Alright, settle in, folks. We’re talking Bitcoin. The world’s largest cryptocurrency, which, let’s be honest, sounds like something you’d order at a particularly pretentious coffee shop. It currently boasts a market cap of $1.6 trillion – more than half the entire crypto industry, which is, shall we say, a bit like a house of cards built on a bouncy castle.

Now, last October, this digital doodad hit a peak of over $126,000. A real head-scratcher, that one. But, as with all things that go up on a rocket ship, it came crashing down. A 40% plunge! Investors are cashing out faster than you can say “blockchain,” and frankly, who can blame them? It’s enough to give a macro strategist indigestion.

But here’s the thing. Volatility is Bitcoin’s middle name. Since 2009, this thing has had more ups and downs than a caffeinated squirrel. Two crashes of 70% or more, and yet… it always bounces back. Always. So, is this a buying opportunity? Well, that’s what everyone wants to know, isn’t it? Like asking a fortune teller if you’ll win the lottery.

The Case For Owning a Piece of the Digital Pie

Bitcoin is… unique. It’s like nothing else. No central bank, no government, no grumpy CEO calling the shots. It’s decentralized, meaning it’s run by a bunch of computers and a whole lot of hope. And it’s capped at 21 million coins, which creates a sense of scarcity. It’s the digital equivalent of a limited-edition Beanie Baby, but with more complicated math. Plus, it’s built on this thing called the blockchain, which is a highly secure, transparent system. Transparency! That’s good, right? Investors like that. It’s like looking at the ingredients list on a hot dog – you know what you’re getting (hopefully).

But even after 17 years, Bitcoin is still having an identity crisis. Some folks think it’ll revolutionize finance. Others see it as digital gold. And then there are the cynics who believe it’s just a speculative bubble waiting to pop. Honestly, they might be right. It’s a bit like arguing whether Pluto is a planet or not – we’ll probably be debating it for centuries.

Still, let’s not forget the numbers. Over the past decade, Bitcoin has returned a whopping 20,810%. That’s… substantial. It left real estate, the stock market, and even actual gold in the dust. Which, frankly, is embarrassing for gold. I mean, gold has been around for thousands of years, and it’s getting outperformed by a bunch of computer code? Ouch.

However, and this is a big “however,” the case for owning Bitcoin is getting… narrower. The path to further gains is becoming increasingly challenging. For example, there’s no real evidence that Bitcoin will become a global currency. So far, only 6,714 businesses accept it as payment. That’s a drop in the ocean compared to the 359 million registered businesses worldwide. It’s like opening a deli in Antarctica – good luck with that.

Even Cathie Wood, the queen of disruptive innovation, has her doubts. She recently reduced her 2030 price target from $1.5 million to $1.2 million per coin. Why? Because stablecoins are stealing Bitcoin’s lunch. Stablecoins offer practically zero volatility, making them more suitable for sending money around the world. It’s like comparing a rollercoaster to a gently rocking chair – sometimes, you just want a smooth ride.

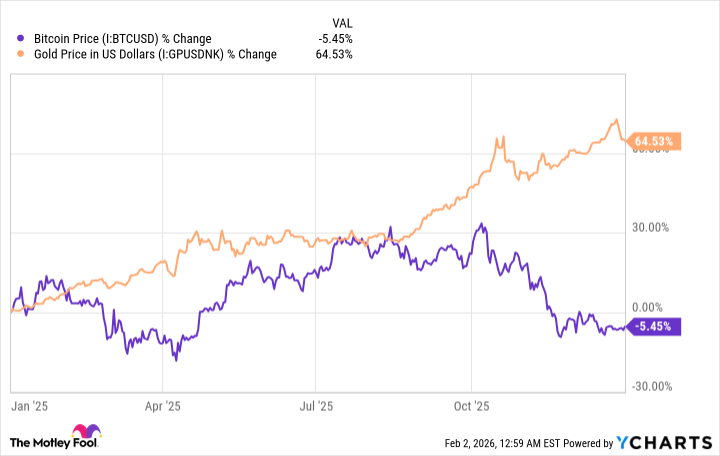

And the argument that Bitcoin is digital gold? It’s… crumbling. Last year, with political and economic turmoil reaching fever pitch, gold actually increased by 64%, while Bitcoin declined by 5%. Yes, you heard that right. When investors were looking for a safe haven, they ran to good old-fashioned gold. It’s like finding out your grandmother is a secret agent – shocking, but ultimately reassuring.

Let’s be blunt: when fear grips the market, investors abandon Bitcoin and flock to gold. Gold has been a store of value for thousands of years. Bitcoin? It’s still trying to prove itself. It’s like bringing a knife to a gunfight – you might get lucky, but probably not.

Buy the Dip? Proceed With Caution (and a Sense of Humor)

Investors who bought the dip in Bitcoin since 2009 eventually ended up in the green. Even if they didn’t pick the absolute bottom. So, it might make sense to start building a small position. As long as you’re willing to hold it for several years to maximize your chances of a positive return. Think of it as a long-term investment. Like a really, really long-term investment. Like, potentially generational investment.

However, if this decline is similar to the ones we saw in 2017-2018 and 2021-2022, Bitcoin might not bottom until it loses 70% to 80% of its peak value. That means it could trade as low as $25,000 per coin in the near future. So, you need a strong stomach to ride this rollercoaster. And maybe a barf bag.

I’m not necessarily predicting that outcome, because Bitcoin continues to attract hordes of new investors, including many institutions, thanks to the widespread availability of Bitcoin exchange-traded funds (ETFs). Many of these investors have been waiting for an opportunity to buy Bitcoin at a discount, so I expect lots of dip-buying activity. It’s like a Black Friday sale for crypto enthusiasts.

On the flip side, Bitcoin’s price action last year is likely making many believers nervous – especially those who were holding it as an alternative to gold, because I think that narrative is officially busted. It’s like realizing your favorite superhero is actually a villain in disguise.

Although it’s impossible to predict the direction of such a speculative asset, investors who think Bitcoin will eventually recover from its recent dip have history on their side. However, take a long-term view, and keep position sizing small to keep the potential risks in check. Remember, past performance is not indicative of future results. But it’s still fun to look at, isn’t it?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2026-02-04 13:03