As a researcher delving into the dynamic world of cryptocurrencies, I’ve observed an increasing institutional interest in this market. This trend was substantiated last year by the U.S.’s approval of two crypto-based Exchange Traded Funds (ETFs), and Europe‘s implementation of the Markets in Crypto-Assets (MiCA) regulatory framework, which signifies a more comprehensive approach to overseeing digital assets as financial instruments.

According to Catherine Chen, the Head of VIP at Binance, she predicts that the year 2025 will keep stirring up investor curiosity. Chen also speculates that other nations may adopt similar strategies as the crypto market looks forward to more advantageous circumstances under Donald Trump’s presidency in the United States.

The Number of Institutional Investors in Crypto Rises

The cryptocurrency world is experiencing a substantial shift, marked by a growing influx of institutional investors.

The surge of investment funds from large financial institutions is significantly altering the nature of the cryptocurrency market, moving it towards a sector where institutions hold more control, as opposed to individual investors.

As per Chen’s report, it is Binance – one of the leading cryptocurrency trading platforms in terms of volume, that has undergone such a transition.

On a worldwide scale, there’s been a swift escalation in institutional investors joining this market. In fact, the number of registered institutional clients has doubled almost every quarter since 2024! For instance, during the first quarter, we observed a 25% increase, followed by a 50% rise in the second quarter. Currently, we’re nearly at double the number of clients we had at the start of the year.

2021 served as a symbol of global cryptocurrency advancement. In spite of opposition, digital currencies achieved victories in various sectors, including the establishment of regulatory guidelines and integration into conventional business structures.

ETFs Act as an Entry Point for Traditional Investors

2024 saw the U.S approval of two Crypto Exchange-Traded Funds (ETFs). This move offered conventional institutional investors a chance to interact with digital assets, all without needing to personally possess them.

Back in January, Bitcoin (BTC) became the first cryptocurrency to receive approval for an exchange-traded fund (ETF). This decision was made during a time when Gary Gensler was serving as chairman of the U.S. Securities and Exchange Commission (SEC), and the landscape was quite challenging under his leadership. He developed a reputation for being tough on crypto regulations, which often put him at odds with those in the crypto community.

2024 was an exciting year for me as a crypto investor, with the approval of the Bitcoin ETF standing out as the pivotal moment. This approval has substantial long-term implications because it provides the legitimacy that the crypto asset class truly deserves. The arrival of Bitcoin ETFs demonstrates that the world’s leading ETF issuers are treating this asset class with seriousness, which is a significant step forward for our community.

Chen explained that an ETF functions as an easy-to-use investment tool for various investors, providing them access to diverse markets like the crypto industry. Furthermore, he mentioned that when referring to its long-term impact, it’s due to the fact that traditional financial institutions who have been hesitant can now enter the crypto market through a familiar instrument.

In May, Ethereum (ETH) mirrored this move when the SEC approved spot Ethereum ETFs for trading, which started appearing on exchanges such as Nasdaq, the New York Stock Exchange, and the Chicago Board Options Exchange about two months later.

The significant success of these digital assets in obtaining ETF approval after numerous trials and mistakes led to a surge of investments and skyrocketed their prices, fueling optimism among investors and financial analysts alike.

2024 has exceeded all expectations, marking a new epoch for cryptocurrency. Notable advancements have occurred across various sectors, such as Bitcoin and the total crypto market cap hitting all-time highs (ATHs). The U.S. spot Bitcoin ETFs amassed a staggering $31 billion in net inflows and boasted over $100 billion in assets under management (AUM). Moreover, Chen mentioned that the recently approved spot Ether ETFs attracted significant investor interest, accumulating over $730 million in inflows and achieving an AUM of over $9 billion.

Industry experts are predicting a surge in the approval of ETFs (Exchange Traded Funds) related to various cryptocurrencies by the year 2025.

The Debate Over Future ETF Approvals This Year

Multiple companies have recently submitted fresh applications for Exchange-Traded Funds (ETFs) focusing on digital assets. Specifically, in November 2024, asset management firms VanEck, 21Shares, and Canary Capital applied to the Securities and Exchange Commission (SEC) for a Solana ETF. Grayscale followed suit with a similar application one month later.

The SEC also received ETF applications from Litecoin (LTC), Hedera (HBAR), and Ripple (XRP).

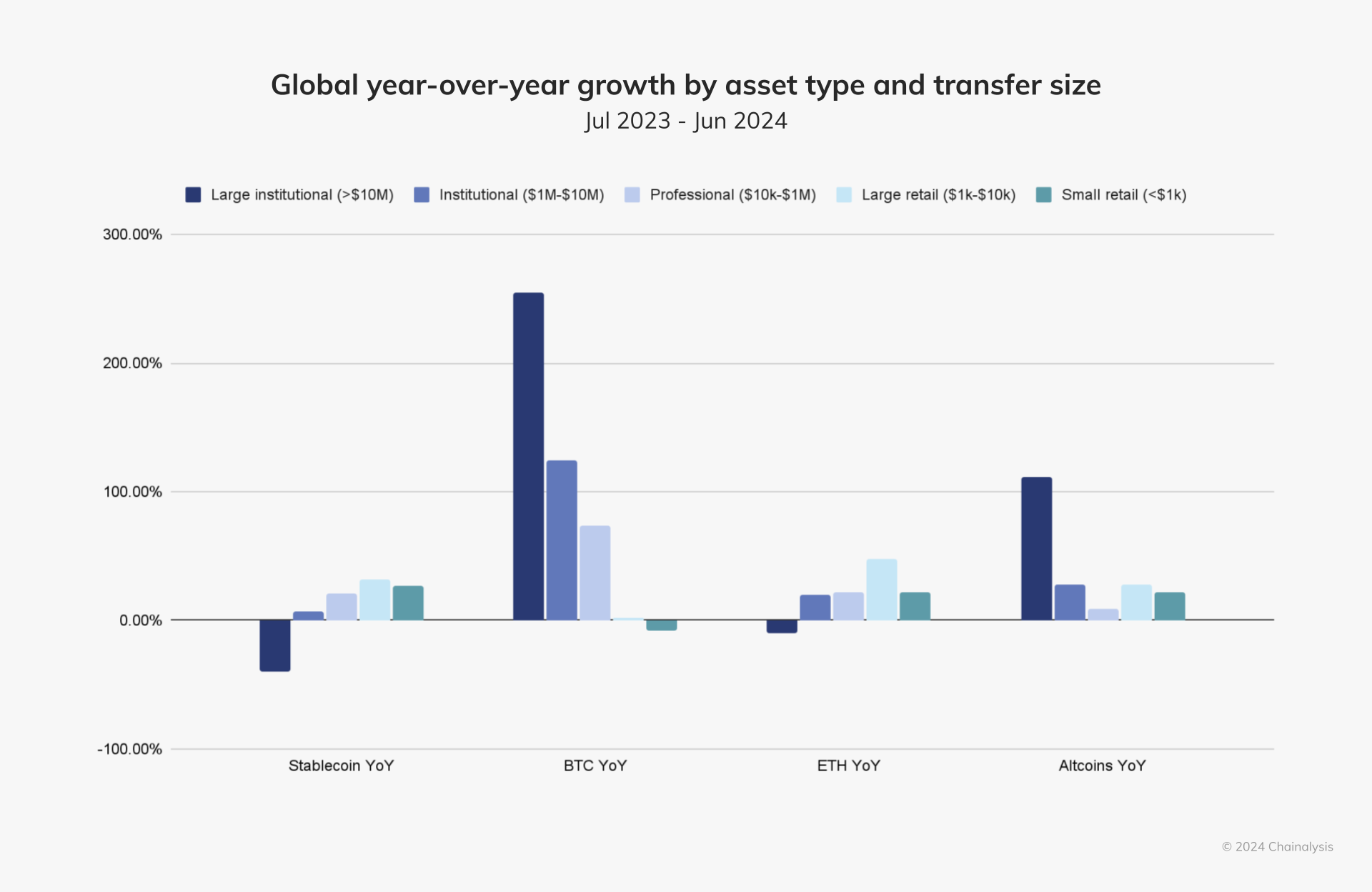

It’s anticipated that a greater number of ETFs will be approved next year, leading to an increase in institutional investment as cryptocurrency becomes increasingly integrated into traditional markets. Although we don’t disclose our specific targets, it’s worth noting that the trading volume by institutional investors rose approximately 60% over the past 12 months compared to the previous period. On a global scale, Binance has witnessed a remarkable 97% increase in onboarded institutional investors this year, as per Chen’s statement.

Although there’s a general positive outlook on increasing the number of ETFs next year, it’s important to take several factors into account before making that prediction. When deciding whether an ETF qualifies for approval, the SEC requires the underlying asset to meet stringent regulatory guidelines.

This encompasses following the established financial rules, maintaining a strong demand for investments from both institutional and individual investors, secure storage options, high trading volume, and strict disclosure of asset performance and management practices.

Bitcoin and Ethereum held a distinct edge during their ETF application process with the SEC, primarily because both networks enjoy a widespread recognition that extends beyond the boundaries of the cryptocurrency sector.

Compared to other similar networks such as Solana, Litecoin, and Hedera, these platforms are not as widely recognized. This lack of fame may reduce the overall appeal of an ETF related to them among conventional investors.

Crypto Becomes Part of US Political Agenda

Starting from 2009 when Satoshi Nakamoto introduced Bitcoin, cryptocurrencies have made significant strides. For much of this journey, those in traditional finance have considered digital assets as a passing trend. Many people who are not well-versed in their usefulness have linked them with the risk of being involved in scams or illegal activities.

In 2024, cryptocurrency became one of Donald Trump’s central pillars during his election campaign.

In the election, cryptocurrency was a significant point of discussion for both candidates. Given that we now have a pro-crypto president-elect and numerous pro-crypto politicians elected to the Senate and House of Representatives, it’s likely that we will witness new advancements in crypto legislation by 2025. This is already quite important, but let’s remember this development.

During his election campaign, Donald Trump often described himself as a “cryptocurrency-savvy president.” Following his win in the November elections, numerous appointments made by him have garnered broad approval within the cryptocurrency industry.

At the start of December, Trump appointed David Sacks as the Cryptocurrency Advisor for the White House. Known for his long-standing career as an entrepreneur and investor within Silicon Valley, Sacks is anticipated to contribute a wealth of expertise to this position.

Trump additionally chose Paul Atkins, an advocate for cryptocurrencies, as the new head of the Securities and Exchange Commission (SEC), replacing Gary Gensler in the position. This decision was met with enthusiasm by crypto supporters, while the market responded promptly with increased valuations.

During his initial term, Donald Trump tapped Stephen Miron, a previous Treasury Department official, to head the Council of Economic Advisors (CEA). Known as a strong supporter of digital currencies, Miron has earlier advocated for regulatory changes within the U.S.

Chen stated that any new regulations emerging in the U.S. could stimulate increased involvement in cryptocurrencies throughout the market, thereby raising global understanding of cryptocurrencies.

The change in the government’s approach to be more favorable towards digital assets might trigger similar changes in policies of other countries as well.

Adoption Extends Beyond Financial Giants

There’s been an increase in the curiosity towards cryptocurrencies among significant financial institutions and corporations primarily operating within the retail market.

In 2024, significant financial entities such as BlackRock and Fidelity stepped into the cryptocurrency market, and it’s anticipated that we’ll witness an influx of new players entering the crypto space in the upcoming years, as Chen pointed out.

As a researcher, I recently found myself delving into an exciting new development: In March, BlackRock, the world’s largest asset provider, introduced the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), their pioneering tokenized fund built on a public blockchain. This groundbreaking move offered qualified investors the chance to generate US dollar returns. Utilizing Securitize Markets, LLC, I was able to tap into this innovative fund, marking a significant change in investment landscapes.

Through this partnership, Coinbase emerged as a crucial foundation element for BlackRock’s pioneering blockchain investment fund. This alliance signified a substantial advancement in combining conventional financial systems with blockchain technology, notably by introducing the BUIDL initiative.

In a similar move to BlackRock, Fidelity International linked up with JPMorgan’s Tokenized Collateral Network (TCN) in June.

The action placed Fidelity among the key competitors in the tokenization industry, and the partnership with JPMorgan showcased growing enthusiasm for using blockchain technology for practical, real-life scenarios.

This increased adoption extends beyond financial giants.

As an analyst, I’ve observed a significant rise in companies educating themselves about cryptocurrencies and incorporating crypto features into their businesses. This trend, which has been on the rise for quite some time, shows no signs of slowing down, and I anticipate further advancements in this domain.

Numerous upscale fashion and luxury merchants are showing that the use of cryptocurrency is gradually increasing. Established brands such as Ferrari, Gucci, Balenciaga, and Farfetch have all expanded their payment methods to include accepting digital currencies.

Global Crypto Adoption

Institutional investment in cryptocurrencies is not confined to just the U.S.; instead, it’s a global phenomenon. As people across various countries are increasingly using digital currencies, governments worldwide are stepping up to govern these developments.

Approximately one-third of countries worldwide have established regulatory frameworks for cryptocurrencies as an asset class or for VASPs (Virtual Asset Service Providers), with varying degrees and methods. For instance, Dubai has a sophisticated system of licenses, registrations, and reporting. Japan, El Salvador, and several European nations are also part of this group, to name a few. The regulatory discussion is progressing swiftly and gaining traction on political agendas, which creates an optimistic outlook for the industry as we peer into the future, according to Chen’s statement to BeInCrypto.

Economic powerhouses and nations with emerging economies alike have taken these initiatives.

Certain countries such as Dubai possess sophisticated systems for licenses, registrations, and reporting. This is also true for Japan, El Salvador, and several European nations, to name a few. The regulatory discussion is progressing quickly and has become a significant political issue, which is undoubtedly a promising sign for the industry as we look towards the future, according to Chen.

The sequence goes on, encompassing all continents. Some nations are contemplating using cryptocurrency as a backup resource. Just last week, the Gelephu Mindfulness City in Bhutan announced that they have integrated digital assets such as Bitcoin, Ethereum, and BNB into their strategic reserves.

Recently, the head of the Czech National Bank, Aleš Michl, voiced his curiosity about incorporating Bitcoin into the nation’s foreign currency reserves.

As a researcher, I find myself pondering over Switzerland’s potential move to store Bitcoin in their strategic reserves. This action underscores the growing influence of cryptocurrencies in shaping the future of financial innovations.

In a similar vein, reserves for Bitcoin are picking up steam in the U.S., with 13 states expected to take the lead by the year 2025.

Chen commented on the ongoing discussion regarding a possible Strategic Bitcoin Reserve in the U.S. He pointed out that if this idea progresses and becomes reality, it could set a trend for other nations to do the same. Such a development would undoubtedly influence Bitcoin’s adoption.

The increasing worldwide usage of cryptocurrencies, along with their possibility to serve as backup resources, hints at a bright prospect for their influence within the broader financial system.

Europe Sets Precedent on Crypto Regulatory Framework

In 2024, Europe established a particular global precedent regarding regulatory clarity.

Speaking about regulations globally, Chen mentioned significant advancements such as MiCA in Europe, as well as progress in other nations.

Just two days prior to welcoming the New Year, the European Union enacted the Markets in Crypto-Assets (MiCA) framework, a set of standardized crypto regulations applicable to all member states.

As an analyst, I find a significant contrast between the recent regulatory landscape in the U.S., which has been marked by uncertainty, and the European Union’s (EU) latest move – the approval of the Markets in Crypto-Assets (MiCA) regulation. This EU decision effectively clarifies the ambiguity that previously arose due to varying regulatory requirements.

MiCA strengthens consumer safety by mandating that all cryptocurrency issuers and service providers follow identical laws and regulations. Obtaining a Crypto Asset Service Provider (CASP) license from any European Union (EU) member state grants companies the ability to offer their services throughout the EU.

Following its approval, various cryptocurrency companies across multiple European nations have submitted applications for a MiCA license.

Among the initial international firms granted such a license this month in the Netherlands, MoonPay is one of them. Similarly, BitStaete, ZBD, and Hidden Road have also secured AFM’s approval from the Dutch Financial Markets Authority.

Additionally, Socios.com has gained approval from the Malta Financial Services Authority (MFSA) for a MiCA license. This decision enables their fan engagement platform to operate as a licensed supplier of digital financial assets.

Educational Barriers Hinder Further Institutional Involvement

As investors gradually move towards broader cryptocurrency acceptance, obstacles in education persist.

According to Chen, investing in cryptocurrencies can still be challenging due to the high learning curve that’s associated with it.

In October 2024, the “Crypto Literacy State” survey was carried out, gathering responses from a diverse group of 670 participants within the United States, representing a mix of different ages, genders, and income levels.

Based on the findings, approximately one-third (31.8%) of those surveyed indicated they have extensive knowledge about cryptocurrencies. The study also pointed out several factors hindering widespread acceptance, as 26.6% of participants expressed the need to grasp what determines a cryptocurrency’s worth.

It was clear that there was a general lack of understanding concerning complex subjects such as Decentralized Finance (DeFi) and staking.

Approximately one out of five survey participants accurately recognized a private key as essential for overseeing cryptocurrencies, whereas around 14% indicated they grasped the workings of DeFi. Interestingly, just 9% of those polled acknowledged their understanding of staking’s role within blockchain networks.

There’s a greater interest in cryptocurrencies than ever before, but is the appropriate guidance being provided for people to enter this realm?” Chen commented.

As a seasoned crypto investor, I’ve come to realize that understanding the intricacies of cryptocurrency is paramount in building trust and encouraging wider acceptance within our community. Closing the informational divide between investors and novices is essential if we want institutions to maintain their active involvement in the crypto space.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2025-01-17 00:11