As a seasoned crypto investor with a decade of experience navigating the ever-changing landscape of digital assets, I find myself both intrigued and concerned by Binance Research’s analysis of Ethereum. On one hand, the bullish developments for 2024, such as the Dencun update and potential US ETF approval, are undeniably promising. However, the decline in Ethereum’s market dominance is a stark reminder that no coin, not even the pioneer of smart contracts, can rest on its laurels.

The latest Binance Research study titled “The ETH Value Debate” delves into Ethereum’s evolving position within the cryptocurrency market.

While it highlights Ethereum’s foundational role in blockchain innovation, the report notes its position is now under scrutiny due to emerging competitors and evolving market dynamics.

Binance Research Analyzes Ethereum

According to Binance Research’s report, there are several positive indicators for Ethereum in 2024. Notable progress includes the deployment of the Dencun update, designed to substantially lower transaction fees, and the greenlight given to Ethereum ETFs within the U.S., opening up fresh investment avenues.

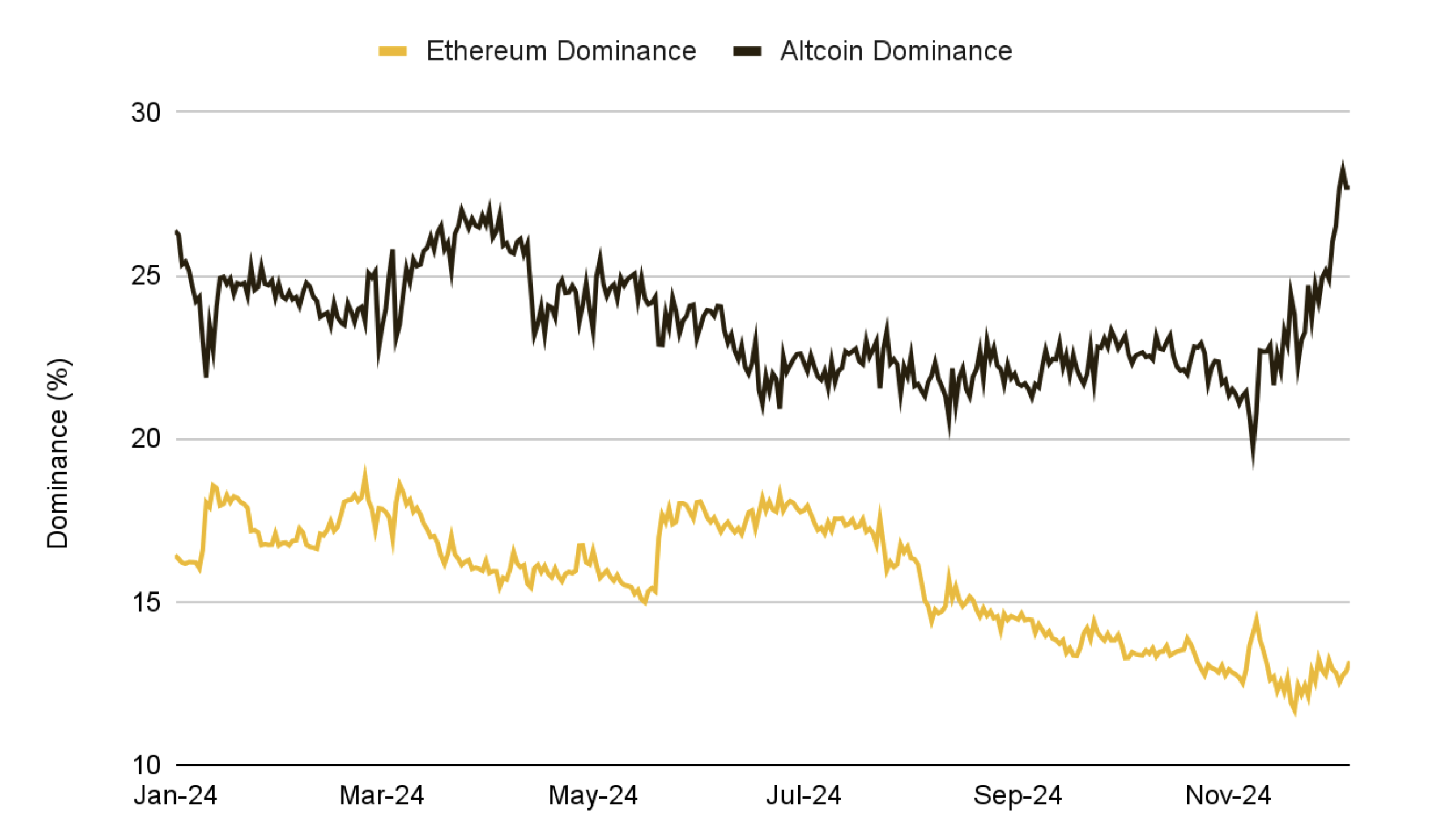

Even with its impressive accomplishments, Ethereum’s control over the crypto market has been waning, reaching a low not seen in years of 13.1%. This decrease indicates increasing rivalry and shifting trends inside the digital currency landscape.

The report indicates that Ethereum’s influence, calculated by comparing its market capitalization to the overall crypto market cap, has been steadily decreasing this year and hit a low of 13.1% which is a significant drop compared to other years. This decline stands out even more in a broader economic context where optimism towards risky investments has grown significantly.

After the Dencun update, Ethereum’s income decreased dramatically by 99%, largely due to the increasing use of Layer-2 solutions. Moreover, there has been a significant decline in network activity on Ethereum. Binance Research described these events as challenging and emphasized the difficulties Ethereum might encounter in maintaining its dominant position.

2024 saw a modest start for Spot ETH ETFs in July, but following the US election, interest escalated significantly, accumulating over $1.7 billion in net inflows. However, despite this surge, the trading volume and search interest for Ethereum have remained relatively stable, trailing behind the escalating activity on other Layer-1 platforms like Solana, which are experiencing increased popularity.

The continuous discussion indicates Ethereum’s increasing requirement for prioritization. Some argue that it should expand using Layer-2 methods, which would boost its value capture potential and further establish ETH as a form of non-sovereign currency.

Some people advocate boosting the functionalities at the base layer by generating fee-driven demand and fostering a robust ecosystem of decentralized applications. Defining a clear strategy ahead will be essential for ensuring its prosperity in the long run.

Binance Research suggests that Ethereum’s objectives are not entirely clear, as they seem to focus both on rollup technology and broader goals. This ambiguity is causing market uncertainty. By agreeing on a unified mission statement, Ethereum could solidify its storyline and product strategy.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-14 11:40