For some investors, earnings season is the high noon of the quarter, a time when the S&P 500 companies unveil their quarterly results, like a magician revealing their tricks, but with more spreadsheets and fewer rabbits. This is the six-week period where the financial world collectively holds its breath, waiting for the next act in the eternal drama of market performance.

But earnings season isn’t the only act in this play. One week ago (Aug. 14), institutional investors with at least $100 million in assets under management faced a deadline that, if forgotten, might have resulted in a bureaucratic scolding from the SEC. This was the filing of Form 13F, a document that, if you squint, resembles the opening of a treasure map, but with more legalese and fewer pirates.

While Warren Buffett’s trading activity is the main event, he’s not the only one with a golden touch. Bill Ackman, the maestro of Pershing Square, is a conductor of market symphonies, his baton made of… well, probably not gold, but maybe a very expensive pen. His $13.7 billion portfolio is a patchwork of concentrated bets, each one a carefully orchestrated move in the grand game of value extraction.

Enter Amazon (AMZN), the e-commerce colossus, which found itself at the center of Ackman’s latest maneuver. While he added to three existing positions, it was this “Magnificent Seven” stock that stole the spotlight. A stock so vast, it’s like a black hole that swallows entire industries and spits out profit margins.

Billionaire Bill Ackman loaded up on this dual-industry leader

Ackman’s purchase of 5,823,316 shares of Amazon during Q2 was no accident. It was a calculated move, akin to a chess player sacrificing a pawn to secure a queen. Though he hinted at the trade in May, the scale of the bet was a surprise. By mid-2025, this stake was worth nearly $1.3 billion, a fourth-largest holding that would make even the most seasoned investor raise an eyebrow.

The timing was impeccable. April, a month that saw tariffs and trade policies, but also a time when the market, like a confused cat, decided to pounce on Amazon’s stock, which had been quietly waiting for its moment. The 34% rise since April 8 was less a rally and more a cosmic alignment of market forces, as if the universe itself had whispered, “Buy Amazon.”

The rationale? Amazon’s resilience to tariffs, its dual-industry dominance, and the sheer audacity of its business model. It’s a company that sells you a book, then hosts your data, then delivers a package while you stream a movie. It’s like a Swiss Army knife, but for capitalism.

Amazon’s cash flow can more than double in three years

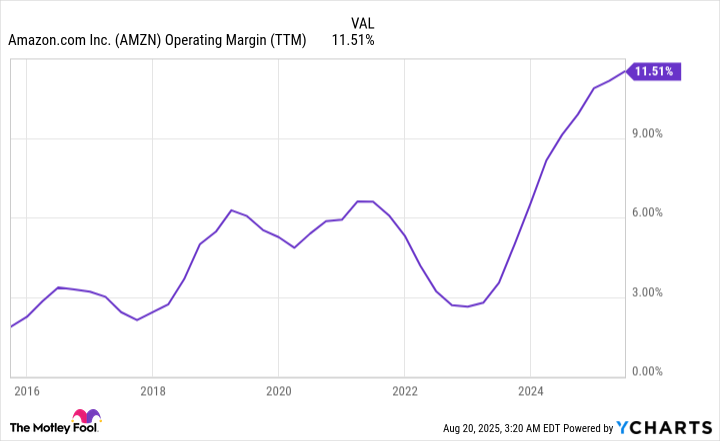

Amazon’s cash flow is the engine of its empire, and it’s revving at a pace that would make a Formula 1 driver jealous. While its online retail margins are as thin as a spreadsheet, its cloud infrastructure (AWS) is the real money-maker. Think of AWS as the invisible hand that keeps the internet running, but with more servers and fewer hands.

AWS, which accounts for 32% of global cloud infrastructure spend, is growing at 17% to 19% annually. The integration of generative AI is like adding rocket fuel to a spaceship. Meanwhile, Amazon’s advertising revenue is climbing, fueled by its massive user base and the allure of its platforms. It’s a snowball effect, but the snow is made of data and dollars.

With Prime subscriptions and exclusive content deals, Amazon’s subscription services are another engine of growth. It’s like having a loyal fanbase that not only buys your products but also pays for the privilege of doing so. The result? A cash flow that’s set to double by 2027, a number that makes even the most jaded investor pause and think, “What’s the catch?”

And here’s the kicker: despite a 34% rise, Amazon’s stock is still valued at just 9.4 times estimated 2027 cash flow. It’s like finding a bargain bin at a record store that’s actually got some good stuff. Bill Ackman, ever the opportunist, has once again proven that the best investments are often the ones that seem too obvious to be true.

So, as the market continues its endless dance of chaos and clarity, one thing is certain: the universe, like a well-timed joke, has a way of rewarding those who pay attention. And for the rest of us? We can only hope our investments are as lucky as a cat with a laser pointer. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-21 10:12