Ah, mesdames et messieurs! Today, a staggering $5.79 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to meet their fateful expiration! 🎉

Market observers, like hawks circling their prey, are keenly watching this spectacle, for it holds the power to sway the fickle winds of short-term trends! The volume of contracts and their notional value shall reveal the traders’ secret desires and possible market directions. 🦅

Insights on Today’s Expiring Bitcoin and Ethereum Options

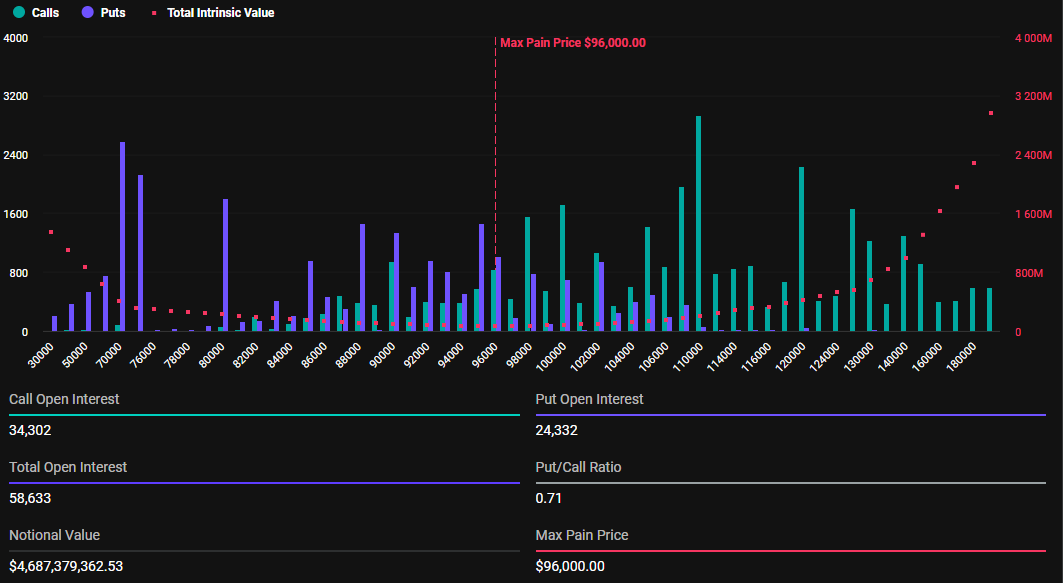

Lo and behold! The notional value of today’s expiring BTC options is a princely sum of $4.68 billion. According to the wise sages at Deribit, these 58,633 expiring Bitcoin options boast a put-to-call ratio of 0.71. A clear sign that the calls are more popular than the puts—like a fine wine over a cheap ale! 🍷

But wait! The maximum pain point for these options is a staggering $96,000. Ah, the irony! This is the price that shall bring the most sorrow to the holders, like a tragic hero in a Molière play! 🎭

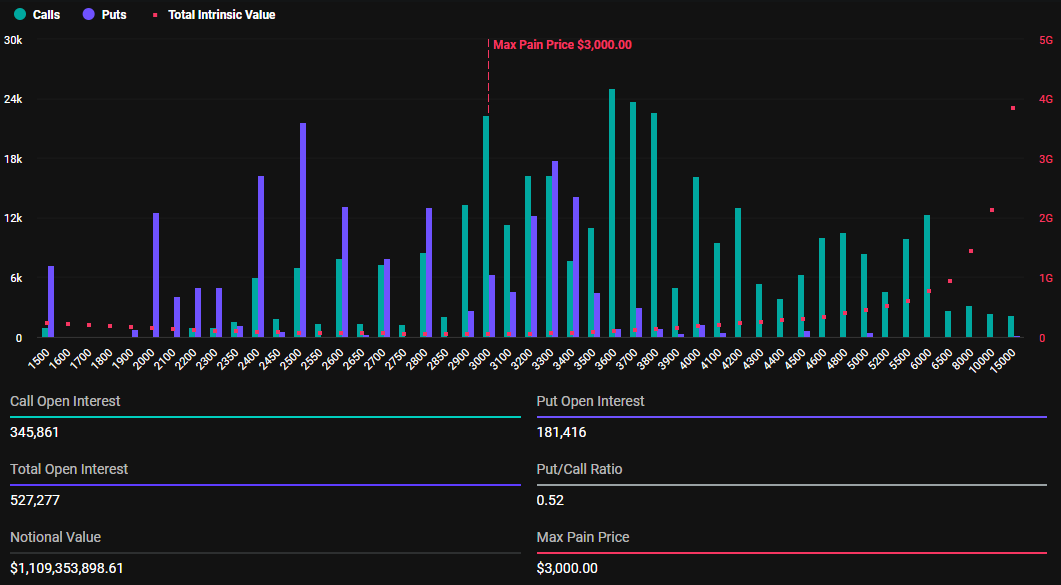

And what of Ethereum, you ask? A whopping 527,277 Ethereum options contracts are also set to expire today, with a notional value of $1.109 billion, a put-to-call ratio of 0.52, and a maximum pain point of $3,000. Such drama! 🎭

Last week, the options expiry was but a mere $2.04 billion, with only 16,561 BTC and 153,608 ETH contracts. What a difference a week makes! It seems the traders have decided to throw a grand ball this month! 💃

Market makers, those crafty fellows, prefer monthly expiries for their superior liquidity and tighter spreads. They are like the clever foxes of the market, always seeking the best opportunities! 🦊

As the clock ticks down to expiration, the wise Greeks.live have shared their insights: the market sentiment is decidedly bearish, with traders fretting over the potential for further declines. Oh, the suspense! 😱

“Overall Market Sentiment: The group is predominantly bearish, with traders eyeing $82,000 as a critical support level. Will it hold? Or shall it crumble like a poorly constructed set in a farce?” read the post. 🎭

Implication of Today’s Options Expiry on BTC and ETH Prices

In this grand theater of finance, some traders are shifting to call ratio spreads, adopting a more defensive posture. They believe that after this tumultuous drawdown, Bitcoin’s price may dance chaotically, perhaps retesting $88,000 before deciding its fate. 💃

Deribit warns of impending volatility, as traders hedge against the specter of declining crypto prices, reminiscent of the days following election turmoil. The market is as unpredictable as a Molière plot twist! 🎭

As reported, Trump’s surprise tariffs have cast a shadow over Bitcoin and the broader crypto market. Will these tariffs be the tragic flaw that leads to downfall? Only time will tell! ⏳

For now, the max pain prices for both Bitcoin and Ethereum soar above their market values. Bitcoin trades at $79,890, while ETH is at $2,137. The tension is palpable! 😬

As the max pain price looms above, options sellers may be tempted to push Bitcoin and Ethereum prices higher, like a desperate actor seeking applause! 🎭

“With the end of the month approaching, BTC options traders should take heed: Max Pain for Feb 28 sits at $98,000, with a massive $5 billion notional value. The highest open interest is clustered here, urging market makers to keep BTC close to this price. Expect a dramatic climax!” stated the altcoin options exchange PowerTrade. 🎭

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-28 09:59