Bill Ackman, a man who has made a fortune from others’ misfortunes, now bets heavily on artificial intelligence. As manager of Pershing Square Holdings, he wields $13.7 billion in public stocks, with 45% concentrated in three AI-linked names. This is not speculation-it is calculated aggression. The fund’s 12.7% gain this year and 23.4% annual return suggest a strategy as precise as it is audacious.

Uber: 21% of the Portfolio

Uber Technologies (UBER) dominates Ackman’s ledger. The ride-hailing titan, now a “highly profitable and cash-generative growth machine” under Dara Khosrowshahi, has surged 55% this year. Yet its allure lies less in current performance than in its bet on autonomous vehicles. Uber does not build cars; it brokers access to them, partnering with Waymo and WeRide. The company’s claim that autonomous transport could be a $1 trillion market reads like a fairy tale told by men who’ve never driven a car. Still, the logic is sound: Uber’s operational scale and regulatory clout make it a gatekeeper in an industry where control of the wheel is the new gold standard.

Shares trade at 25 times forward earnings-a premium, but one that reflects optimism. Whether this optimism justifies the price remains to be seen. For now, Ackman treats UBER as a leveraged play on the future, not the present.

Alphabet: 15.1%

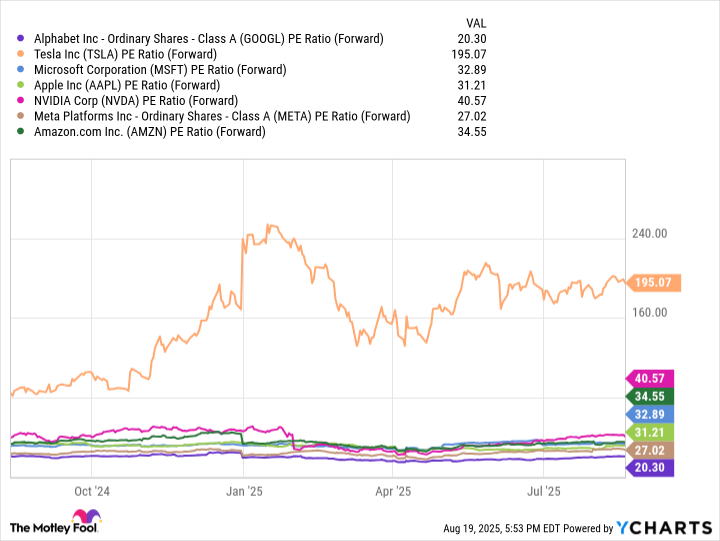

Alphabet (GOOG, GOOGL) is the oddball in the “Magnificent Seven.” At 20 times forward earnings, it is the cheapest, yet its struggles are plain. The Department of Justice demands it sell its Chrome search business; AI chatbots erode its search dominance. Yet Pershing Square sees value in Google’s AI Overviews and Gemini, where ad monetization mirrors traditional search. The company’s other bets-YouTube, Google Cloud, DeepMind-are buried under layers of complexity, much like the man who runs it.

Alphabet’s survival depends on proving it can adapt. For Ackman, this is a test of resilience, not innovation. He buys into the idea that a company can outlast its problems, even if it cannot outthink them.

Amazon: 9.3%

Amazon (AMZN) entered Ackman’s portfolio after Trump’s tariff threats rattled markets. The e-commerce giant’s exposure to Chinese goods makes it a political lightning rod, yet its logistics network-100 million products, one-day delivery-is a fortress. Ryan Israel, Pershing’s CIO, praises Amazon’s “unique and valuable logistics franchise,” a phrase that sounds less like praise and more like a warning. AWS, the cloud arm, is Amazon’s real crown jewel, hosting 20% of global IT workloads. In the AI era, data centers are the new oil rigs.

Tariffs loom like a storm cloud, but Amazon’s scale suggests it will weather them. The question is whether its dominance in cloud and AI can offset the frictions of geopolitics. For now, Ackman bets on the former.

Three stocks. 45% of a $13.7 billion fund. The arithmetic is simple; the stakes are not. Ackman’s bets are a mirror held to the AI revolution-reflecting its promise, its chaos, and the men who dare to profit from both. 🏁

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

2025-08-24 12:24