When the quarterly curtain lifts on Wall Street’s dealings, the 13F filings reveal more than capital flows-they expose the quiet calculus of survival in a system where fortunes are measured in milliseconds and human labor is but a footnote in earnings calls. The “smart money,” as they call it, has been reshuffling its deck: discarding Palantir’s data-mining promises and betting aggressively on Nvidia’s silicon empire.

Let us not romanticize this shift. These are not gambles made in the glow of midnight oil lamps, but cold recalibrations by entities that see the world as a spreadsheet. The billionaires trimming Palantir stakes-Ken Griffin’s Citadel, Stanley Druckenmiller’s Duquesne, Ray Dalio’s Bridgewater-are not fleeing failure, but chasing proximity to power. Palantir, for all its government contracts and enterprise mystique, offers no monopoly on the future. Its code may parse petabytes, but it cannot parse certainty.

The Retreat from Palantir: Hedging or Despair?

Citadel’s 48% reduction in Palantir shares is but a footnote in its labyrinthine portfolio, yet it speaks volumes. Griffin’s shop holds both puts and calls-a hedge, perhaps, against a world where data analytics proves as fickle as the wind. Druckenmiller, who once danced in and out of Palantir’s volatility, has abandoned the floor entirely. Dalio’s Bridgewater, ever the cautious steward, bled out its position gradually, like a factory owner shuttering mills one by one as demand wanes.

These are not the actions of men clutching pearls and crying into silk handkerchiefs. They are the adjustments of machines designed to sense friction before it grinds their gears to dust. Palantir’s valuation climbs ever higher, pricing in a future where its algorithms become indispensable. But the masters of the universe know: when the code demands perfection, even a single bug becomes a revolution.

Nvidia’s Rally: A Revolution in Silicon

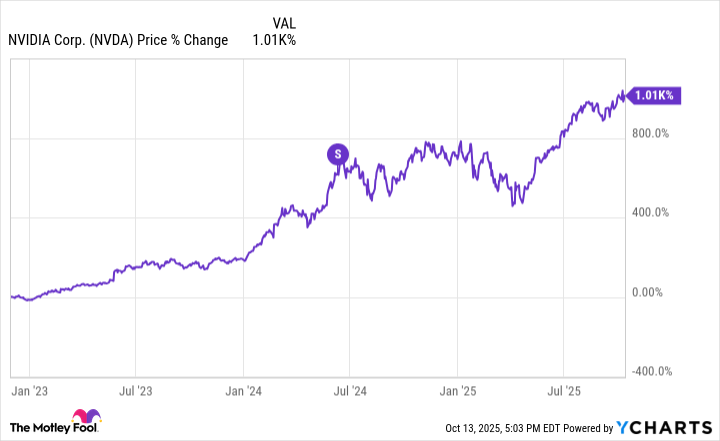

Between the birth of OpenAI and Nvidia’s 2024 stock split, its shares rose 620%-a number that makes the blood of mortals run cold. Coatue Management added 34% more shares; Citadel, in its hunger, swallowed 414% more. They see what others do not: that Nvidia’s chips are not mere hardware, but the loom weaving the fabric of artificial intelligence, robotics, and the next frontier of capital.

The common worker may toil under the weight of this revolution, their livelihoods dissected by algorithms and automated systems. Yet here, in the glow of Nvidia’s rally, the financiers smell not just profit but dominion. The machine grinds on, but whose bread does it bake?

Valuation: The Illusion of Certainty

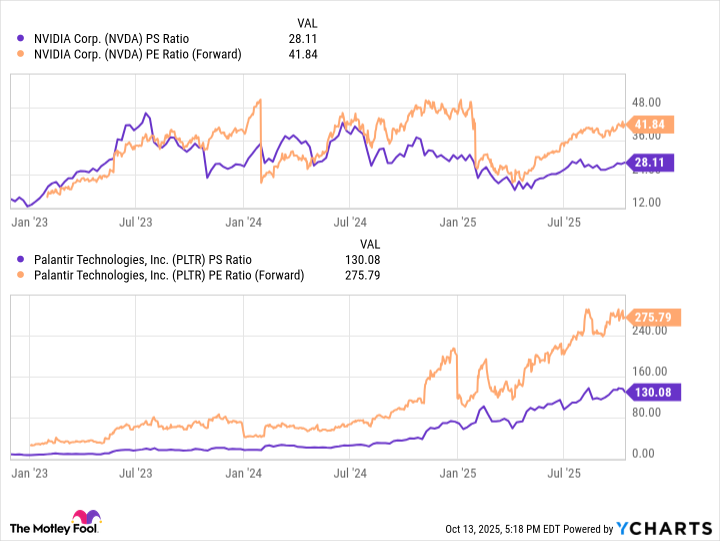

Nvidia trades at 28x sales and 42x forward earnings-a valuation that would make a Cossack weep. Yet compared to its own fevered peaks, it seems almost reasonable. Palantir, meanwhile, stretches its multiples like a beggar reaching for crumbs, priced for a utopia where every line of code generates gold.

The billionaires’ choice is clear: bet on the shovel-makers when the gold rush begins. Nvidia’s silicon is the shovel; Palantir’s analytics are the prospector’s fevered dream. One feeds the revolution; the other dances atop its pyre.

Let the workers of the world take note: when capital rotates, it does not seek justice, only momentum. Nvidia’s chips will power the factories of tomorrow, while Palantir’s code may become the ghost in the machine-remembered, but no longer needed. 🧰

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-18 00:13