Author: Denis Avetisyan

New research leverages the power of artificial intelligence to reveal how people prioritize their financial goals, mirroring Maslow’s classic hierarchy of needs.

This study validates a financial needs hierarchy by analyzing social media discussions with generative AI, demonstrating a correlation between income and the prioritization of financial well-being.

Despite established frameworks in behavioral science, understanding the dynamic prioritization of financial needs in real-world contexts remains challenging. This research, ‘A methodology for analyzing financial needs hierarchy from social discussions using LLM’, introduces a novel approach leveraging large language models to infer a hierarchical structure of financial needs directly from social media discourse. Our analysis confirms the existence of this hierarchy-ranging from immediate essentials to long-term aspirations-and demonstrates a correlation between expressed needs and underlying economic factors. Could this data-driven methodology offer a more nuanced and scalable alternative to traditional survey-based approaches for gauging financial well-being and predicting behavioral trends?

The Erosion of Conventional Measures: Mapping Financial Need in the Digital Age

Conventional methods of gauging financial need, such as surveys and questionnaires, frequently encounter limitations that compromise their accuracy and scope. These approaches are susceptible to several biases; individuals may not accurately report their financial situations due to social desirability, recall errors, or a simple lack of self-awareness. Moreover, surveys inherently suffer from limited reach, often failing to capture the perspectives of marginalized communities or those less likely to participate in formal research. This restricted accessibility creates an incomplete picture of true financial hardship, hindering effective resource allocation and targeted intervention strategies. Consequently, reliance on these traditional tools presents challenges in developing a comprehensive and representative understanding of evolving financial needs within a population.

Social media platforms have emerged as powerful digital mirrors reflecting the financial realities of individuals, offering a wealth of previously inaccessible data. Unlike traditional methods that depend on self-reported information – often subject to biases or limited participation – platforms like Reddit, Twitter, and Facebook contain billions of candid expressions of financial worry, aspiration, and lived experience. These platforms provide a continuous stream of data detailing specific concerns – from affording childcare and managing debt to saving for retirement or navigating unexpected expenses. This ‘digital exhaust’ isn’t simply a collection of complaints; it represents a nuanced and evolving picture of financial needs, priorities, and the language people use to describe their challenges, offering researchers and financial institutions a unique opportunity to understand and respond to these concerns with greater accuracy and timeliness.

The analysis of social media data offers a dramatically improved capacity to gauge financial stress and need compared to conventional methods. Traditional assessments frequently depend on self-reported information, which can be influenced by social desirability bias or simply fail to capture the immediacy of evolving financial hardship. By examining publicly available posts and discussions, researchers gain access to organically expressed concerns, revealing not just what people are struggling with, but also the intensity and context surrounding those struggles – in near real-time. This allows for a far more granular and nuanced understanding of financial precarity, identifying emerging trends and specific vulnerabilities that might otherwise remain hidden, and ultimately enabling more targeted and effective interventions.

Researchers are increasingly turning to digital footprints to understand complex human needs, and this study demonstrates the potential of publicly available Reddit data to illuminate financial concerns in a way traditional surveys often cannot. By analyzing millions of posts and comments, the investigation moved beyond self-reported data to identify prevalent financial stressors and priorities as expressed organically by individuals. Critically, the analysis didn’t just catalog these needs, but empirically validated that they aren’t random; instead, a clear hierarchical structure emerged, suggesting that basic needs – such as housing and food security – consistently take precedence over longer-term goals like retirement planning or investment, offering a valuable framework for targeted financial assistance programs and interventions.

Extracting Signal from the Noise: A Methodology for Digital Financial Assessment

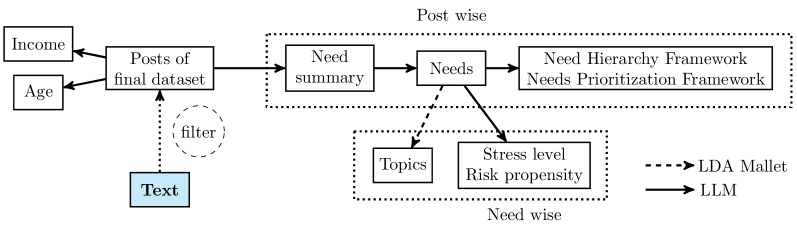

Data collection for this research utilized the Pushshift API, a publicly available interface to Reddit’s historical post archive. This API enabled the retrieval of submissions and associated comments from a specified timeframe and across designated subreddits. The Pushshift API was selected due to its capacity to deliver large volumes of data, facilitating a broad analysis of user-generated content. The resulting dataset comprised millions of posts and comments, providing a statistically significant corpus for identifying patterns and trends related to expressed financial needs. Data was downloaded in JSON format and subsequently processed to remove irrelevant information and prepare it for natural language processing techniques.

Large Language Models (LLMs) were utilized to process the textual data obtained from Reddit posts, enabling the extraction of pertinent features for subsequent analysis. Specifically, LLMs performed tasks including part-of-speech tagging, named entity recognition, and dependency parsing to identify key financial terms, user requests, and contextual information. These extracted features served as the foundation for identifying patterns and themes related to financial needs expressed within the Reddit discussions; the models were selected based on their demonstrated proficiency in natural language understanding and their capacity to handle the informal and often colloquial language present in online forum posts.

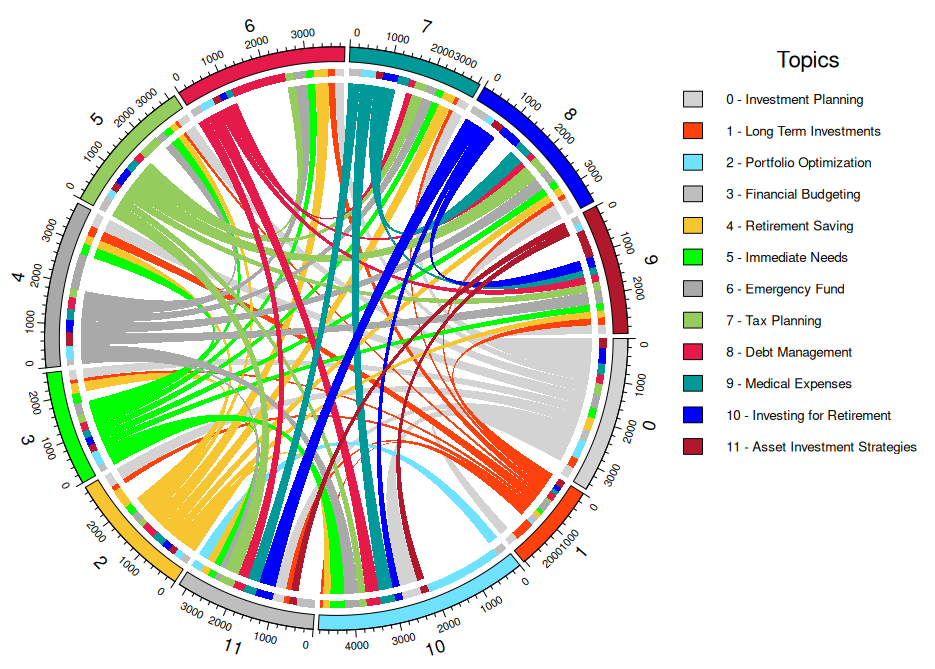

Topic modeling was performed on the Reddit post text corpus using Latent Dirichlet Allocation (LDA) implemented through the MALLET toolkit. This unsupervised machine learning technique identified underlying thematic structures within the data by probabilistically assigning each document to one or more topics. The number of topics was determined through coherence score optimization, evaluating the semantic similarity between words within each identified topic. The resulting topics were then manually interpreted to reveal prevalent financial needs expressed by Reddit users, providing a data-driven categorization of user concerns and interests. Parameters for the LDA model, including the number of topics and alpha/beta values, were tuned to maximize topic coherence and interpretability.

Emotional analysis of Reddit post text was performed using the Text2emotion library, a tool designed to identify and quantify emotions expressed in text. This process assigned scores to eight primary emotions – anger, disgust, fear, joy, sadness, surprise, trust, and anticipation – for each post. The Text2emotion library utilizes a lexicon-based approach, comparing words within the Reddit posts against a pre-defined emotional lexicon to determine the prevalence of each emotion. These emotion scores were then aggregated and analyzed to understand the emotional landscape surrounding stated financial needs, providing insight into user anxieties, frustrations, and positive sentiments related to their financial situations.

The Architecture of Need: Mapping a Financial Hierarchy

The investigation into a Financial Needs Hierarchy was predicated on the psychological theory of Maslow’s Hierarchy of Needs, which posits that human motivation is structured around a series of escalating needs. Applying this framework to financial concerns involved conceptualizing basic financial requirements – such as food, shelter, and essential healthcare – as foundational elements, analogous to physiological needs. Subsequent levels then addressed needs for financial security, including emergency funds and debt management, followed by investment for long-term goals like retirement and education, and finally, needs related to wealth building and philanthropic endeavors. This adaptation allowed for the categorization of financial needs based on their perceived level of necessity and their contribution to overall financial well-being, mirroring the progressive nature of Maslow’s original model.

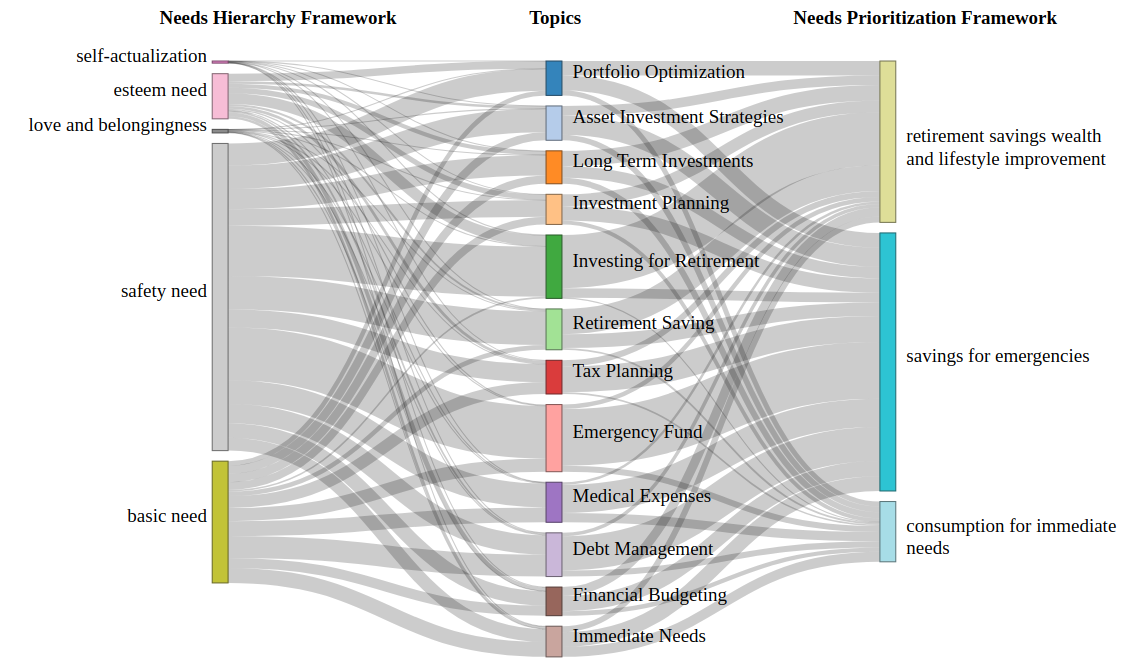

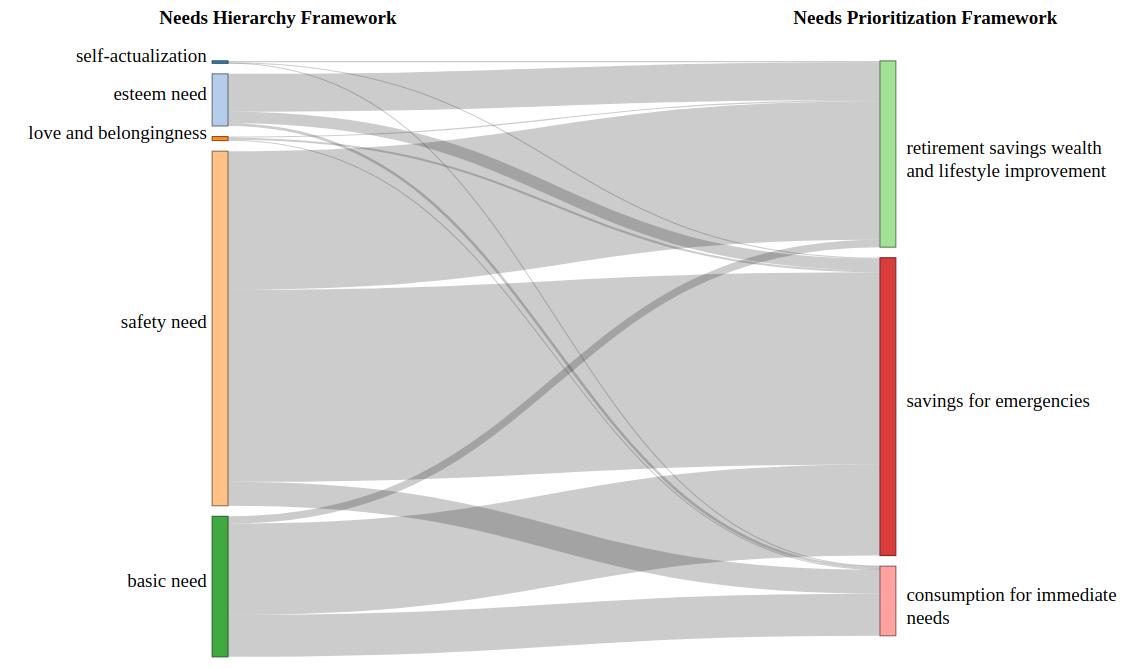

The research employed two distinct frameworks for categorizing and analyzing identified financial needs: the Needs Hierarchy Framework (NHF) and the Needs Prioritization Framework (NPF). The NHF, inspired by Maslow’s hierarchy, structured needs based on a tiered system reflecting fundamental requirements progressing to discretionary items. Conversely, the NPF utilized a more flexible approach, allowing for the prioritization of needs based on individual circumstances and perceived urgency, without a rigid hierarchical structure. Data collected on expressed financial concerns were then assessed using both frameworks to determine the prevalence of different need categories and to compare the results obtained from each analytical method.

The observed hierarchical structure of financial needs indicates that individuals do not approach all financial concerns with equal weight. Prioritization is demonstrably influenced by both perceived urgency – the immediacy of a need requiring attention – and perceived importance, which relates to the long-term consequences of not addressing a particular financial requirement. Needs categorized as both urgent and important were consistently ranked highest, while those deemed less urgent or important were addressed subsequently or potentially deferred. This prioritization process suggests a rational allocation of limited financial resources, aligning with behavioral models where individuals attempt to maximize benefit while minimizing risk and immediate negative consequences.

Analysis of collected financial need data consistently demonstrated a tiered structure, validating the use of hierarchical frameworks. Specifically, basic needs such as housing, food, and healthcare consistently ranked as highest priority, followed by security needs encompassing emergency funds and insurance. Subsequent tiers addressed needs related to financial independence, including debt reduction and retirement planning, and finally, discretionary needs like leisure and long-term wealth accumulation. This prioritization was observed across diverse demographic groups, indicating a predictable pattern in how individuals structure and address their financial concerns, thereby supporting the premise that a hierarchical model accurately reflects real-world financial behavior.

The Weight of Circumstance: Socioeconomic Influences on Financial Priorities

Research indicates a strong link between an individual’s income and how they rank their financial objectives. The analysis demonstrates that as income rises, focus shifts from immediate necessities – such as securing housing and managing food costs – towards longer-term financial goals like investment and future security. This prioritization isn’t simply a matter of choice; it’s a reflection of constrained resources and the pressures of meeting fundamental needs. Consequently, individuals with lower incomes dedicate a larger proportion of their financial thinking and behavior to basic survival, while those with greater financial stability can afford to consider wealth accumulation and long-term planning, shaping markedly different financial landscapes for people across socioeconomic strata.

Research indicates a clear divergence in financial priorities based on socioeconomic status. Individuals facing financial constraints consistently prioritize securing fundamental necessities – housing, food, and healthcare – dedicating the majority of their resources to immediate survival. Conversely, those with greater financial stability are able to shift their focus towards long-term financial security, demonstrated by increased investment in assets, retirement planning, and wealth accumulation. This suggests that financial priorities aren’t simply personal preferences, but are powerfully shaped by the pressures and opportunities inherent in one’s economic circumstances, creating a cycle where those with limited means remain focused on short-term needs while those with greater resources can build for the future.

Socioeconomic status profoundly influences how individuals approach their finances, shaping not just what they prioritize, but also how they behave in pursuit of those priorities. Research indicates a clear divergence in financial focus based on income level; those with limited resources understandably concentrate on securing fundamental necessities like housing and food, operating within a framework of immediate need. Conversely, individuals with greater financial stability tend to direct their attention towards long-term investments and building future financial security. This isn’t merely a matter of differing goals, but a reflection of how financial pressures – or the lack thereof – dictate behavioral patterns and risk tolerance, ultimately creating a cyclical relationship between socioeconomic standing and financial well-being.

Analysis revealed a strong relationship between financial resources and the psychological drivers of spending. A correlation of 0.40 demonstrated that as income decreased, focus on securing basic needs – such as food and shelter – increased, concurrently indicating heightened levels of financial stress. Conversely, a positive correlation of 0.25 showed that higher incomes were associated with a greater emphasis on pursuing esteem needs – including investments in experiences, education, or assets that contribute to social status and personal fulfillment – and, notably, lower reported stress levels. These findings suggest that financial priorities aren’t simply about economic capacity, but are deeply intertwined with psychological well-being, revealing how limited resources can concentrate attention on immediate survival while greater financial stability allows for the pursuit of longer-term goals and personal enrichment.

The analysis of user financial behaviors revealed a strong preference for calculative risk-taking, observed in over 70.83% of instances. This approach doesn’t imply reckless abandon, but rather a deliberate assessment of potential gains versus losses before engaging in financial activities – often involving careful research, comparison of options, and a focus on maximizing returns within acceptable parameters. This dominant strategy suggests individuals aren’t simply avoiding risk, but actively attempting to manage it through informed decision-making, prioritizing opportunities where perceived benefits outweigh potential drawbacks. The prevalence of this behavior highlights a generally rational, albeit cautious, approach to financial engagement within the studied population, contrasting with purely impulsive or avoidance-based strategies.

The study revealed a nuanced connection between financial priorities and risk tolerance. While securing basic needs like housing and food predictably correlated with risk aversion – a relationship quantified by a correlation of 0.28 – a surprising, albeit slight, positive correlation of 0.19 emerged between actively saving for retirement and engaging in calculated risk-taking. This suggests that individuals planning for long-term financial security may be more inclined to accept measured risks, potentially viewing them as pathways to achieving their future goals, rather than avoiding risk altogether. This interplay indicates financial behavior is not solely dictated by immediate needs, but also shaped by forward-looking aspirations and an assessment of potential rewards.

The observed links between socioeconomic status and financial priorities present a clear call to action for policymakers and financial institutions. Understanding that individuals facing economic hardship understandably prioritize immediate needs – housing, food, and essential expenses – highlights the limitations of conventional financial advice geared towards long-term investment. Effective interventions require tailored approaches; financial literacy programs must address the practical challenges of budgeting with limited resources, while institutions can design products and services that cater to those with varying income levels and risk tolerances. Furthermore, policies aimed at reducing income inequality and strengthening social safety nets could alleviate the financial stress that drives prioritization of basic needs, enabling broader participation in long-term financial planning and fostering greater economic well-being across all segments of the population. Addressing these disparities is not simply a matter of financial education, but a systemic shift towards inclusive financial systems and equitable economic opportunities.

The study’s validation of a financial needs hierarchy, mirroring Maslow’s established framework, suggests systems, even those governing economic behavior, are not static. They evolve, prioritizing foundational elements before ascending to more complex concerns. This resonates with a sentiment expressed by Alan Turing: “No system is immune to the ravages of time.” The research demonstrates how social discourse reflects this inherent prioritization-a bottom-up construction of needs driven by circumstance and income level. While the model identifies patterns, it implicitly acknowledges that these patterns are temporary states, subject to the inevitable decay of any structured system. Stability, in this context, is merely a snapshot of a constantly shifting landscape, a delay of the inevitable re-evaluation of needs as conditions change.

What Lies Ahead?

The validation of a financial needs hierarchy, as demonstrated through analysis of social discourse, merely establishes a baseline. It confirms a pattern-a gravitation towards baseline security before aspirational expenditure-but does not explain the rate of decay within those tiers. One might observe a persistent striving, a Sisyphean cycle of need fulfillment, rather than a static progression. The methodology itself, reliant on the currents of social media, is subject to the inevitable erosion of platforms and shifting user demographics-a technical debt accruing with each new algorithm update.

Future work must address the temporal dynamics at play. Uptime – that fleeting phase of harmonic need fulfillment – is rarely absolute. The research could expand to model the velocity of need, quantifying how quickly individuals revert to lower tiers following disruption. Furthermore, the inherent subjectivity of ‘need’ remains a challenge. What appears ‘essential’ is culturally contingent, and predictive models must account for the shifting sands of societal values.

Ultimately, this is not merely an exercise in behavioral finance, but a mapping of human resilience – or the lack thereof. The methodology provides a lens, but the true complexity lies in understanding the forces accelerating or decelerating the inevitable descent into entropy. The hierarchy itself is not a solution, but a symptom – a predictable response to the relentless pressures of existence.

Original article: https://arxiv.org/pdf/2602.06431.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 08:12