As a seasoned researcher with years of experience navigating the volatile crypto market, I find myself cautiously optimistic amidst the current Trump rally and the massive expiration of options contracts for both Bitcoin and Ethereum. The sheer volume of these contracts adds an element of uncertainty to the market’s next move, but the bullish sentiment suggested by the put-to-call ratios is hard to ignore.

In recent times, there’s been substantial growth in the cryptocurrency market, often referred to as the “Trump rally.” Yet, given its large upcoming expiration, predicting the market’s next action becomes challenging and uncertain.

Watching closely, investors anticipate whether the prices of large cryptocurrency options will stabilize or drop following their expiration. This significant event has the power to influence market sentiment due to the immense number of contracts set to expire.

As per Deribit’s reports, approximately 20,815 Bitcoin option agreements with a total worth of about $2.077 billion will be settled. The ratio of put options to call options for these contracts is 0.83, indicating that traders are more inclined towards long positions (calls) rather than short ones (puts). This lean suggests a predominantly optimistic outlook among traders, or “bullish sentiment”.

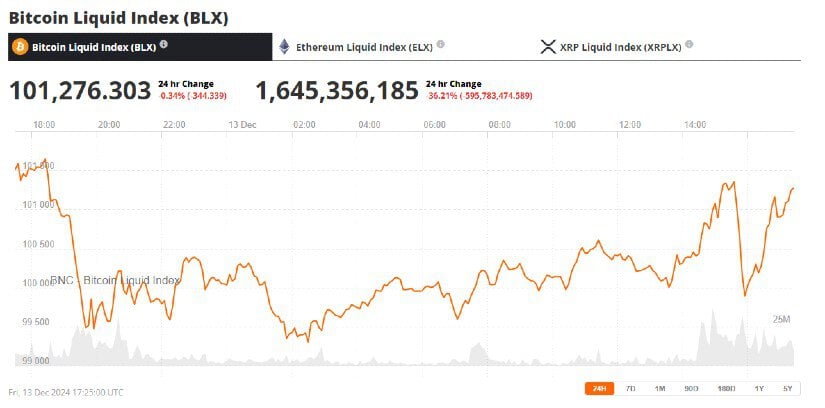

remarkably, the point at which Bitcoin experiences the most discomfort is approximately $98,000. This figure is slightly lower than its current market price of $101,276, as reported by Brave New Coin’s Bitcoin Liquid Index. The “maximum pain point” refers to a narrow region where price fluctuations could affect the greatest number of traders.

Ethereum Joins the Expiry Drama

As an analyst, I’m observing that while Bitcoin garners the limelight, Ethereum isn’t lagging too far behind. Approximately 164,330 Ethereum options, valued at approximately $644 million, are due to expire today. Interestingly, the put-to-call ratio for Ethereum stands at 0.68, indicating that a majority of traders are wagering on price growth rather than drops, much like Bitcoin.

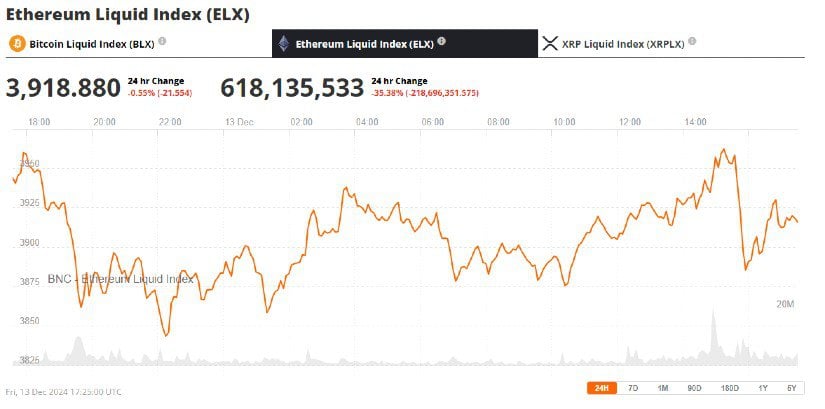

The crucial challenge for market observers in relation to Ethereum is its maximum resistance level, which at present lies slightly below the current asset value. So far this year, ETH hasn’t reached a new record high and is trading just under $4,000. As per Brave New Coin’s Ethereum Liquid Index, there has been a 0.55% drop in ETH over the past 24 hours.

Greeks Live stated that a larger portion of recent Block call options trading exceeded 30% on average daily. In contrast to past years when European and American trading activity during Christmas would significantly decrease, this year there’s an increased impact of US stocks on cryptocurrencies, a trend that may be more prominent.

As the holiday season and annual deliveries draw near, market makers are subtly modifying their stances. An increase in bullish option transactions indicates that traders have a generally upbeat outlook regarding the year’s conclusion.

Trump Rally Adds to Market Optimism

The possibility of a future Trump administration being favorable towards cryptocurrencies in 2025 has increased enthusiasm among traders. They are speculating about potential policies that might boost the crypto sector, thereby adding an optimistic perspective to the present market trends.

As an analyst, I find it noteworthy that while Ethereum may be trailing Bitcoin’s performance, its potential is undeniably evident. The consistent influx of funds into ETH-based Exchange Traded Funds (ETFs) since November 22 is a testament to this. As of December 12, the total net flows have surged to $1.97 billion, as per SoSoValue’s data. This steady stream of investments indicates a rising faith among investors in Ethereum’s future possibilities.

Over the last fortnight, numerous trades have centered around quick-gain tactics (PVP), as options trading’s affordability has made it appealing. This surge in activity is largely driven by recent economic indicators. The recently released Consumer Price Index (CPI) report indicates a rise in U.S. inflation, matching economists’ predictions. Furthermore, the heightened probability of a 25 basis point interest rate reduction on December 18th, as suggested by the Federal Reserve, has boosted investor assurance.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2024-12-15 15:40