In a universe less comprehensible than the tax code of Betelgeuse, Bitcoin’s future is being divined by armchair soothsayers, planetary alignments, and, apparently, several individuals with more charts than friends. The most gloriously optimistic scenario points to Bitcoin rocketing up to $175,000 in the next 12 months—a sum sufficient to buy a small spaceship, lunch at Milliways, or perhaps a slightly used towel. 🚀💰

For those who prefer their investment advice sprinkled with a touch of political absurdity, this cosmic prediction is bolstered by the notion that institutional capital will flood in, spurred by enthusiastic investors and the Trump administration’s plans to create a national Bitcoin reserve—presumably because nothing says ‘stability’ like stuffing a digital mattress with cryptocurrency. 🏦😏

Seers, Signals, and the Not-So-Infinite Improbability Drive

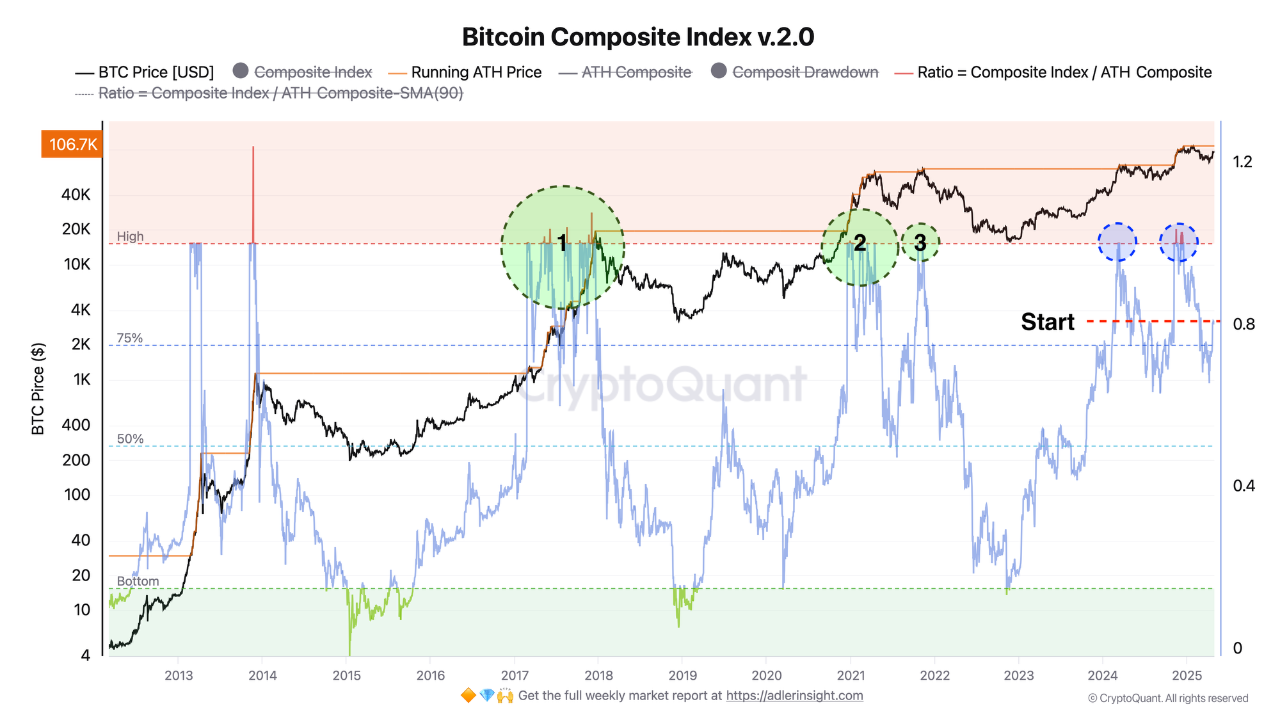

As we barrel into May 2025, Bitcoin (BTC) is flashing more hopeful signals than Marvin the Paranoid Android at a positivity seminar. Pseudonymous prophet AxelAdlerJr points out that on-chain momentum is in the “starting” phase of a bull run—think of it as the Bitcoin equivalent of a towel being cautiously unwrapped from a gift box.

The famed (or possibly infamous) Bitcoin Composite Index now hovers dramatically at ≈ 0.8 (also known as “almost but not quite a mathematical adventure!”). AxelAdlerJr outlines three scenarios, much like a badly written Choose Your Own Adventure novel:

- 🎉 If the Index courageously exceeds 1.0 and ekes out an existence above that magical threshold, expect BTC to shoot for our $150,000–$175,000 cosmic bowling alley. (Cue the sound of champagne corks being popped… somewhere in cyberspace.)

- 🤔 Should it loiter between 0.8 and 1.0, the market will consolidate, shuffling disinterestedly between $90,000 and $110,000. Investors will maintain positions; trolls will maintain memes.

- 😬 A slump to 0.75 or below could see short-term holders take profits and trigger a price correction to $70,000–$85,000. This is, according to the man himself, about as likely as a Vogon poetry appreciation club.

The return of YoY True MVRV to positive territory means the average purchase price of all coins acquired over the past year is now below the current market price. The pressure from panic sellers is decreasing – many are now in profit and don’t need to lock in losses. Holder…

— Axel Adler Jr (@AxelAdlerJr) May 2, 2025

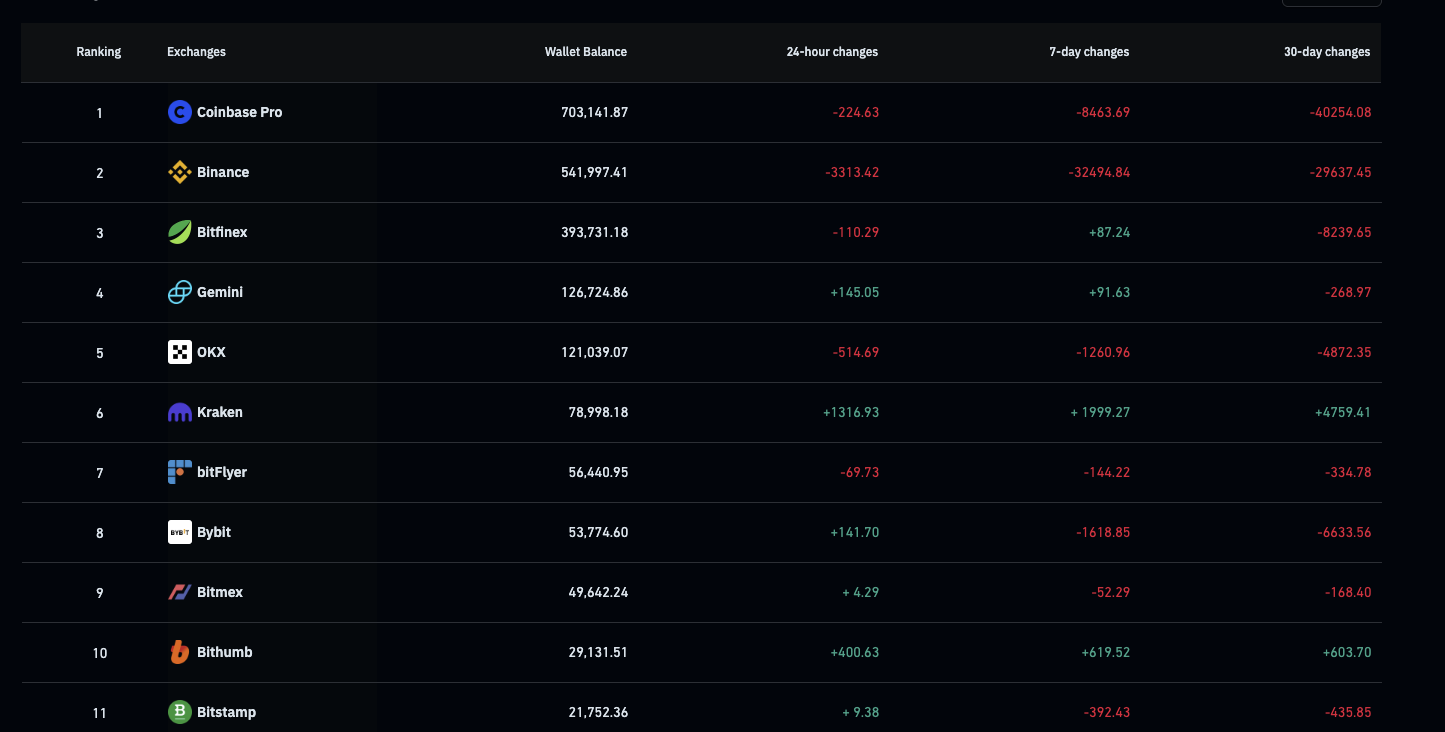

On-chain signs continue to cheerlead. Coinglass reports a mass exodus—42,525.89 Bitcoin vanished from centralized exchanges (CEX) in just seven days, pushing exchange balances to a 7-year low. Picture millions of BTCs packing their little digital suitcases, headed for cold storage and hot speculation. 🧳

This withdrawal frenzy is generally considered bullish, because nothing says ‘future price increase’ like everybody taking their ball and going home, presumably waiting for someone else to blink first.

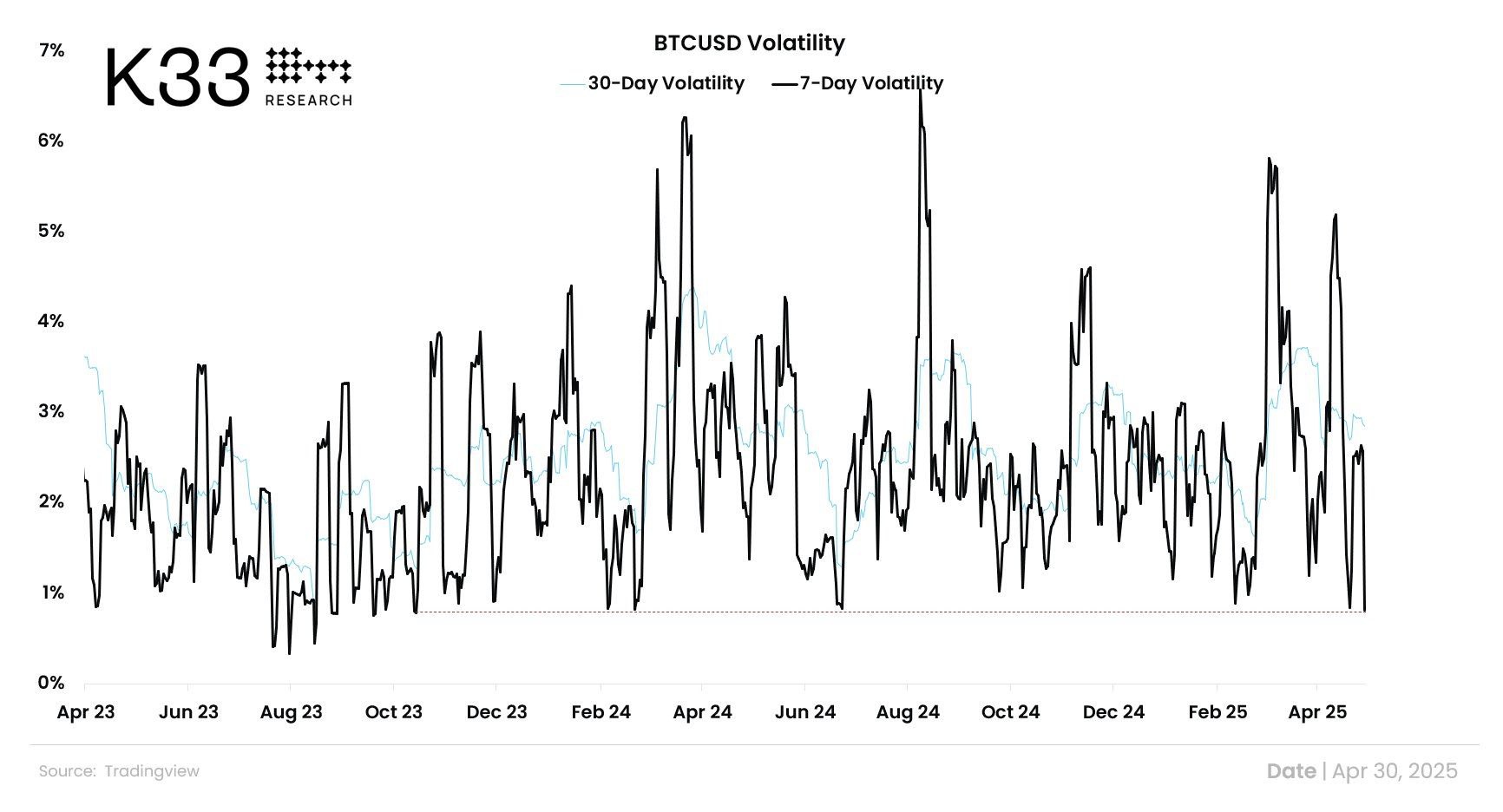

Meanwhile, Bitcoin’s 7-day volatility has slipped into a lower state than an accountant on a Sunday afternoon nap: the lowest in 563 days. Traditionally, this means the market might be about to do something exciting. Or not. The universe, as ever, is rarely bothered to provide spoilers.

Technical Analysis: The Hitchhiker’s Guide to Numbers

Technical analysts—those brave souls who draw squiggly lines on charts and call it science—are also bullish. According to “Ali” (just Ali; like Madonna but with more candlesticks), the support levels are at $93,198 and $83,444. Apparently, should Bitcoin remain above the magic $93,198 line, the path to $150,000 resembles less a fantasy and more a probability. Or at least a very lavish mouse experiment.

“The most critical support levels for #Bitcoin $BTC are $93,198 and $83,444. Key zones to watch if momentum shifts,” Ali shared.

Over on X, analyst Breedlove22 presents his own trinity of optimism:

- 📉 The Average Miner Cost of Production, now at a bottom, which could mean a major bull market ahead, or just that miners want to get paid before their GPUs become sentient and unionize.

- 💾 The supply held by long-term holders—Bitcoin that’s stayed put for at least 155 days—recently increased by 150,000 BTC. Apparently, nobody’s in a rush, unless the pizza place finally starts accepting crypto for pineapple toppings again.

“Bitcoin is running out of sellers in the $80,000 to $100,000 range,” Breedlove22 stated.

And finally, the Holy Grail: rising USD (and general fiat) liquidity. More dollars slosh about the system, so apparently the hope is that some of these bucks stumble and fall into Bitcoin by accident. 🏦💦

“And it’s not just USD liquidity that’s increasing – liquidity of all fiat currencies is on the rise, and Bitcoin is a global asset,” Breedlove22 added.

For further validation, yet another analyst claims Bitcoin’s hash rate has found support, which apparently is a good thing and not just a line drawn by someone who owns too many rulers.

If the cheerful scenario prevails, prepare for a wild ride to $175,000—or at least enough narrative volatility to make the Guide’s “Don’t Panic” recommendation seem especially wise. Still, beware: short-term corrections and inexplicable panics remain as likely as a cup of tea at an interstellar party.

With sturdy support at $93,198 and $83,444, Bitcoin could well be rocketing skyward… probably after the dolphins leave and someone remembers where the off switch is.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2025-05-02 21:00