Ah, today marks the expiration of nearly $5 billion in Bitcoin (BTC) and Ethereum (ETH) options. The sort of milestone that should make traders clutch their pearls in delightful anticipation-or, you know, sheer terror.

With traders split on their next move and volatility strategies in full-on circus mode, all eyes are now glued to key support levels. Will this expiry shake the market out of its deep, sloth-like slumber? Only time will tell. But if you’re betting on excitement, place your chips carefully.

Bitcoin, Ethereum Options Expiry Looms With $4.96 Billion at Stake

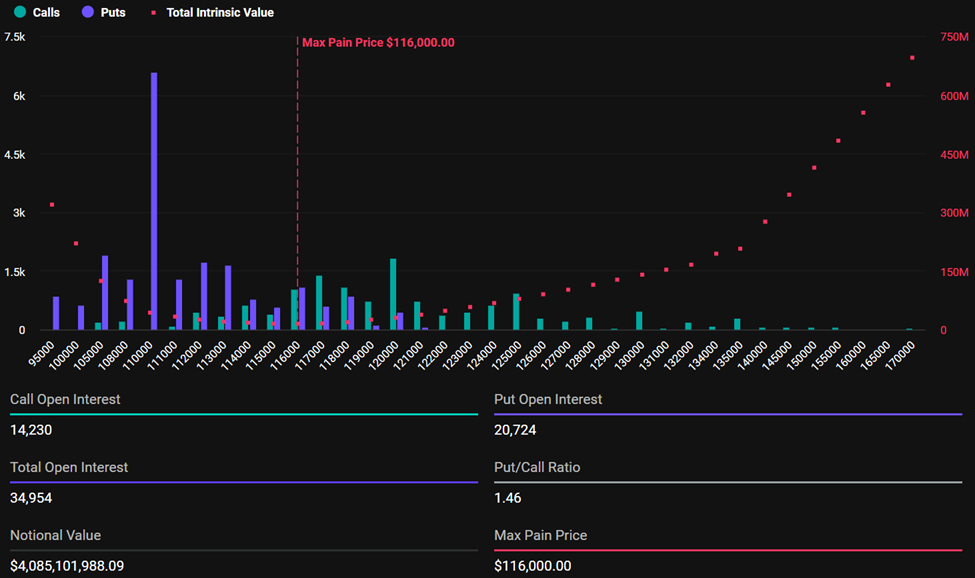

According to the ever-reliable (and sometimes overly dramatic) data from Deribit, Bitcoin is the star of the show, leading the pack with option contracts worth a staggering $4.09 billion. The max pain point, where the most options expire worthless and dealers don’t lose their shirts, stands at a tantalizing $116,000. A round of applause for that level of precision, please.

In case you’re wondering, the open interest (OI) for these expiring Bitcoin options is a hefty 34,954 contracts, with a put-to-call ratio (PCR) of 1.46. A little bearish, you say? Well, it’s not like traders were planning to throw a party.

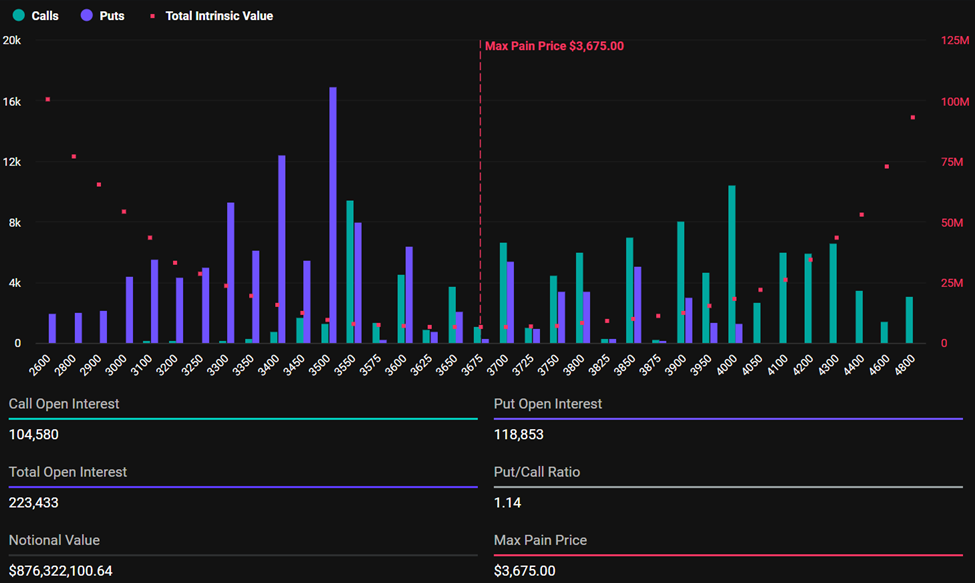

Now, let’s talk Ethereum. The numbers here are modest, but hey, significant is still… significant. At 8:00 UTC on Deribit, Ethereum will see $876 million in options expire. That’s a smaller chunk, but still a small fortune by anyone’s standards. And with 223,433 contracts hanging in the balance, traders are clearly doing something right-or terribly, terribly wrong.

The max pain point for Ethereum? A cozy $3,675, which aligns with the notional value of $876.3 million. The PCR of 1.14 reveals a more neutral sentiment, suggesting that the Ethereum crowd might be having a quiet tea party compared to Bitcoin’s louder, more dramatic affair.

Deribit’s analysts have generously shared their insights, noting that the open interest distribution looks like a game of musical chairs with puts below spot and calls stacked above. Charming. Will the expiry finally shake things up? We’ll let you decide.

“OI distribution hints at puts clustered below spot, calls stacked higher. Do you think the expiry could shake things up?” Deribit analysts quizzed.

Of course, this skew might act as a gravitational force, keeping prices within their range-bound little comfort zone. But, hey, only until expiry happens today at 8:00 UTC. So much can change in a day, don’t you know?

Low Volatility Dominates Market Sentiment

Options analysts at Greeks.live note a delightfully mixed sentiment across the market. Apparently, many traders have adapted to the lull of low volatility like cats napping in the sun.

Despite the 32% implied volatility (IV) looming like a dark cloud on the horizon, traders are selling puts with abandon, especially around the BTC 112,000 strike for the end-of-week expiration. It’s almost as if they’re betting on nothing happening… or a mild upside, which is perfect for harvesting those sweet premiums. Ah, the thrill of mild stability.

“Traders are actively selling puts at 112,000 strike for end-of-week expiration despite 32% implied volatility concerns,” said analysts at Greeks.live. Oh, the irony.

These same analysts are waxing poetic about premium selling strategies, suggesting that if the underlying moves in the right direction, profits shall be had. A small, predictable world, where everyone knows their place. How quaint.

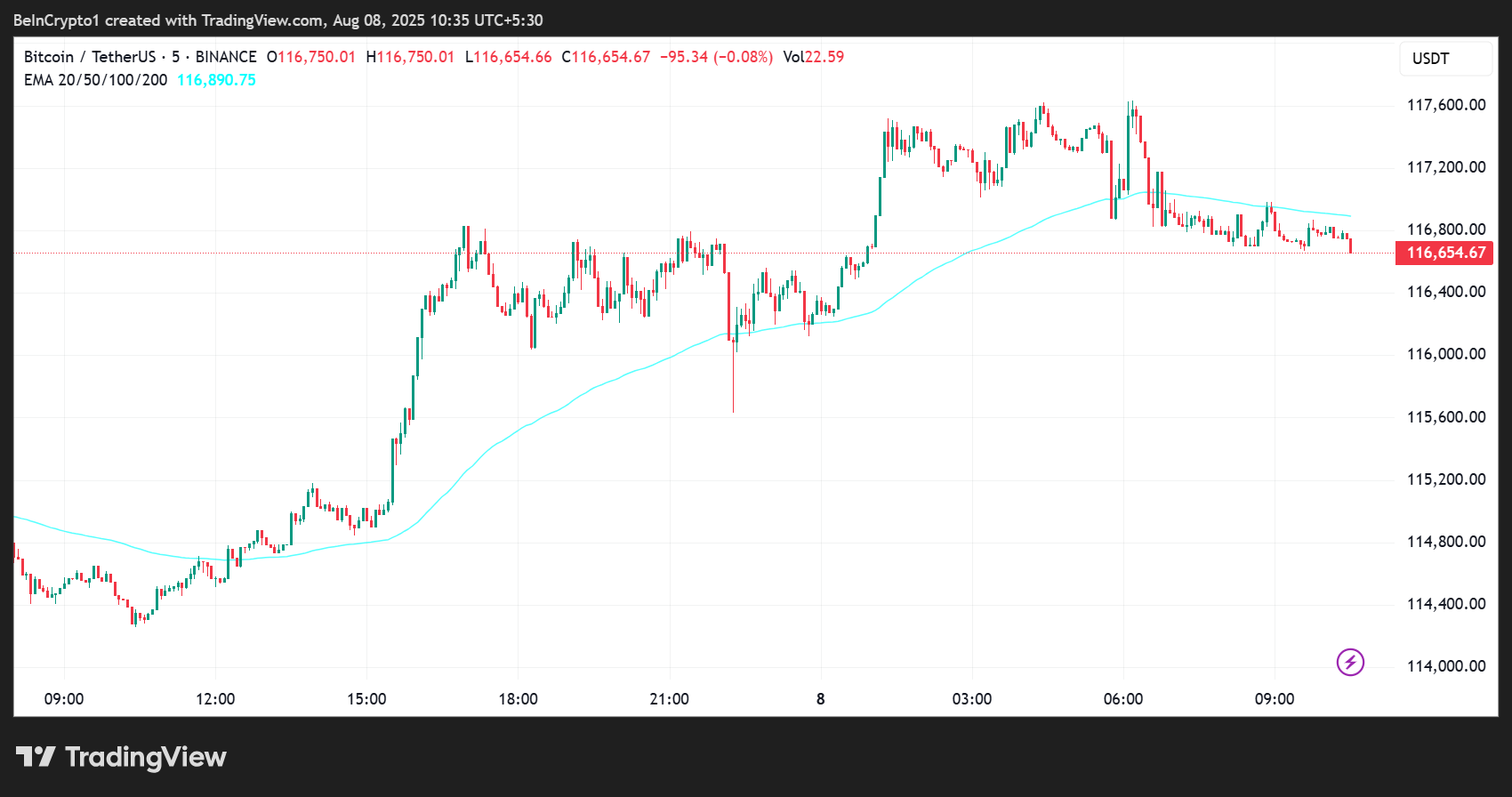

And then there’s the BTC 5-minute EMA100, the so-called “technical battleground.” As Bitcoin now dips below this moving average, it’s signaling short-term bearish momentum. How utterly delightful.

This could prompt defensive moves from put sellers, who, in the hope of avoiding losses, might try to nudge prices higher. Because when in doubt, why not attempt to control the chaos?

Could this expiry bring forth a massive spike in volatility? The jury is still out. With such a colossal volume of contracts set to expire, sudden repositioning is a very real possibility-especially if BTC or ETH break key technical levels. But given that most traders are positioned as volatility sellers, don’t expect fireworks just yet.

Still, once these positions unwind, the post-expiry environment could offer fresh, directional opportunities. That is, if anything unexpected happens, like, say, a macro catalyst or a liquidity shift. Fingers crossed, right?

Meanwhile, traders will continue to play defense, squeezing whatever profits they can from this week of compressed volatility. But beware: the calm before the storm can be perilously deceptive.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-08 09:58