BigBear.ai (BBAI) has become the kind of stock that makes investors do a double-take, like spotting a $20 bill on the sidewalk. Up 50% this year, it’s the size of a modest lunch tab at a mid-tier steakhouse—under $2 billion market cap. The pitch? Pure-play AI with growth potential that could theoretically turn your brokerage account into a retirement miracle. But let’s not get ahead of ourselves.

Is this the golden goose of AI, or are we about to make a colossal social blunder by buying in? Let’s dissect this like a bad waiter’s explanation of why the soup was cold.

BigBear.ai’s growth is the human equivalent of slow Wi-Fi

Here’s the thing about BigBear.ai: they specialize in AI solutions for government clients, which would be fine if the government moved at the speed of a caffeinated hummingbird. Instead, they’ve hired a CEO who practically has a security clearance tattoo—Kevin McAleenan, former DHS Secretary under Trump. Great for networking, sure, but does this guy know how to hustle or just how to fill out a 10-page form?

They also signed a partnership in the UAE, which sounds exciting until you realize partnerships are like dating apps: everyone’s swiping right, but actual dates are rare. Their Q1 revenue? A 5% crawl. If growth were a dinner party, this company would be the guy who arrives 45 minutes late, spills wine on the host, and talks about blockchain the whole time.

Look, the revenue backlog is up 30% year-over-year, which sounds promising until you realize backlog is just accounting jargon for “promises we might not keep.” It’s the financial equivalent of saying you’ll “definitely” RSVP to a friend’s wedding… three months later.

BigBear.ai’s margins: cheaper than a thrift store suit, but not in a good way

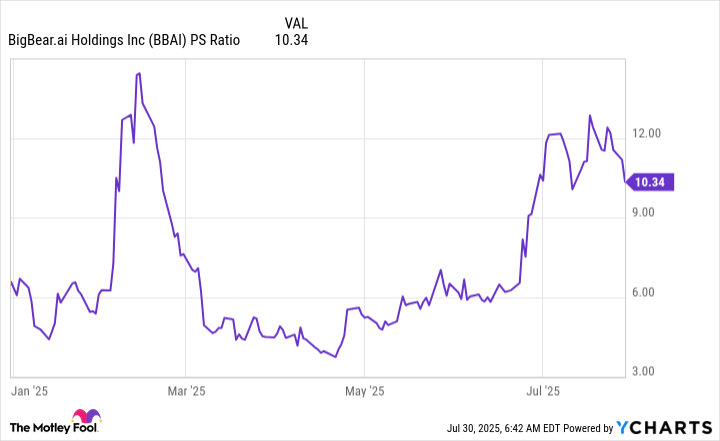

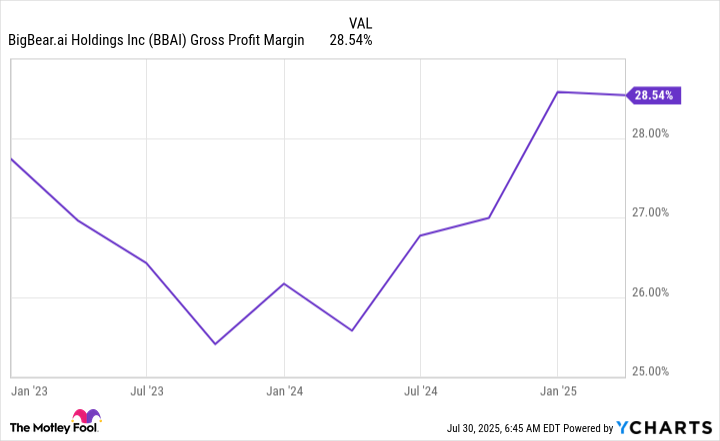

At 10x sales, the stock looks like a bargain. But gross margins under 30% make this thing smell like a “buy one, get one free” coupon for expired yogurt. Software companies with decent margins (70-80%) are the ones printing money. These guys? They’re the sad barista who charges $5 for a latte but still can’t afford rent.

Here’s the kicker: their business model relies on custom solutions, which is just Wall Street code for “we do whatever the client says, like a desperate Uber Eats driver.” No scalable products, no recurring revenue—just a bunch of one-night stands with government contracts.

If you’re looking for a stock to make you rich, this isn’t it. It’s like buying a lottery ticket because your barista said it was “cute.” There are faster-growing, more profitable companies out there that won’t make you wait six months for a return. BigBear.ai isn’t a missed opportunity—it’s a missed subway train. 🚇

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

2025-08-02 13:30