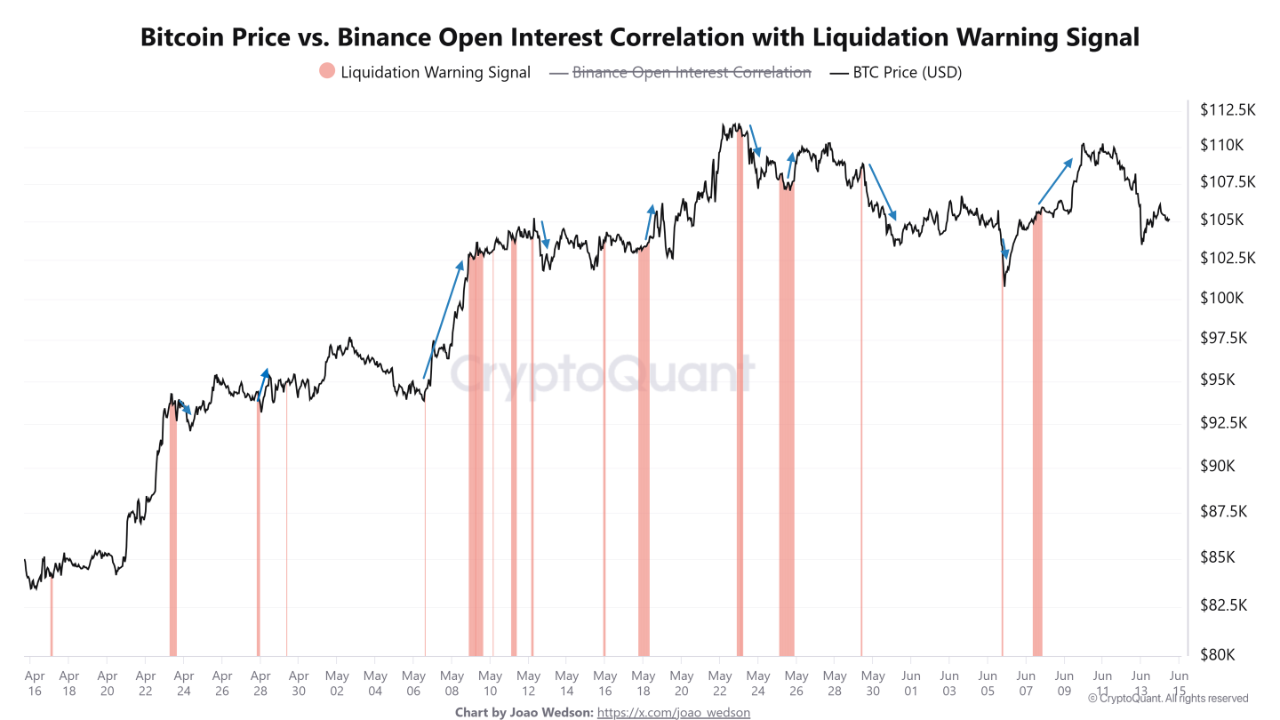

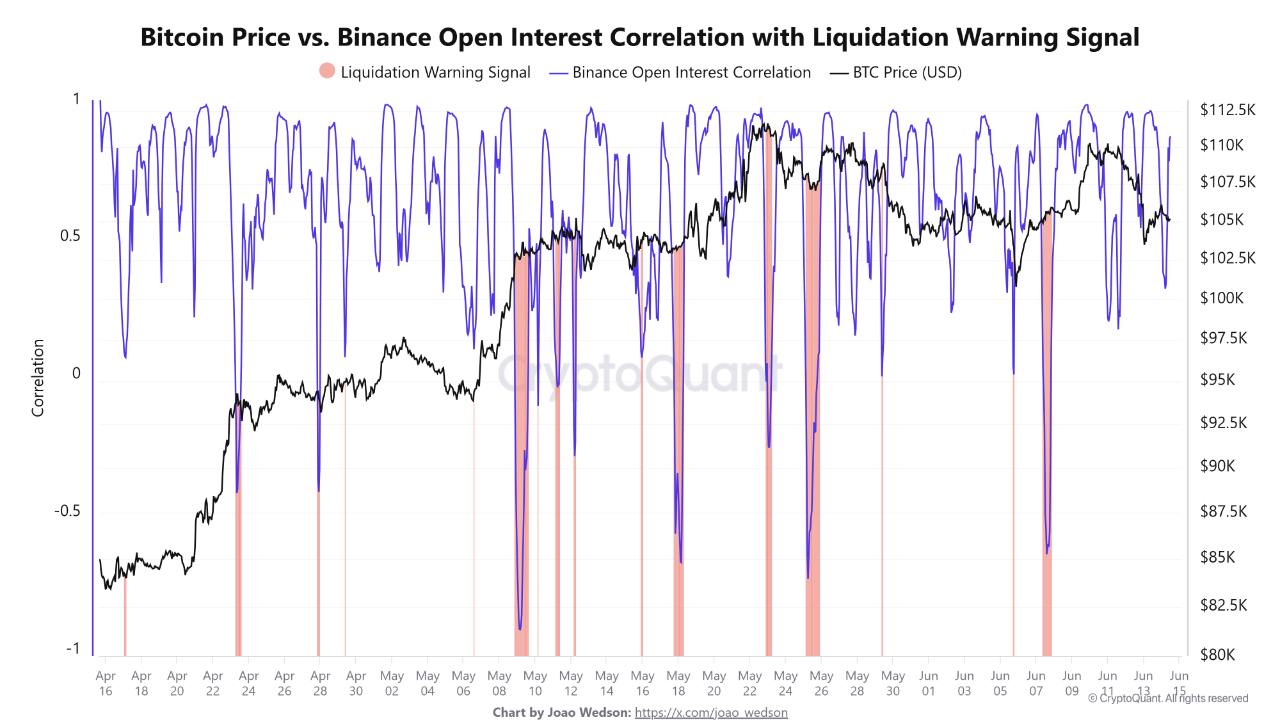

Ah, once again, the eternal ballet of price and open interest is performing an elaborate pas de deux, though one suspects neither dancer has read the programme. Observers note—at arm’s length, lest they be splashed by the bloodletting—that whenever price and OI part ways so dramatically, the leveraged fraternity gathers like moths to an exceedingly expensive candle. 🤦♂️

The report (authored no doubt by a committee with serious views on tweed and very little skin in the game) confides in hushed tones: such decoupling heralds the arrival of traders whose idea of prudent risk management involves strenuous opposition to common sense.

Picture the scene: a battalion of contrarians, gamely piling into positions even their grandmothers would question. As these wagers accumulate, the market becomes a house of cards atop a precariously located washing machine—one sharp vibration (or tweet) away from spectacular collapse.

This predicament arises from a mounting divorce between what the price bothers to do and what the leveraged hopefuls desperately will it to do. Should the market slip a little sideways—possibly after someone in Shanghai sneezes—liquidations cascade, and traders are left scrambling faster than a butler caught napping at teatime. 😬

Why Fuss?

- When correlation falls to ≤ 0.1, price and OI barely wink at each other in the corridor.

- Liquidation risk soars, because why not pour petrol on a bonfire?

- Volatility often ensues, sweeping long and short positions into the great unknown, like debutantes flung onto a dance floor when the band strikes up an unfamiliar waltz.

The Moral, If One Insists Upon Having One

Perhaps don’t nod off entirely. Whenever Binance’s OI correlation drops, history suggests someone, somewhere, is about to experience what can only be described as a character-building lesson in volatility. Will it be up? Will it be down? The smart money is on “yes.”

Read More

2025-06-14 23:43