As a seasoned analyst with over two decades of experience in the financial industry, I must say that the recent investment activity surrounding Usual (USUAL) is nothing short of remarkable. Having closely followed the evolution of the Real-World Asset (RWA) sector and its intersection with DeFi, I can attest to the potential this project holds.

2024 is nearing its end, and my attention has been drawn to USUAL – a project that’s generating quite a buzz among leading venture capital firms. After making its debut on Binance Launchpool, this project managed to secure additional investments from some of the most influential VCs in our industry. I find myself intrigued by the growing interest surrounding USUAL and am eagerly watching its progress.

This investment activity reflects strong investor confidence in Usual and the broader Real-World Asset (RWA) sector.

Top-Tier VCs Back Usual

Usual is a decentralized initiative for a stablecoin that’s securely anchored to real-world assets. Its main stablecoin, USD0, is reinforced by U.S. Treasury Bills (T-Bills), which earn interest from T-Bills and distribute these earnings to investors through both Usual and USD0.

Just now, it was disclosed that the project successfully finished a Series A funding round worth $10 million. This round was spearheaded by Binance Labs and Kraken Ventures, with other notable contributors such as Coinbase Ventures, Wintermute, Ondo, and others participating as well.

At Binance Labs, we look for projects that foster significant advancements and broaden the network, and we’re thrilled to be backing Usual in their quest to explore new frontiers for stablecoins. This is according to Alex Odagiu, the Investment Director at Binance Labs.

Furthermore, it was also revealed that OKX Ventures had invested in Usual on the same day; however, the specific sum involved has yet to be disclosed.

Through seamlessly combining RWA and DeFi, USUAL has redesigned the earning potential of stablecoins and established an economy based on community collaboration and mutual advantage. Dora, the founder of OKX Ventures, expressed enthusiasm about USUAL’s journey towards becoming the innovative foundation that fuels the long-term worth creation and expansion of global decentralized finance.

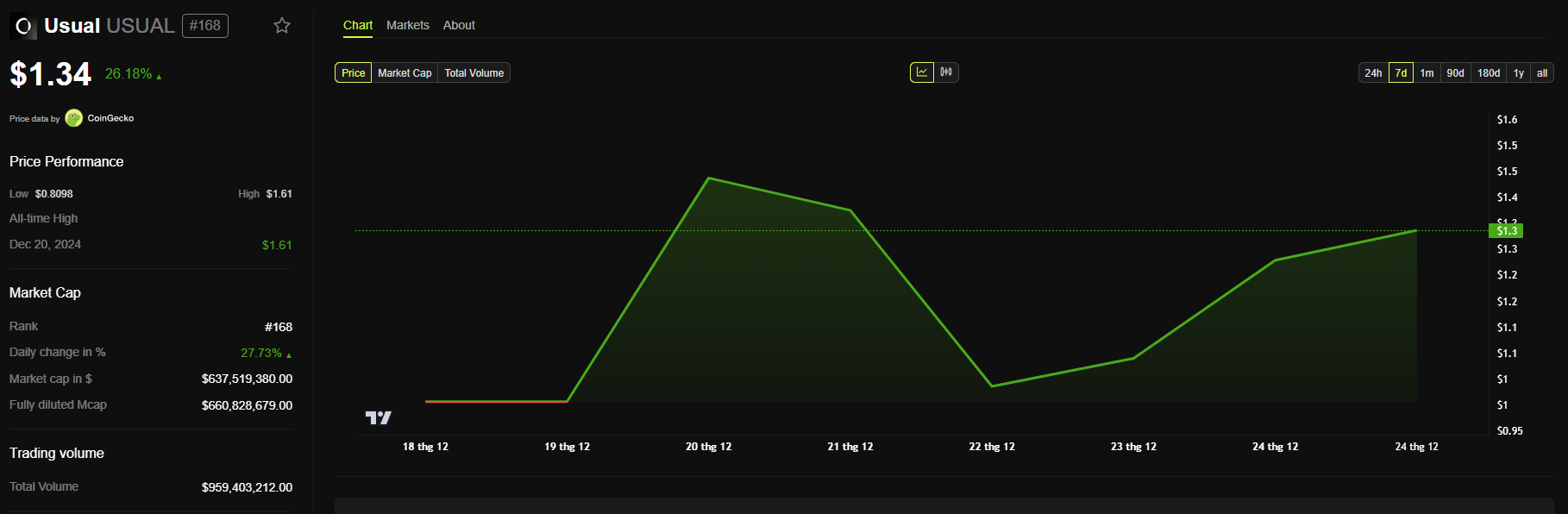

According to data from BeInCrypto, the value of USUAL surged approximately 26% after the latest announcement, with its current trading price hovering around $1.30.

As an analyst, I can report that our project, Usual, has garnered a total of $18.5 million in disclosed funding so far. Furthermore, according to the data from CoinMarketCap, the market capitalization of Usual has exceeded an impressive $600 million.

Its fully diluted valuation (FDV) exceeds $5 billion. Only 12% of the total supply, or 494 million USUAL, is in circulation. The project will unlock at least 3.2 million USUAL daily until 2028.

USD0 Stablecoin Growth Leads the Market

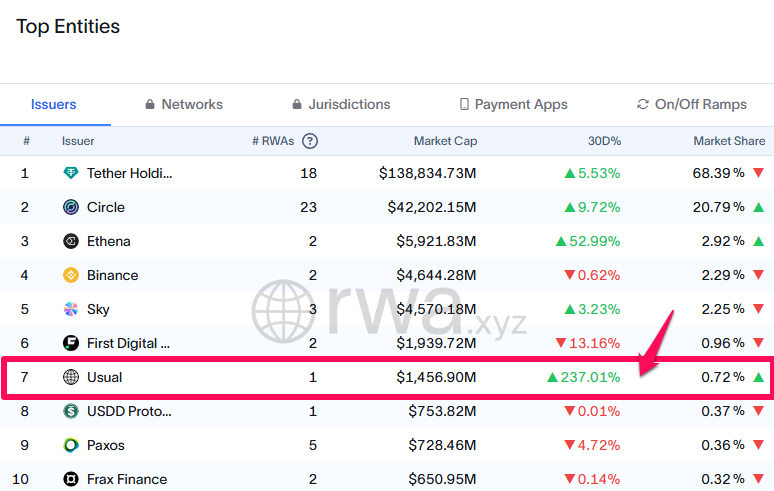

According to information from RWA.xyz, the market value of Usual’s main stablecoin has significantly increased. Starting at $20 million in mid-2024, its market cap has since grown to over $1.4 billion. Over the last 30 days, this growth has been particularly rapid, with a remarkable increase of 237%, making it the swiftest growing stablecoin for the month.

Furthermore, in 2024, the market for stablecoins has become more and more competitive as multiple new players have emerged. To illustrate, Ethena Labs introduced USDtb, a stablecoin supported by BlackRock’s BUIDL platform, while Ripple garnered attention with the launch of RLUSD.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-24 13:16