BigBear.ai (BBAI 4.66%) may be the darling of speculative investors in 2026, a stock that tickles the fancies of those who imagine themselves as modern-day financiers. It boasts the allure of artificial intelligence, the charm of a small-cap enterprise, and the grandiosity of a market opportunity. Yet, one must wonder if such a stock is merely a mirage, a gilded cage for the unwary.

Indeed, it is a favored choice among AI enthusiasts, though one might question whether it serves as a passport to riches or a ticket to disillusionment. The prospect of becoming a millionaire through its shares is as plausible as a parrot reciting Shakespeare-entertaining, but improbable.

Is BigBear.ai a surefire bet for astronomical returns, or does it merely echo the folly of past speculative ventures? The answer, like many in finance, lies in the fine print.

BigBear.ai: A Shadow of Palantir’s Ambition

Palantir Technologies has long been a paragon of resilience for investors, its rise marked by a focus on government contracts and AI software. BigBear.ai, in its own way, seeks to emulate this path, though with the subtlety of a sledgehammer. Its custom AI solutions for government clients-though occasionally bleeding into civilian applications-resemble the laborious process of building a cathedral, one stone at a time. Such bespoke work, while noble, chisels away at margins, leaving a trail of modest profitability.

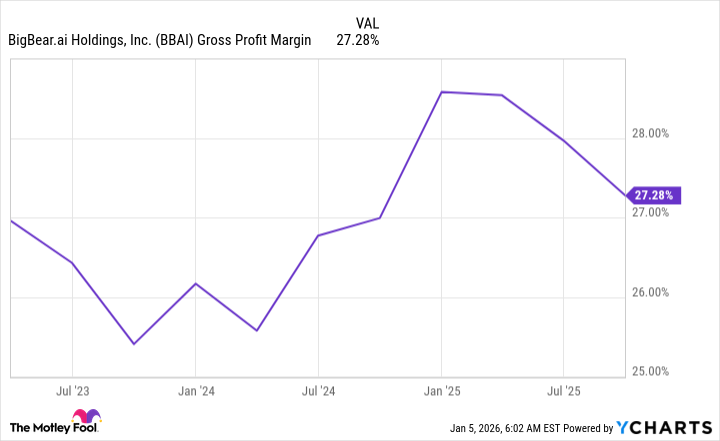

BigBear.ai’s gross margins, languishing between 25% and 30%, starkly contrast with the 70% to 90% typical of subscription software firms. Palantir, by comparison, boasts a net income margin of 40%-a figure that seems to mock BigBear.ai’s current model. One might say the latter is a ship adrift in a sea of unmet expectations.

Yet, BigBear.ai’s recent acquisition of Ask Sage offers a glimmer of hope, though hope is a fickle companion in the realm of stock markets.

Ask Sage: A Masterstroke or a Gambit?

In Q3, BigBear.ai’s management announced the purchase of Ask Sage for $250 million, a sum that, given the latter’s $25 million annual recurring revenue, equates to a tenfold multiple. This seems a bargain, especially for a company projecting sixfold growth. Ask Sage, a generative AI platform targeting defense and regulated sectors, could prove a lifeline-but lifelines, as the saying goes, are often slippery.

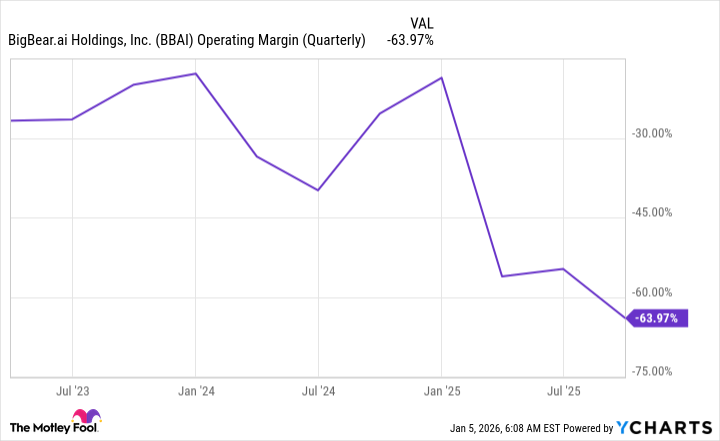

Though the acquisition is astute, BigBear.ai remains mired in challenges. Its Q3 operating margin, the worst in three years, signals a widening chasm between aspiration and reality. The company’s revenue, down 20% year-over-year, further undermines its allure. One might ask: if AI products are selling themselves, why does BigBear.ai’s lag so conspicuously?

Until BigBear.ai demonstrates improved profitability and sustained growth from Ask Sage, it remains a curiosity rather than a compelling investment. The road to millionaire status, it seems, is paved with caution and skepticism.

BigBear.ai might yet ascend, but the odds are as favorable as a dachshund’s chance of winning a race. For those seeking dividends, the stock’s current trajectory is less a promise and more a cautionary tale. The true investors, after all, are those who know when to hold and when to fold-though BigBear.ai’s story may not yet warrant either.

💰

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-01-07 19:02