As a seasoned crypto investor with a decade of experience under my belt, I find the September 2024 CCData’s Exchange Review both intriguing and enlightening. My investment journey has been marked by volatility and unpredictability, but this report provides a much-needed compass amidst the chaos.

As an analyst, I recently delved into the September 2024 issue of CCData’s Exchange Review report, uncovering some striking patterns shaping the digital asset market.

CCData, a globally recognized benchmark provider approved by the FCA, specializes in top-tier digital asset data. They provide reliable real-time and historical data to both institutional and retail investors. Renowned for their deep understanding and impartial perspectives on the digital asset sector, CCData releases their Exchange Review every month.

This study covers significant advancements in the cryptocurrency trading platform sector, delving into aspects such as exchange transaction volumes, derivative trading of cryptos, categorization of markets based on fee structures, and comparisons between crypto-to-crypto and fiat-to-crypto transactions. It further investigates Bitcoin trades against various fiat currencies and stablecoins, lists the top digital currency exchanges by volume of spot trading, and monitors historical trends in transaction volumes for leading trans-fee mining and decentralized platforms. This resource is designed to meet the needs of crypto enthusiasts, investors, analysts, and regulators who require in-depth and precise market analysis.

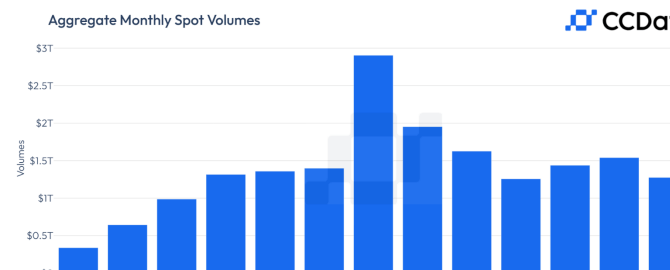

In September, the total volume of transactions in both spot and derivative markets on centralized exchanges decreased by approximately 17%, reaching a monthly activity level not seen since June, with a total of $4.34 trillion traded. The volume of spot trading fell by around 17.2% to $1.27 trillion, while the volume of derivatives trading dropped by about 16.9% to $3.07 trillion.

The decrease in trading activity was predictable since we’re approaching the final month of a usual seasonal lull, where activity tends to drop off. However, the report indicates an air of optimism for higher trade volumes in Q4, driven by factors like increased market liquidity due to the Federal Reserve lowering interest rates and the upcoming U.S. election.

As a researcher, I observed a significant shift in the cryptocurrency trading landscape recently. Binance, the long-standing market leader, experienced a noticeable drop in its spot trading volume, plummeting approximately 22.9% to $344 billion – the lowest since November 2023. This decline has reduced Binance’s share of the spot market to 27%. Additionally, the overall market share, incorporating both spot and derivatives trading, dipped to 36.6%, marking the lowest point since September 2020.

The derivatives sector likewise saw a drop, however, the report underscores an impressive jump in open positions, climbing 32.1% to reach $52.4 billion – the highest since June 10th. This rise suggests heightened confidence among traders, propelled by the Federal Reserve’s recent rate reduction that strengthened bullish feelings in the market. Binance continued to dominate the derivatives market, handling trades worth $1.25 trillion in September, with OKX and Bybit trailing closely behind, processing volumes of $565 billion and $469 billion respectively.

As Binance maintained its top position in both spot and futures trading, it’s worth noting that its market dominance has been gradually decreasing. Meanwhile, Crypto.com and Upbit have managed to expand their market presence considerably. In fact, Crypto.com has witnessed a remarkable increase in its spot market share, reaching 10.5% in September this year, and growing at an impressive rate of 8.08% year-to-date. This growth makes it one of the fastest-growing exchanges in 2024. Conversely, Binance and OKX have seen their market shares diminish throughout the year, with Binance experiencing a decrease of 5.34%, lowering its share to 27.0% as of 2024.

The report additionally focuses on advancements in the derivatives market, where traders have been actively trying to profit from market fluctuations. Notably, the Chicago Mercantile Exchange (CME), a prominent player in institutional derivatives trading, observed a decrease of 11.8% in its total trade volume, amounting to $114 billion. The volume of Bitcoin futures traded on CME also decreased by 9.04%, reaching $95 billion. On the other hand, the options trading volume at CME underwent a more substantial drop, experiencing a 43% decrease and hitting an all-time low of $1.70 billion since November 2023.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-10-04 11:00