In the world of cryptocurrency, where volatility is king, Binance has decided to make a bit of a splash, releasing its updated monthly proof of reserves report for May 2025. It seems they’ve taken a very literal approach to “backing up” their assets – and then some! According to the numbers, Binance’s reserves are over 100% for some of the major tokens, including Bitcoin, USDT, and Ethereum. You know, just in case you were worried.

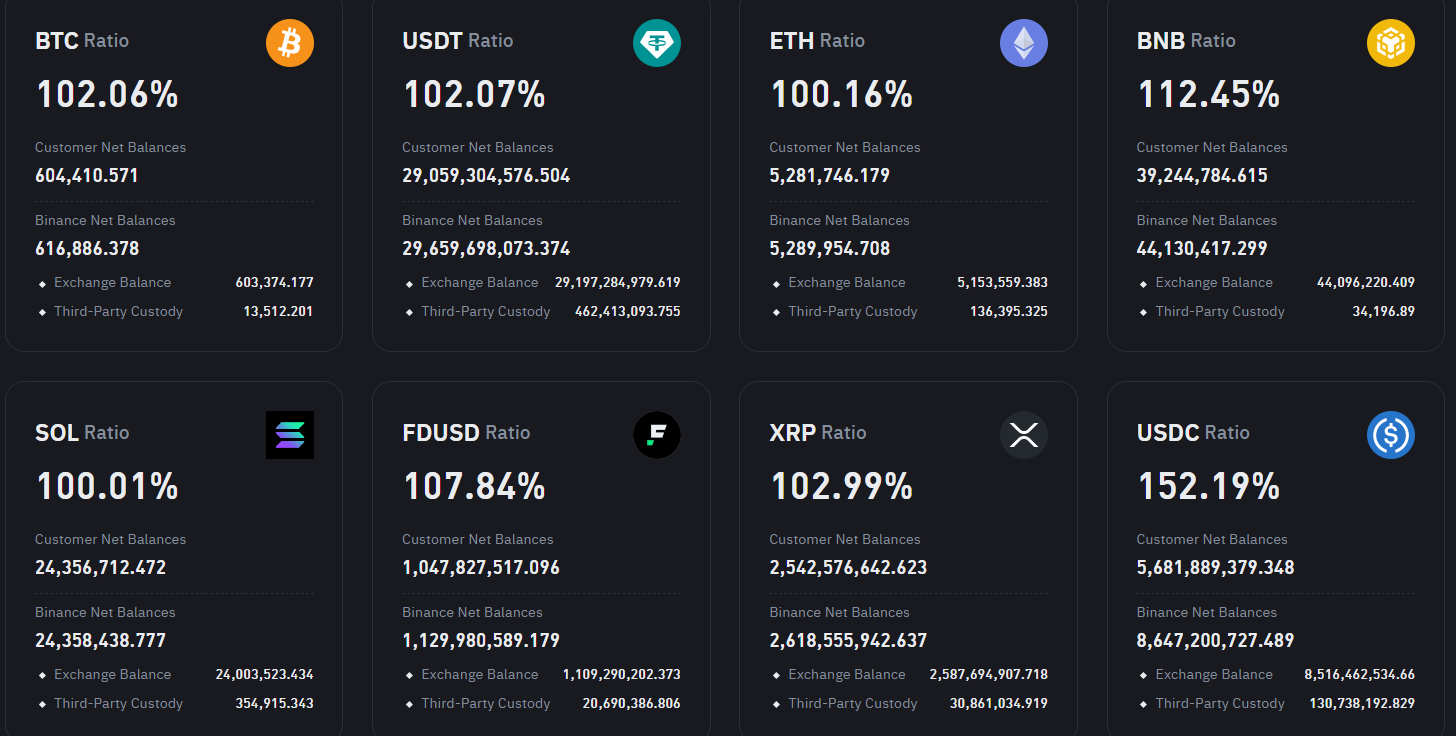

On the fine morning of May 8, the crypto exchange delivered their latest update, proudly showcasing their reserves for a whopping 37 crypto assets. For instance, Binance now holds 616,886.378 BTC, which—wait for it—comes in at a robust 102.06% of their customers’ net assets. That’s right, folks, overachieving by more than 12,000 BTC. Is it excessive? Who’s counting?

But wait, there’s more! The USDT reserves are doing just as well. With over 29.6 billion USDT, Binance is comfortably exceeding its customers’ assets by 102.07%. You might wonder, “Why the extra 600 million USDT?” Well, it’s just a little something extra, a cushion of crypto comfort, if you will. 😏

Now, let’s talk about Ethereum, Solana, and Ripple. You thought the party was over? Nope. Binance’s Ethereum reserves are cruising at 5,289,954 ETH, a little more than 8,000 ETH above customer balances. Solana’s reserves are also having a good time, sitting just above 100% with a 0.01% surplus, or 2,000 SOL more than necessary. It’s like the crypto equivalent of buying too many donuts but refusing to let any go to waste. 🍩

And as for Ripple, Binance is out here flexing with a 102.99% reserve ratio. With a cushion of 76 million XRP, they’ve clearly mastered the art of surplus. Because why not? 💸

The crown jewel in Binance’s treasure chest? Binance USD (BUSD), of course. With a reserve ratio more than double their customers’ balances at a grand 206.04%, it’s clear that BUSD is having a bit of a moment. But before you get too excited, let’s not forget that Binance stopped supporting BUSD in 2023 after waving goodbye to its U.S. markets. Apparently, it was just too much of a good thing. 🙄

In a twist that could only be described as “crypto drama,” Binance’s U.S. branch reopened USD transactions in February 2025 after an almost year-long hiatus caused by a pesky little thing called the SEC lawsuit. Talk about a comeback! 📉➡️📈

Binance is also sitting pretty with over 8.6 billion USDC in reserves, which is a solid 152.19% of customer-held assets. And don’t think they’re stopping there. The FDUSD reserves? They’re at a delightful 107.84%, exceeding customer holdings by more than 82 million FDUSD. It’s like they’ve been shopping for crypto and refused to leave anything on the shelf. 🛒

Now, for those who might be new to this whole crypto exchange thing, “proof of reserves” is basically a way for exchanges to assure their customers that their deposits are fully backed by on-chain reserves. This trend really kicked off after the dramatic collapse of FTX, when exchanges decided it might be wise to show a little more transparency—especially when it comes to covering those pesky withdrawal requests. A bit of a trust exercise, if you will. 🧐

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-05-08 10:42