As a seasoned crypto investor with over two decades of experience navigating the ever-evolving financial landscape, I find myself intrigued by the ongoing debate surrounding the potential incorporation of Bitcoin into the US financial reserves.

Given my background, I’ve seen firsthand the rise and fall of various trends in the financial world, from the dotcom bubble to the 2008 global financial crisis. This experience has taught me that predicting market movements is a precarious endeavor, often fraught with uncertainty and unexpected twists.

While I admit that the prospect of Bitcoin entering the US reserve strategy seems remote at this juncture, I can’t help but be captivated by the optimistic projections put forth by some experts. The potential for Bitcoin to revolutionize global finance is undeniable, especially considering its role as a decentralized, digital asset that could circumvent traditional financial systems.

However, I share the skepticism expressed by analysts like Ki Young Ju, who highlight the political resistance and current economic conditions that make such a move unlikely. History has shown us that change comes slowly in the realm of finance, and the US is not one to embrace new ideas without careful consideration and substantial evidence supporting their benefits.

As for my personal opinion, I believe that the odds of Bitcoin being incorporated into the US financial reserves within President-elect Trump’s first 100 days are indeed slim. However, I wouldn’t be surprised if we start seeing more discussions on this topic in the coming years, especially if global economic conditions continue to shift and traditional assets become less reliable.

To lighten the mood, I’ll leave you with a little joke: Why did Bitcoin cross the road? To prove it wasn’t tethered!

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous technological advancements revolutionize the way we transact and store value. The potential for Bitcoin to become part of the United States’ financial reserves is a topic that has piqued my interest. However, I remain skeptical due to my personal experiences with digital currencies and their volatility. While I acknowledge the benefits of decentralization and the potential for increased security, I believe that the current regulatory environment and the lack of transparency in Bitcoin’s underlying technology make it a risky proposition for the U.S. Treasury. In my opinion, a more robust and stable digital currency, one that is backed by a strong governmental entity and has transparent governance mechanisms, would be a better fit for the nation’s financial reserves.

In the crypto world, numerous professionals view the odds as quite low, at least for the immediate future, since debates are often clouded by unpredictability.

Bitcoin Reserve Odds Drop as US Policy Analysts Predict Pushback

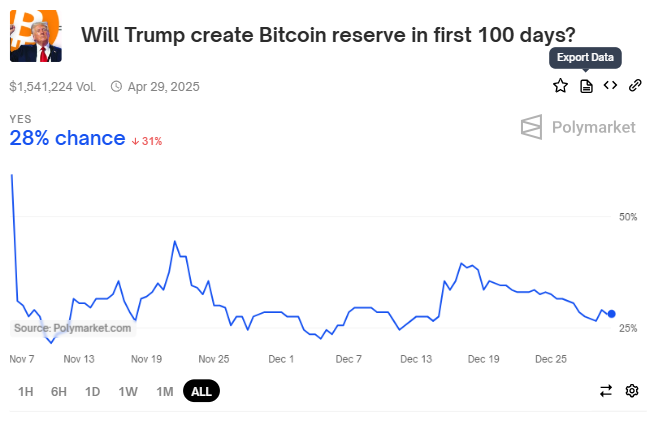

Based on my observations and experiences in the financial world, it seems that there is a divide between prediction platforms and analysts regarding the possibility of Bitcoin becoming part of the U.S. reserve strategy under President-elect Donald Trump. Personally, I find it rather improbable for Bitcoin to be incorporated into the U.S. reserve within his first 100 days in office, as suggested by data from Polymarket, where users have assigned a mere 29% probability to this event.

This is a significant drop from the post-election optimism when odds peaked at 60%. Given my understanding of the complexities involved in integrating digital currencies into the existing financial system, I believe it would require more time and careful consideration before any such decision could be made. Furthermore, as someone who has closely followed the crypto market for several years now, I’ve come to realize that rapid changes or radical shifts in policy are not common in the realm of finance, especially when it comes to something as significant as adding a new asset class to the U.S. reserve.

In conclusion, while I understand the allure and potential benefits of Bitcoin, I believe it is unlikely that we will see it become part of the U.S. reserve strategy within Trump’s first 100 days in office. However, I remain open to the possibility that it may be considered at a later stage, as the financial landscape continues to evolve and the benefits of digital currencies become more apparent.

From my personal perspective, having closely observed the financial world for several years, I believe this decline in Bitcoin’s acceptance within US financial policy mirrors a broader wave of skepticism among policymakers. As someone who has kept an eye on various investment trends, I can see why proponents view Bitcoin as a fitting addition to traditional reserves like gold and oil. However, based on my understanding of the current political landscape and economic conditions, I find it challenging to envision Bitcoin becoming a significant player in US financial policy any time soon. The resistance from policymakers seems entrenched, and the current economic climate is not conducive to such a move.

According to Ki Young Ju, CEO of CryptoQuant, it’s questionable whether the United States could adopt Bitcoin as a reserve asset during the Trump administration. He believes this change might happen only if America’s worldwide economic superiority encounters a severe challenge.

Ju highlighted similarities between current Bitcoin supporters and earlier proponents of reinstating the gold standard, suggesting that in each instance, they presented these non-traditional resources as answers to economic instabilities.

Nevertheless, past patterns indicate a reluctance towards relying solely on one asset. To illustrate, proposals to revive the gold standard in the late 1990s were discarded, as the US chose to navigate economic difficulties through innovation instead. It’s predicted that Bitcoin might encounter similar resistance unless a country’s overall financial health significantly deteriorates.

If Trump manages to display the robustness of the U.S. economy, enhance the dominance of the dollar, and improve his public approval ratings, it’s uncertain whether he will continue to uphold his pro-Bitcoin position from his campaign. He might effortlessly shift away from his Bitcoin endorsement, justifying it as a matter of shifting priorities, without causing dissatisfaction among his voters.

As a crypto investor, I find myself intrigued by the optimistic views of some financial experts who see Bitcoin’s transformative potential in redefining global finance. Matthew Sigel from VanEck has recently made a compelling case that the United States could potentially diminish its national debt by as much as 36% by 2050, if it were to establish a Strategic Bitcoin Reserve. His vision is one where Bitcoin emerges as a primary settlement currency in global trade, offering an attractive alternative for countries aiming to circumvent US sanctions.

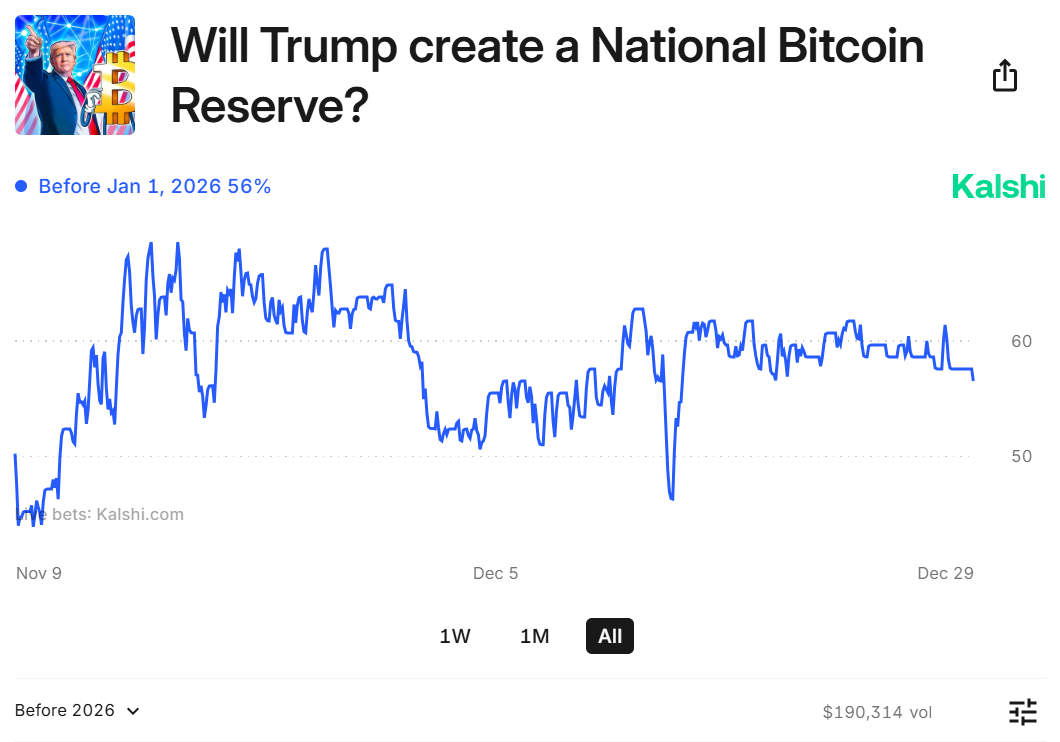

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous technological advancements and market shifts. Based on my observations, I believe that the implementation of Bitcoin development could happen by 2026. This prediction is not mere speculation but an informed assessment based on the current trends and the rapid pace of innovation in the digital currency space.

Recently, I have been closely following the activities of Kalshi, a New York-based platform that specializes in prediction markets. Their odds for the Bitcoin development occurring by January 2026 stand at 56%. As someone who has seen the power of prediction markets in forecasting future events accurately, I find this figure quite significant.

However, it’s essential to remember that past performance is not always indicative of future results. The success of Bitcoin development depends on a myriad of factors, including regulatory environment, technological advancements, and market sentiment. Nonetheless, I remain optimistic about its potential realization by 2026.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-12-29 20:01