As a seasoned researcher with over two decades of experience in finance and technology, I have seen my fair share of market predictions that ultimately fell flat. However, the optimism surrounding Bitcoin‘s price trajectory in 2025 has piqued my curiosity, to say the least.

The collective enthusiasm among industry insiders and experts, led by the likes of Changpeng “CZ” Zhao and Richard Teng, is reminiscent of the dot-com bubble days. Yet, it seems this bull market may have more substance than its internet predecessor. With the backing of institutional investors, clearer regulatory frameworks, and an expanding role for Bitcoin in traditional finance, the digital asset’s potential growth looks promising, to say the least.

The predictions of Bitcoin reaching anywhere from $80,000 to $250,000 or even beyond, while audacious, are not entirely unfounded. The increasing recognition of Bitcoin as a reserve asset, coupled with the launch of spot Bitcoin ETFs and potential government involvement, could indeed fuel such upward momentum.

That being said, I remain cautiously optimistic. As Carol Alexander, professor of finance at the University of Sussex, rightfully points out, volatility remains a significant factor in Bitcoin’s price fluctuations. And while I may not predict that Bitcoin will reach $250,000 in 2025, I am confident that we will see substantial growth—provided regulators continue to support the crypto space and exchanges address their vulnerabilities.

Lastly, let me leave you with a little humor to lighten the mood: I remember when people said Bitcoin would never reach $1,000. Now, they’re predicting it could hit $250,000. If only we had a time machine to cash out at each milestone! Alas, we must wait and see what 2025 brings us.

Despite differing predictions ranging from steady advancements to unprecedented record-breaking peaks, experts remain optimistic about Bitcoin’s ability to sustain its upward trend throughout the upcoming year.

As an analyst, I’m sharing a perspective that resonates with me: Changpeng “CZ” Zhao, a renowned former CEO of a significant cryptocurrency exchange, has forecasted 2025 to be an exciting year for the crypto sector. This prediction, shared on social media platforms, has sparked a wave of enthusiasm within the digital trading community. Even after relinquishing his leadership position and encountering legal challenges in 2024, CZ continues to express optimism about the industry’s progression. He attributes this momentum to increasing institutional investment and regulatory advancements.

According to CZ’s post, the year 2025 could mark significant changes in the world of cryptocurrency. With a growing number of institutions adopting this technology and more transparent regulations being put in place, Bitcoin may reach unprecedented levels of success.

Meet the Successor

Richard Teng, who is now at the helm of Binance, mirrors CZ’s positive outlook. In a recent conversation, Teng predicted that next year will see favorable regulatory changes and a thriving cryptocurrency market in 2025. “We expect that regulatory certainty will eliminate many obstacles that have hindered institutional investors,” Teng said. “This, along with increasing user adoption, sets the stage for Bitcoin to experience substantial growth.

The surge in Bitcoin’s price in December 2024, pushing it past the six-digit milestone, has increased confidence among many experts in the field that even greater increases might be imminent. Various analysts have repeated predictions that Bitcoin could reach anywhere from $80,000 to $150,000 throughout 2025, with some setting even more ambitious goals. James Butterfill, chief researcher at CoinShares, told CNBC, “It’s plausible that Bitcoin could attain both $80,000 and $150,000 during the year, depending on regulatory decisions and institutional investments.

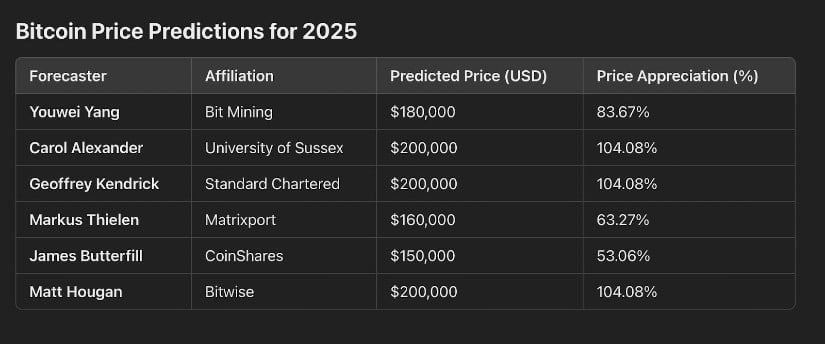

Bitcoin Price Predictions 2025

As an analyst delving into the intricacies of the digital currency market, I’ve come across numerous optimistic forecasts for Bitcoin’s value by 2025. These projections indicate a remarkably positive outlook on the future price of Bitcoin.

Elitsa Taskova, the head of product development at cryptocurrency lending platform Nexo, is optimistic about Bitcoin’s future, forecasting that it could potentially reach $250,000 by year’s end. “With increasing acknowledgement of Bitcoin as a safe-haven asset and the introduction of more exchange-traded products,” Taskova stated, “we anticipate significant growth in its value.

A key advancement driving these forecasts is the increasing involvement of institutional investors. The launch and success of Bitcoin exchange-traded funds (ETFs) in 2024 has attracted a lot of interest from traditional financial institutions eager to gain access to digital assets. Markus Thielen, head of research at Matrixport, stated to CNBC that “Continued demand for Bitcoin ETFs and favorable market conditions could potentially push Bitcoin prices up to $160,000 by 2025.

According to Bitwise’s latest report titled “The Golden Age of Crypto,” they highlight significant achievements, regulatory advancements, and growing acceptance in the crypto world. In this report, Bitwise anticipates that Bitcoin will surpass the $200,000 mark. This prediction is driven by factors such as reduced supply due to the 2024 halving event, escalating institutional interest, and potential intervention from governments, like the U.S. creating a strategic Bitcoin reserve.

As a crypto investor, I’m always keeping an eye on the broader economic landscape, as it plays a crucial role in shaping Bitcoin’s future. Geoffrey Kendrick from Standard Chartered predicts that we might see Bitcoin soaring to $200,000 by 2025. His reasoning? Continued institutional investments and the possibility of Bitcoin being integrated into U.S. retirement funds. In fact, if even a fraction of the $40 trillion in U.S. retirement funds were allocated to Bitcoin, it could lead to a substantial increase in its price.

Despite an optimistic outlook, a sense of caution remains. Carol Alexander, a finance professor at the University of Sussex, pointed out the possibility for fluctuations. In conversations with CNBC, she expressed that while Bitcoin’s price might soar to $200,000, there are no indications that volatility is decreasing. She added that favorable U.S. regulations could bolster Bitcoin, but the absence of regulation in crypto exchanges will persistently fuel volatility.

David Siemer, the CEO of Wave Digital Assets, presents a measured perspective, stating that even though altcoins might not undergo the intense fluctuations of past years, “we can expect a substantial surge in altcoin values as Bitcoin (BTC) ascends.” He underscores that for altcoins to outperform relative to BTC, they require substantial growth in adoption and revenue generation.

In addition, Bit Mining’s Chief Economist, Youwei Yang, anticipates that Bitcoin will reach anywhere between $180,000 and $190,000 by 2025. However, he cautions about possible dips in the market. According to Yang, speaking with CNBC, “The price of Bitcoin in 2025 may experience strong growth as well as temporary, substantial declines.” He further notes that geopolitical tensions between the U.S. and China, and disruptions in global financial markets could potentially present risks.

Bitcoin Price Predictions for 2025

As we venture deeper into 2025, I find myself brimming with optimistic expectations about the cryptocurrency market. Bitcoin appears poised for a robust performance this year. Furthermore, promising altcoins like Ripple‘s XRP and the playful Dogecoin are forecasted to register significant price increases in 2025. With such predictions in mind, any prudent investor should consider all available crypto options, conducting thorough research before making a decision.

Discussions on platforms such as X are buzzing with anticipation for a new bull market, as many crypto experts view Bitcoin as a significant safeguard against economic instability. While it remains uncertain whether Bitcoin will reach the more extreme predictions, the overall sentiment within the field indicates that Bitcoin’s value and reputation could potentially increase in the upcoming year.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-01-04 13:48