In the shadow of the FOMC’s deliberations and the digital asset summit’s grandiloquence, a staggering $2.09 billion in Bitcoin and Ethereum options are poised to expire today. The market, ever the fickle mistress, watches with bated breath.

This expiration, a mere blip in the grand tapestry of financial machinations, could yet stir the pot of market conditions. Investors, those eternal optimists, are on high alert for any signs of upheaval.

The $2 Billion Question: To Expire or Not to Expire?

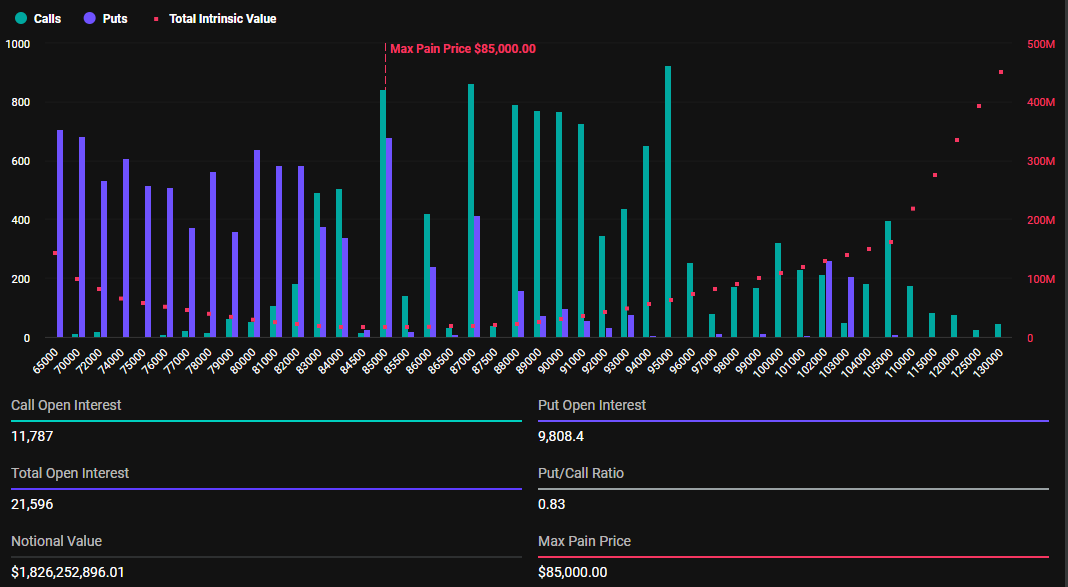

Deribit, the oracle of options, reveals that $1.826 billion in Bitcoin options are set to expire today. The maximum pain point? A lofty $85,000. Ah, the sweet agony of it all!

These options, numbering 21,596 contracts, are a tad fewer than last week’s 35,176. Despite the recent volatility, the put-to-call ratio of 0.83 whispers of a bullish sentiment. How quaint.

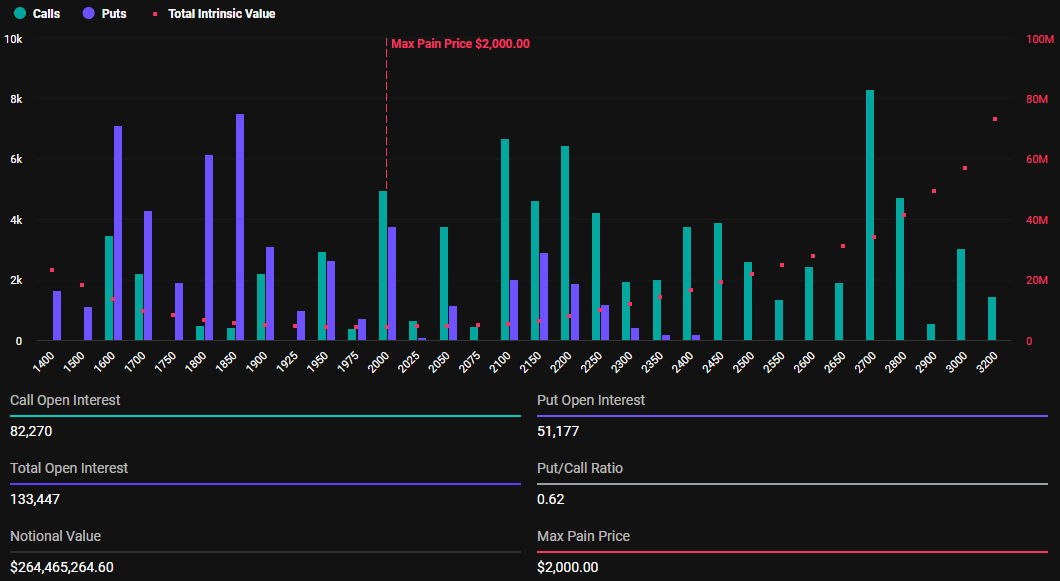

Ethereum, the younger sibling, has $264.46 million in options expiring, involving 133,447 contracts. This figure, too, is lower than the previous week’s 223,395 contracts. The maximum pain point? $2,000. The put-to-call ratio? 0.62. The drama? Unparalleled.

As the clock ticks towards 8:00 UTC today, Bitcoin and Ethereum prices are expected to flirt with their respective maximum pain points. According to BeInCrypto data, BTC traded for $84,414, whereas ETH exchanged hands for $1,977. A modest upside, perhaps, but in this game, even a modest upside can feel like a triumph.

This surge, if it comes, is plausible given the smart money’s strategy in options trading, pushing prices toward the “max pain” level. Here, the highest number of contracts, both calls and puts, expire worthless. A cruel twist of fate, indeed.

“Will we see a volatility squeeze or a slow unwind?” Deribit mused on X (Twitter). A question as old as time itself.

Based on Bitcoin and Ethereum’s put-to-call ratios, both below 1, call options (purchases) have a higher prevalence than put options (sales). The market, it seems, is a glass half full.

Market Sentiment: A Tale of Two Traders

Analysts from Greeks.live, the soothsayers of crypto options, provided insights on the current market sentiment. The trader community, ever divided, is split between those expecting a price drop post-FOMC meeting and those anticipating a temporary rise before choppy conditions. The range between $83,000 and $85,000 is the area of interest, with expected volatility around President Trump-related developments and potential MicroStrategy (now Strategy) purchases. Ah, the plot thickens!

“Expect chop and drift lower before heading higher again on Monday, despite the current pump not being viewed as sustainable,” Greeks.live analysts observed. A prophecy, or mere speculation? Only time will tell.

Elsewhere, BeInCrypto reported that Bitget exchange CEO Gracy Chen is confident BTC will hold above the $73,000 to $78,000 range, paving the way for a potential rally to $200,000. Her optimism is tied to the US strategic Bitcoin reserve’s potential to drive institutional legitimacy and long-term price stability. A bold claim, but in this market, boldness is often rewarded.

Even as Bitget’s Chen remains optimistic, traders and investors should brace for short-term volatility. Historically, options expirations tend to cause temporary price movements. However, the market usually stabilizes shortly after. A rollercoaster ride, but one with a predictable end.

This calls for vigilance and analysis of technical indicators and market sentiment to manage potential volatility effectively. In this game, knowledge is power, and power is everything.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-21 08:56