Ah, the alluring world of artificial intelligence stocks. They tend to behave like the dedicated overachievers in a school play: glamorous, sure, but under all the sparkles, you’re often left wondering if they’re just good at faking it. Case in point: BigBear.ai (BBAI), strutting its stuff with a nearly 40% leap in value this year-up through the week ending August 15. Living the dream, right? Well, there’s always a catch. The stock still languishes well beneath its 52-week high of $10.36, which it flaunted back in February. So, is now the moment to dive into the murky waters of investment?

To answer that million-dollar question, let’s unearth where our dear BigBear.ai currently finds itself-because wouldn’t you know it, the world of finance rarely goes according to plan.

From Growth to Setback: The BigBear.ai Saga

Here’s the skinny: BigBear.ai isn’t exactly your generic tech startup. It’s knee-deep in providing AI solutions primarily to the U.S. national security apparatus. Think submarine construction software for the U.S. Navy and biometric scanning tech at airports-the kind of exciting work that seldom finds itself in the limelight. What a time to be alive, right?

Once upon a time, their revenue figures were as heartening as a fine cup of coffee. In 2024, they clocked in at $158.2 million-up from $155.2 million in 2023. However, the plot thickened when-spoiler alert-the Trump administration dropped a bombshell of spending cuts. Enter the second quarter: revenues plummeted 18% year-on-year, down to $32.5 million. Ouch. The revenue forecast for 2025? A sad shuffle downwards to between $125 million and $140 million. It’s a rollercoaster of disappointment, folks.

And for those of you hoping for a steely resolve in the form of profitability-sorry to say, but BigBear is still running a deficit. Reporting an operating loss of $90.3 million, it’s a far cry from the $16.7 million loss we’d chuckle about last year. It’s enough to make even the most optimistic investor clutch their pearls, particularly after a hefty goodwill impairment charge of $70.6 million. Bad news bears, indeed.

How BigBear.ai is Tackling its Challenges

Not one to throw in the towel (yet), BigBear.ai’s new CEO, Kevin McAleenan, jumped into his role in January with ample awareness that their business development strategy was a bit like a shrinking violet. Too few clients and too many prayers were not a sustainable way forward.

So, what’s he done? McAleenan’s all about shaking it up, proclaiming, “We’ve taken steps this year to deepen and broaden that pipeline…” -and yes, kudos for using ‘pipeline’ like we understand what’s in it. All we know is, they’re broadening their horizons, with new partnerships in the UAE. Nothing says ‘I’m taking this seriously’ better than a transcontinental collaboration!

As for cash flow, let’s just say there’s enough of it to keep the lights on a little while longer. With $599.4 million in total assets and only $332.8 million in liabilities, they’re not on the verge of financial ruin. Their cash balance? A noteworthy $391 million against a mere $143 million in debt. Living large, but whether that’s enough to rebuild revenue remains to be seen.

Other Considerations for Market Adventurers

Here’s a juicy tidbit: the U.S. Department of Homeland Security, after a special ‘big, beautiful bill’ signed by Trump, is flush with funding. As BigBear supplies tech to DHS, they may just snag a slice of this financial pie. Might that make BigBear.ai a tempting investment choice, particularly with its colossal cash reserve and revamped sales strategy looming large in our imaginations?

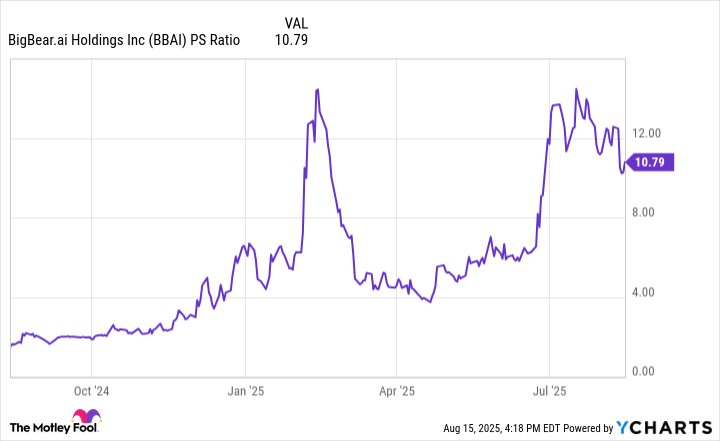

But wait! Before you rush out to buy shares like there’s no tomorrow, let’s take a peek at their price-to-sales (P/S) ratio. Essentially, it’s a way of seeing how much of your hard-earned cash is tied up in every dollar of revenue this company produces over the past 12 months. Spoiler: it’s not looking like a bargain, even after the stock price dip.

The chart’s staring back at us, confirming that BigBear.ai’s P/S ratio has spiked, making its current share price a less-than-desirable option. While fortunes may eventually shift, let’s not forget-a second round of disappointing earnings could follow swiftly behind. So, for the moment, it might be smarter to hold off before our wallets take any further hits.

So, here we are-a classic ‘will they, won’t they’ scenario, but perhaps in the realm of stocks and not romance. Who knew investing could involve such emotional labor? 😬

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-20 03:18