As a seasoned crypto investor with a penchant for unconventional market trends, I find myself awestruck by the strategic moves of nations like Bhutan and El Salvador in their approach to Bitcoin. While Germany’s decision to sell during the summer downturn seems like a missed opportunity, these nations have demonstrated foresight that could redefine sovereign wealth management.

In the secluded mountain realm of Bhutan, a forward-thinking move taken in 2019 is now reaping unforeseen benefits. The nation’s Bitcoin holdings, amassed through mining activities when the digital currency was valued around $5,000, have surged beyond $1 billion, signaling an extraordinary shift in Bhutan’s national wealth profile.

As an analyst, I find it striking how our country’s missed opportunity differs from Germany’s recent situation. They had a chance to pocket around $1.7 billion by offloading 50,000 Bitcoins during the market slump last summer, yet they chose to sell for $2.88 billion with Bitcoin trading below $54,000 due to seized assets. However, Bitcoin’s subsequent soar to record highs, reaching nearly $90,000, has underscored the significant opportunity cost of their decision, making me ponder about our own strategic moves in the crypto market.

Nayib Bukele Was Right

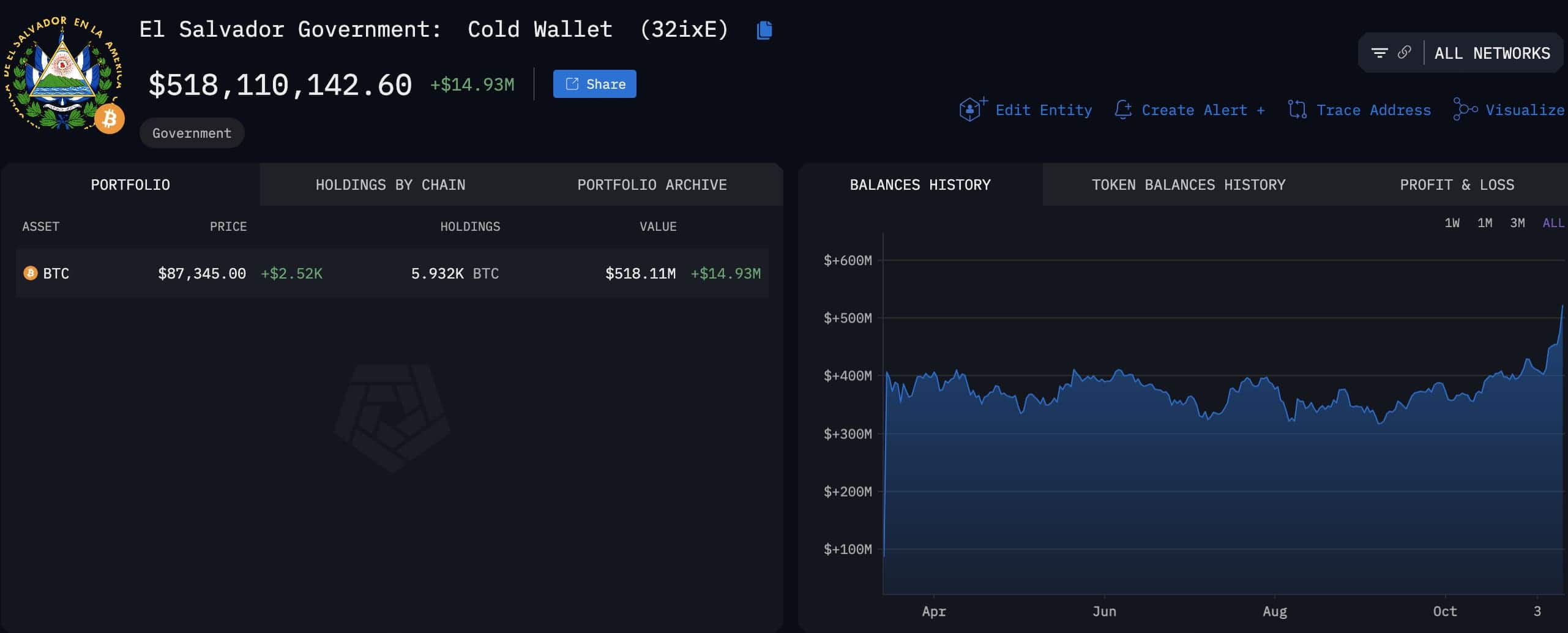

In a groundbreaking move, El Salvador, the pioneer country that made Bitcoin a legal tender, has seen its digital wealth thrive. The Central American nation’s Bitcoin holdings, estimated to be around 5,900 Bitcoins by Arkham Intelligence, have experienced a significant increase of over $100 million in mere seven days.

Initially seen as a bold but risky move, President Nayib Bukele’s decision to make Bitcoin a legal tender for El Salvador is now being reevaluated positively. By implementing a strategic approach of gradually accumulating Bitcoin, starting with 200 coins, the country has amassed a significant national asset. Contrasting Germany’s decision to sell off large amounts, El Salvador’s persistent investment in Bitcoin hints at a vision for the cryptocurrency’s future role within its economy. To underscore his wise choice, President Bukele took to Twitter to taunt his critics, asserting that he had indeed made the right call.

The current value of the country’s Bitcoin holdings is approximately $523 million, marking a significant growth from their initial investment made back in September 2021. This underscores the possible benefits of strategic Bitcoin investments, a strategy that seems to have been underestimated by Germany. As WatcherGuru, a cryptocurrency market analyst, pointed out, Germany’s decision to sell off occurred during a time of increased Bitcoin volatility, leading up to a new record high of $89,643, as per TradingView data.

According to Dennis Porter, CEO of Satoshi Action Fund, there’s a notable change in the way countries manage their reserves. This increase in Bitcoin’s worth has led to a resurgence in interest for sovereign Bitcoin holdings. Experts predict that other nations might emulate this trend, possibly inspired by Bhutan and El Salvador’s achievements and Germany’s perceived mistake.

Bhutan’s approach in managing its economy stands out significantly. The country, operating under the banner of its commercial entity Druk Holding and Investments, has stealthily accumulated approximately 12,568 Bitcoins.

Lately, it seems these digital assets are being actively managed. A significant amount of $66 million in Bitcoin was moved to exchanges by the country in late October, as prices surged. Contrary to this, Germany appears to have sold off a large portion of its Bitcoin holdings, while Bhutan has been steadily adding to its digital assets, indicating a different strategy for management.

A New Era

The success of these early adopters has not gone unnoticed. Financial analysts suggest that this could mark the beginning of a new era in sovereign wealth management, where digital assets play an increasingly important role alongside traditional reserves. Germany’s experience serves as a potential case study in the complexities of managing these volatile assets, highlighting the potential for both significant gains and substantial missed opportunities.

1) In the case of Bhutan, a nation famous for evaluating prosperity based on Gross National Happiness, this monetary boost could offer extra funds for social advancement. On the other hand, El Salvador is progressively enlarging its Bitcoin projects, implying their dedication extends beyond simple investment to a fundamental economic overhaul.

Read More

2024-11-13 13:40