Bitcoin and Ethereum Options Expiring? The Market’s About to Do Weird Things… 😱

🤑 Approximately $3.12 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today. Will this river of money finally float Bitcoin past $100K, or are we just crushing dreams by the billions? Stay tuned and cross your fingers. ✌️

Market watchers have already marked today as “Stress-Testing-Friday.” Why? Because a giant pile of contracts and their jaw-dropping notional value can stir the market pot. If you’ve got a magnifying glass and a calculator, check out the put-to-call ratios and maximum pain points. They’re basically horoscopes for traders. ✨📉

Today’s Bitcoin and Ethereum Drama: Expiring Options Edition

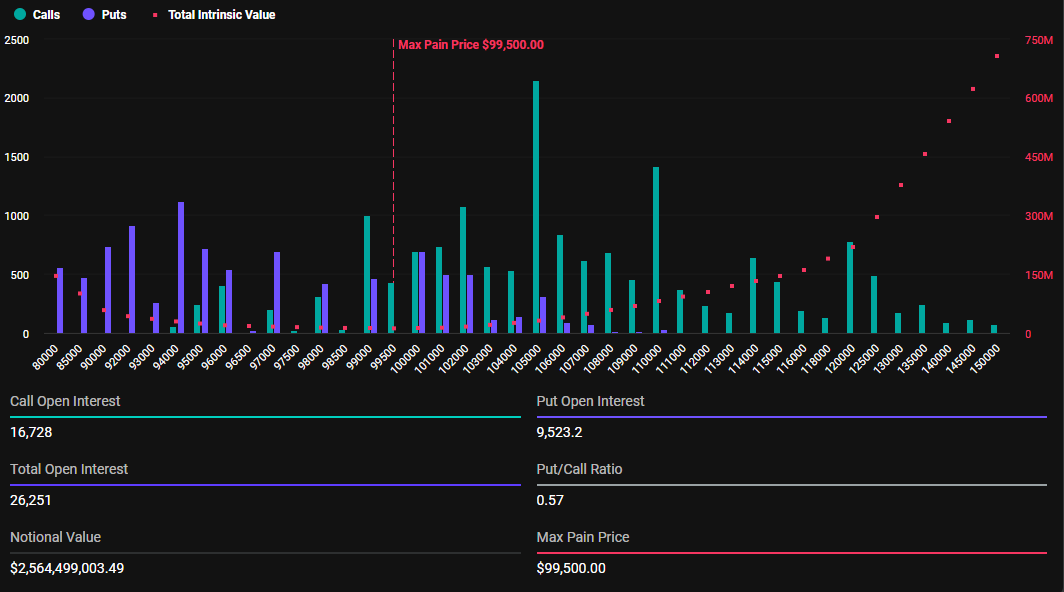

On with the show! Bitcoin options carry a staggering notional value of $2.56 billion. Deribit’s data says there are 26,251 expiring Bitcoin options with a put-to-call ratio of 0.57. Translation? It’s the financial equivalent of everyone yelling “BUY, BUY, BUY!” and whispering “sell” under their breath. 😅

The “maximum pain point” (yes, that’s what it’s actually called—no one said finance was subtle) is $99,500. That’s the price that will cause the most people to say, “Why do I even do this for a living?”

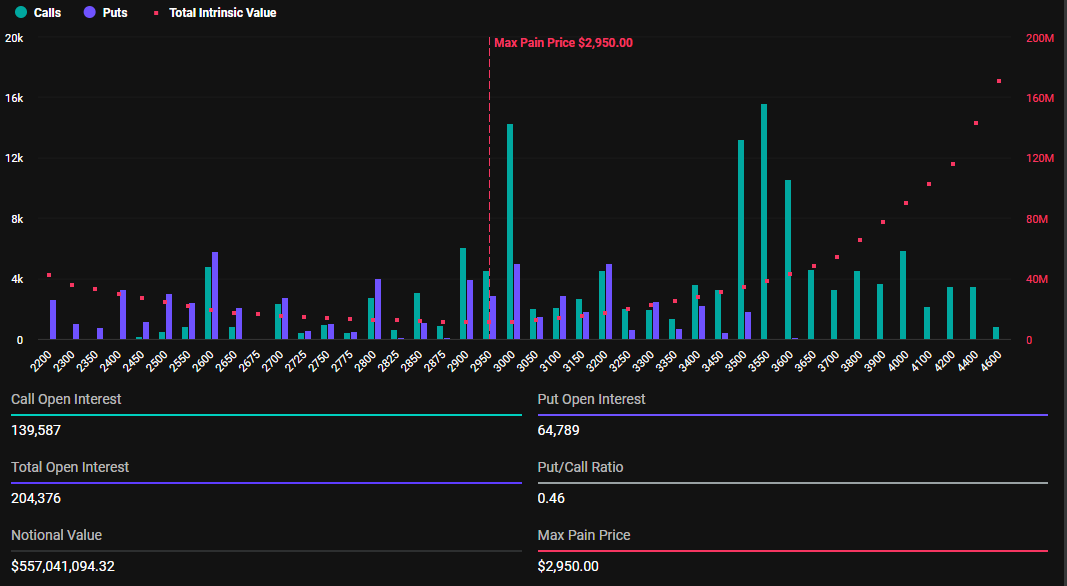

Back to ETH: Ethereum’s drama today includes 204,376 expiring contracts with a notional value of $557.04 million. For those keeping score, the put-to-call ratio is an even smaller 0.46. The maximum pain point? $2,950. Basically, just low enough to make traders wince but not cry. Much. 😢

For context, this week’s numbers are basically the “fun-size candy bars” of last week’s results. Remember, last week was the “super-sized” version with $10 billion worth of contracts expiring. This? More like a lukewarm follow-up. 👎🍫

According to options trading tool Greeks.live (yes, the site name sounds like a dating app for philosophers), things are looking grim, thanks to—you guessed it—market sentiment. Apparently, traders got sad about ETH dropping to $2,100—its lowest level since 2024—and Bitcoin remaining allergic to $100K. Buy tissues, people. It’s gonna be a long ride. 😭

“Market sentiment was weaker this week, with ETH’s Maxpain point falling below $3,000 again… BTC effectively falling below the $100,000 mark,” noted Greeks.live, between sips of their probably spiked coffee. ☕️

Adding spice to the sadness stew is, you guessed it, Trump’s tariffs! Yes, surprise: fees on international trade are still haunting us like a bad Christmas fruitcake. Traders are now warily eyeing the chances of a trade war blowing up in all our financial faces. 🎃💣

“The market is still digesting the effects of 3 months of Trump Trade,” analysts muttered, possibly while sobbing into their spreadsheets. Apparently, Block puts are up, and everyone else is just “trading down significantly.” In layman’s terms? Doom 🙃.

And if you thought unemployment numbers and payrolls data had no bearing on your crypto portfolio—think again, genius. Ups and downs there could either send Bitcoin soaring or straight down to Sadville, population: you. 😬

“If unemployment numbers rise, Bitcoin might shine as the world’s grumpiest hedge fund. If they drop, traditional markets will look tempting. Either way, crypto stays spicy,” observed Mark Cullen, who has probably seen some things. 🍿🔥

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-07 08:48