As a seasoned researcher with years of experience tracking market trends and analyzing crypto data, I find these recent developments intriguing. The consistent outflows from Binance, even amid a seemingly stable Bitcoin price, suggest that investors are becoming more confident in long-term Bitcoin holdings. This trend aligns with my belief that the shift towards self-custodial wallets is a bullish sign for the future of cryptocurrencies.

Data recorded on the blockchain indicates continuous withdrawals from the prominent crypto exchange Binance, despite Bitcoin‘s price hovering near the $90,000 level, which is a decrease from its recent peak of over $93,000.

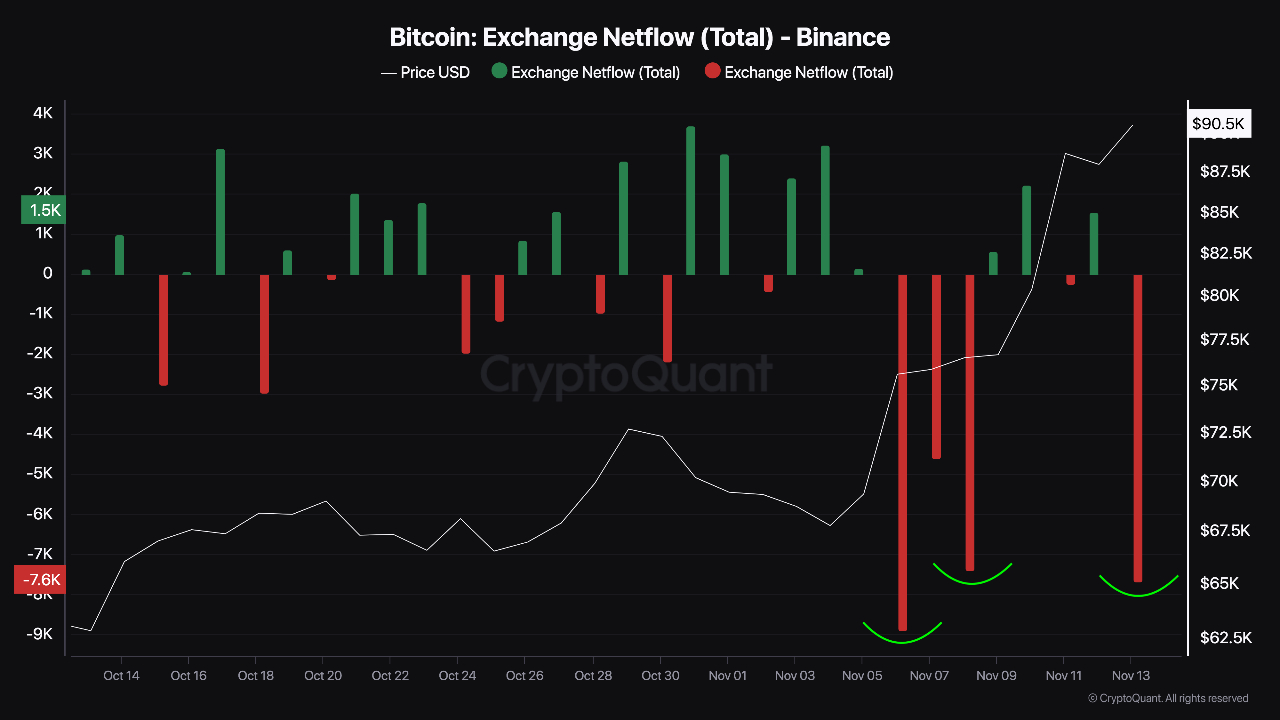

According to a recent post by CryptoQuant, Binance’s Exchange Netflow has shown consistently negative values for several weeks now. This metric measures the overall movement of Bitcoin into or out of exchange wallets, and a negative value means more Bitcoin is being taken out than put in. This could imply that holders are choosing to keep their Bitcoin in personal, offline wallets rather than on exchanges, which is generally seen as a positive sign for the future of cryptocurrency, indicating increased confidence and long-term optimism among investors.

In simpler terms, when Bitcoins are withdrawn from exchanges and held offline (on-chain), it’s seen as a positive sign because it indicates less Bitcoin is available for immediate trading. If the demand stays the same or grows, this scarcity could lead to an increase in price.

As an analyst, I’ve observed a striking pattern in Bitcoin Exchange Netflow on Binance this month, which aligns with the current market rally. The notable downward spikes suggest massive accumulation that might have played a significant role in driving the price increase.

Over the last five days, I’ve noticed a significant surge in outflows, correlating with the influx of approximately $3 billion into the iShares Bitcoin Trust (IBIT) – the Bitcoin exchange-traded fund (ETF) managed by global heavyweight BlackRock. This suggests a growing interest among investors in digital assets.

According to CryptoGlobe’s latest report, U.S.-based Bitcoin spot ETFs have accumulated a staggering total of $90 billion following a significant daily increase of around $6 billion. This growth places these ETFs just over one-third of the way towards surpassing gold ETFs in terms of assets under management.

According to senior Bloomberg ETF analyst Eric Balchunas, who posted on the social media platform X (previously known as Twitter), a $6 billion increase in spot Bitcoin ETFs was driven by $1 billion in inflows and a $5 billion market appreciation due to a substantial rise in Bitcoin’s price.

As a crypto investor, I’ve observed a noteworthy trend: Cryptocurrency investment products have been attracting substantial funds, totaling approximately $1.98 billion, following the election of Republican candidate Donald Trump as the U.S. President.

Based on the latest report by CoinShares titled “Digital Asset Fund Flows,” the surge in inflows, accompanied by the upward trend in the cryptocurrency market, has propelled the total value of assets managed in crypto investment products to an all-time high of $116 billion.

The report details that Bitcoin-focused investment products saw $1.79 billion inflows over the past week, while Ethereum-focused products saw $157 million inflows.

Read More

2024-11-16 02:44