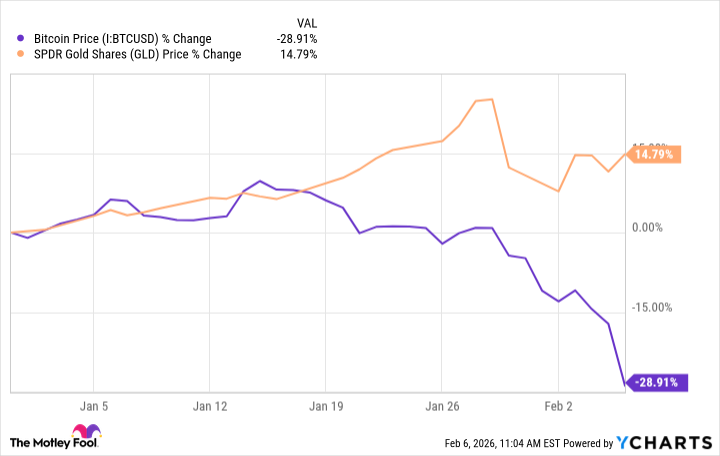

The current distress of Bitcoin – a nearly 22% decline this year, despite a fleeting rally – is not merely a matter of market fluctuations, but a symptom of a deeper malaise. Investors, those restless souls forever seeking refuge from the inevitable entropy, question its claim as ‘digital gold.’ They demand certainty in a world offering only shadows. Is it truly a hedge against the debasement of currency, against the slow, agonizing erosion of value? Or is it simply another phantom, another glittering distraction in the face of our collective doom?

We, as observers of these cycles, understand that such precipitous falls are not anomalies, but the predictable rhythm of these nascent markets. Every few years, the fever breaks, the illusion shatters, and the unwary are left to contemplate their losses. Yet, within this turmoil, strategists at JPMorgan Chase discern a possibility, a faint echo of hope. They see, perhaps, a reflection of our own desperate yearning for something… more.

The Illusion of Stability

Gold, that ancient idol, has surged as faith in fiat currencies wanes, fueled by years of reckless monetary policy and the ever-mounting burden of government debt. Geopolitical anxieties, the constant whisper of conflict, further drive the desperate scramble for perceived safety. Bitcoin, last year, seemed to mimic this ascent, but now… now it has decoupled. A dangerous sign? Or merely a divergence, a premonition of a different path?

“Cryptocurrencies have come under pressure,” the analysts observe, “as risk assets falter and even gold, that supposed bastion of security, experiences a sharp correction.” It is a humbling realization: there are no safe harbors, only varying degrees of vulnerability. But here lies the subtle distinction: while gold has risen more dramatically since October, it has done so with a volatility that borders on hysteria. Bitcoin, comparatively, remains… restrained. A curious anomaly, wouldn’t you agree?

Panigirtzoglou postulates a fascinating, almost terrifying thought: if Bitcoin were to match gold’s volatility, its price would soar to an astronomical $266,000 per token. A seductive vision, a siren song promising unimaginable wealth. But he wisely cautions that such a scenario is unlikely in the near term. Still, the mere possibility lingers, a testament to the latent potential within this volatile asset.

The crux of the matter, however, is this: Bitcoin, despite its aspirations, often behaves like a high-beta tech stock. It is tethered to the whims of sentiment, susceptible to the same irrational exuberance and devastating crashes. The fate of software stocks, crushed under the weight of market anxieties, has inevitably spilled over into the crypto realm. It is a sobering reminder that even the most revolutionary technologies are not immune to the forces of gravity.

And yet, even amidst the ruins, a flicker of hope remains. Bitcoin has survived multiple drawdowns of over 90%, each time rising from the ashes, stronger and more resilient. It is a testament to the power of decentralized networks, the enduring allure of scarcity, and the unwavering faith of its adherents. Perhaps, just perhaps, it can bounce back again. The verdict on ‘digital gold’ remains uncertain, but Bitcoin possesses a unique ability to diversify a portfolio, to offer a hedge against the systemic risks that plague our increasingly fragile financial system. Allocate a small portion of your capital, I suggest. Not out of greed, but out of a desperate need to prepare for the inevitable storm.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-02-06 19:25