As a seasoned crypto investor with a keen eye for regulatory trends, this latest development in India is a cause for both concern and anticipation. On one hand, it’s disheartening to see exchanges like Binance and WazirX entangled in tax evasion charges, potentially impacting the trust and credibility of the entire sector. However, on the other hand, I firmly believe that such scrutiny is a necessary step towards maturing the crypto market and establishing it as a legitimate financial system.

It’s been found that several cryptocurrency platforms operating in India, such as Binance and WazirX, have substantial undisclosed Goods and Services Tax (GST) obligations to the Indian government.

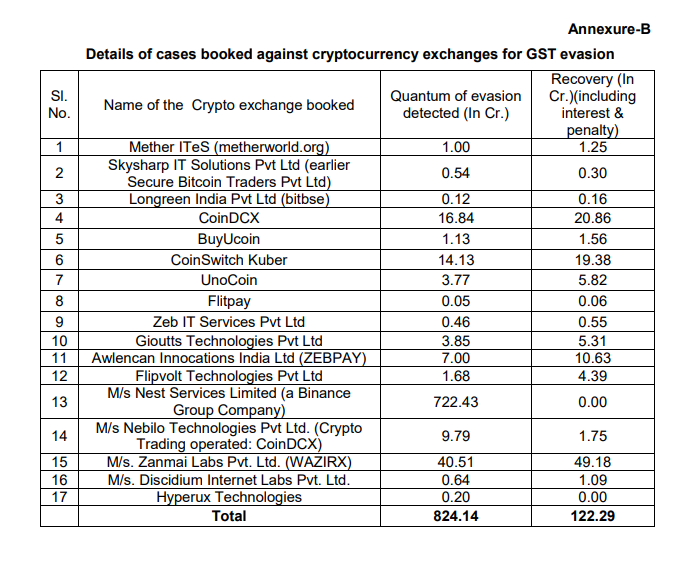

Authorities estimate that these firms owe a combined $97 million in unpaid taxes.

Crypto Exchanges Face Major Tax Evasion Charges in India

As reported by India’s Minister of State for Finance, these entities under scrutiny have already paid back approximately $14 million in taxes, fines, and accrued interest to the government. This revelation was made during a parliamentary investigation conducted on December 2nd.

17 cryptocurrency firms have been found guilty and indicted for tax fraud. WazirX is liable for approximately 405 million Indian rupees (equivalent to about $4.8 million USD), CoinDCX owes around 168.4 million Indian rupees (roughly $1.9 million USD), and CoinSwitch Kuber is responsible for nearly 141.3 million Indian rupees (approximately $1.7 million USD).

Despite many companies on the list having paid their outstanding debts, entities such as Binance and Hyperux Technologies are yet to comply. It is said that Binance has an outstanding tax liability of approximately 722 crore rupees, equivalent to $85 million.

The stated total sum recovered by the government does not include this amount, meaning it has yet to be retrieved.

Binance’s Regulatory Challenges Continue

The tax issue adds to a series of challenges Binance is currently facing. Last week, Amrita Srivastava, a former senior employee at Binance’s Link platform, filed a whistleblower lawsuit in the UK. Srivastava claims she was wrongfully terminated after reporting alleged misconduct, including a colleague’s bribe solicitation.

Furthermore, Binance encountered criticism in November due to their decision to list two meme tokens based on the Solana platform, namely The AI Prophecy (ACT) and Peanut the Squirrel (PNUT).

The exchange was criticized for facilitating illegal activities known as pump-and-dump schemes. It is alleged that these lesser-valued tokens provided advantages to a specific group of traders, potentially harming regular investors in the process.

Conversely, WazirX has been grappling with significant difficulties following the $235 million hack in July. As a result, customer withdrawals were temporarily halted and have not yet fully resumed.

On X (previously Twitter), WazirX stated that they will persistently seek legal remedies to recover frozen and misappropriated funds. Their aim is to safeguard these assets for the benefit of creditors, a process which involves monitoring these assets and preventing unauthorized transactions. By doing this, they hope to maximize potential returns for their creditors.

Lately, Indian authorities have apprehended a significant suspect thought to be involved in the hacking incident. Yet, the main culprit still remains unknown. The increased vigilance by the Indian government signifies a broader regulatory clampdown on the cryptocurrency market, as tax evasion and security concerns continue to be key focal points.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-04 21:35