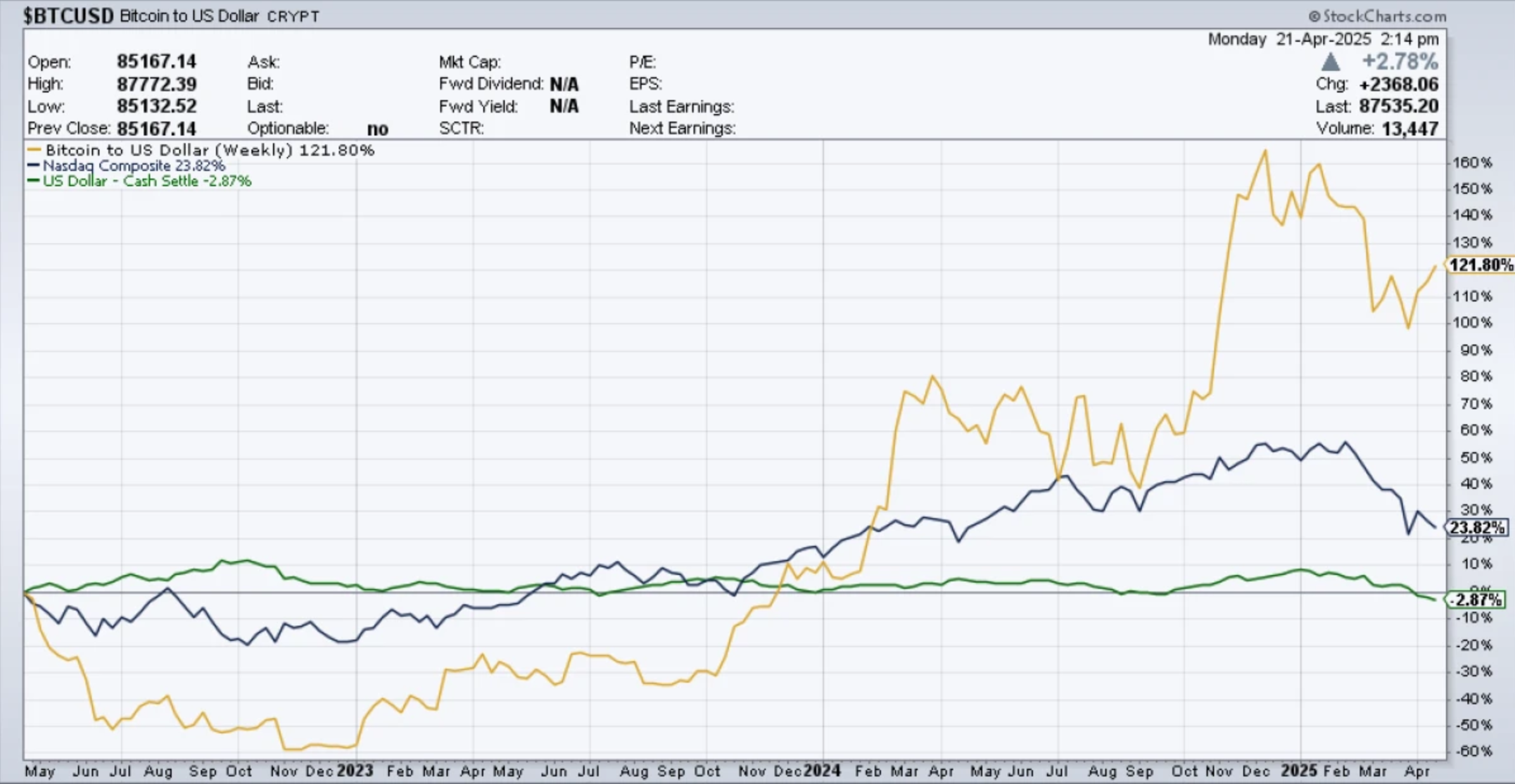

Gold, as always, is the age-old safe haven, wrapped in veteran investor’s nostalgic tales. Bitcoin, not to be outdone, strutted in wearing a similar cloak. But—tick tock!—institutional investors arrived, turning Bitcoin into a jittery cousin of the stock market, mimicking Nasdaq’s every move like a faithful hound, but with more dramatic flair.

Experts? Oh, they’re squabbling like the cast of a Moscow play, each with their own theory. Robbie Mitchnick of BlackRock sulked in March 2025, claiming Bitcoin hasn’t quite mastered Wall Street’s dance moves yet, but he expects it’ll join in as soon as the traditional finance folks get tired of their own waltz.

Did Bitcoin really throw off its shackles from stocks, or is it just playing dress-up?

Late April was a spectacle: Bitcoin and Gold ballooned while the usual suspects—stocks and the mighty greenback—shrunk faster than a wool sweater in a Siberian bath. Just on April 22, Bitcoin leapt 7%, like a cat startled by a cucumber, while risk assets limped home in defeat.

The crypto hive buzzed with declarations that Bitcoin had broken free, assuming the mantle of the fearless safe haven. Meanwhile, other assets cowered, looking like candidates for the next tragicomic collapse in this absurd financial theater.

🇺🇸 BLOOMBERG JUST SAID #BITCOIN IS DECOUPLED FROM THE STOCK MARKET

IT’S HAPPENING!!! 🚀

— Vivek⚡️ (@Vivek4real_) April 22, 2025

Yet, as with any good plot twist, the tale is far from settled. Some whispers remind us this might be a fleeting chapter—a financial hiccup before the grand ensemble returns to its usual chaos. Bitcoin could well resume following the stock market’s woeful march once the political and economic tempest calms down.

“Bitcoin divergence” and “Bitcoin decoupling”—buzzwords to lure readers in 2025, keep your popcorn ready!

— Tuur Demeester (@TuurDemeester) April 22, 2025

Cynics suggest the Bitcoin rocket owes its fuel to a cocktail of increased liquidity and technical triggers—basically, “ignore the noise,” they say, as if noise weren’t half the fun. Meanwhile, global headline writers keep us on our toes: whispers of U.S.-China detente here, Indian sanctions there, and China refusing to play nice with America. Yes, this drama is enough to make even the stoniest trader twitch.

So perhaps this Bitcoin holiday from stocks is more a curious blip inspired by headlines than a new epic saga. The characters might very well reunite once the curtain falls on trade tensions.

Why bother about decoupling? A sage speaks!

We summoned Ekta Mourya, our oracle of markets, to shed light on this financial fantasy. Here’s her incantation on decoupling’s significance and its potential longevity:

“Bitcoin’s recent flirtation with Gold—dropping negative correlation like a bad habit and adopting a friendly 0.45 Pearson coefficient—signals a reawakening of the ‘digital Gold’ myth, first kindled during Trump’s tariff tremors.

For the traders, this opens dinner doors to chase the elusive $109K all-time high—a price level as tempting as a Russian novel’s final secret.

Bitcoin’s sashay away from stocks feels less like a committed affair and more like a passing fancy. While volatile markets and tariff tantrums shake equities, Bitcoin enjoys a cozy reputation as a refuge for bold capital.

However, structurally, Bitcoin is the reckless high-beta circus performer—always challenging the status quo, offering portfolio spice, and keeping both retail and institutional players on their toes.”

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-04-25 21:34