Ever notice how hedge funds act like they’re hosting a secret society? The 13F filings are their annual “look what we did last quarter” Instagram post, delayed by 45 days. It’s like waiting for the next season of your favorite show-except instead of drama, it’s billionaires buying stocks. And guess who’s been busy? Stanley Druckenmiller, the guy who probably has a personal chef and a 500-page spreadsheet of his investments. He’s upped his TSMC stake by 28%, which is like saying “I’m bullish” while wearing a tuxedo and a frown.

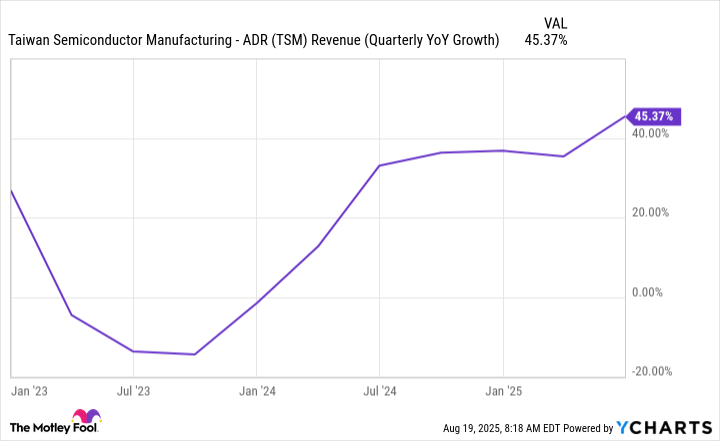

But here’s the thing: By the time this info drops, the market’s already moved on. It’s like getting a memo about last week’s meeting. Still, TSMC’s growth is faster than a toddler on a trampoline. They’re the go-to chip maker for giants like Nvidia and Apple, which is basically the tech world’s version of being the cool kid at school. And they’re not slowing down-they’re building a chip factory in Arizona, because nothing says “I’m global” like a desert. 🚀

While other chip makers are stuck in the “we’re trying” phase, TSMC is out here innovating like it’s 2005 and you’re still using a flip phone. They’re already working on 2nm chips, which is like planning a vacation while you’re still on your last one. Management’s so confident, they’re investing $165 billion in the U.S.-because nothing says “we’re serious” like spending a fortune on a place where the coffee’s overpriced and the traffic’s apocalyptic.

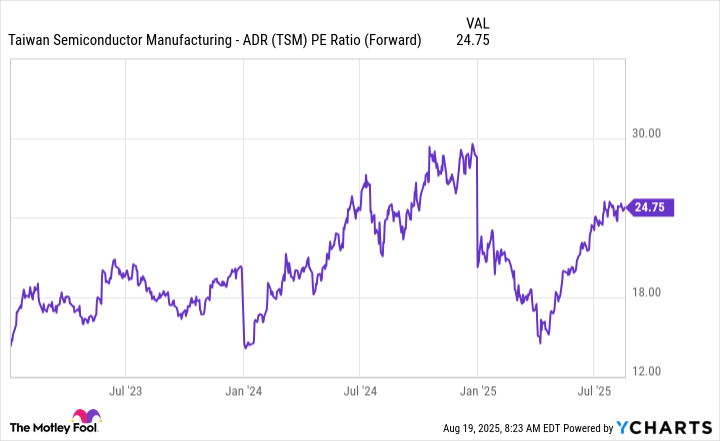

Now, is TSMC still a good buy? Well, it’s trading at 25 times earnings, which is like paying $25 for a burger that’s just a bun and a lettuce leaf. But here’s the twist: Unlike most AI stocks, TSMC isn’t a hype machine. It’s the calm in the storm, the “I’ve got this” of the chip world. And with AI spending set to blow up like a fireworks show in a dry forest, TSMC’s position is about as solid as a well-armed security system.

So, while the rest of us are busy debating whether to “buy the dip,” TSMC’s quietly making its case. And if a billionaire with a spreadsheet thinks it’s worth his time? Well, that’s not a bad sign. It’s like if your friend with a PhD in finance told you to invest in a lemonade stand. You might laugh, but you’d also check the ingredients. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2025-08-23 12:45