Author: Denis Avetisyan

A new dataset and evaluation framework, Conv-FinRe, assesses financial recommendation systems by examining alignment with a user’s long-term goals, rather than simply mirroring their past behavior.

Conv-FinRe introduces a longitudinal, conversation-based benchmark for utility-grounded financial recommendation, revealing a critical trade-off between rational financial advice and behavioral imitation.

Existing financial recommendation benchmarks often prioritize mimicking user behavior, overlooking the critical distinction between short-term actions and long-term financial wellbeing. To address this, we introduce ‘Conv-FinRe: A Conversational and Longitudinal Benchmark for Utility-Grounded Financial Recommendation’-a new evaluation framework that assesses large language models on their ability to provide advice aligned with investor-specific goals and risk preferences. Our analysis reveals a persistent trade-off between delivering rationally sound recommendations and simply mirroring potentially suboptimal user choices, highlighting the challenges of building truly effective financial advisors. Can we develop models that consistently prioritize long-term utility while remaining sensitive to individual behavioral patterns?

The Illusion of Accuracy: Beyond Simple Financial Metrics

The prevailing methods for assessing financial recommendation systems often prioritize simple accuracy – whether a suggestion is ‘right’ or ‘wrong’ – yet this overlooks the critical element of utility alignment. A recommendation can be technically correct but entirely unsuitable for an individual’s specific circumstances, failing to account for their risk tolerance, investment timeline, or broader financial goals. This reliance on limited metrics creates a skewed evaluation; a system maximizing accuracy may simultaneously minimize long-term wealth accumulation or increase unnecessary financial stress for the user. Consequently, a system’s true effectiveness isn’t captured by a single number, but rather by a complex interplay between correctness and its resonance with the user’s unique needs and preferences.

Financial decisions are rarely straightforward calculations; instead, they represent complex interactions between an individual’s circumstances and deeply personal considerations. Traditional evaluation metrics often fail to account for this intricacy, overlooking crucial factors like an investor’s willingness to accept risk – a characteristic that significantly shapes appropriate strategies. Furthermore, these metrics typically prioritize short-term gains, neglecting the importance of long-term financial planning aligned with life goals such as retirement or education. Compounding this issue are predictable behavioral biases – cognitive shortcuts and emotional responses – that consistently lead individuals to deviate from rational economic choices; these biases, including loss aversion and the tendency to follow trends, dramatically influence decision-making and are rarely captured by conventional assessment methods. Consequently, a recommendation deemed ‘accurate’ by a simple metric may prove wholly unsuitable for someone whose risk profile, time horizon, or behavioral tendencies differ from the assumed norm.

Evaluating financial recommendation systems requires a fundamental shift away from singular performance metrics towards a comprehensive, multi-view perspective. Current evaluation often fixates on easily quantifiable aspects, such as prediction accuracy, neglecting the inherently subjective and complex nature of financial well-being. A robust framework acknowledges that ‘good’ financial advice isn’t a universal constant, but varies based on individual circumstances, risk profiles, and long-term objectives. Consequently, evaluation should incorporate diverse expert opinions, behavioral insights, and a broader range of financial goals beyond simple returns. This necessitates developing methodologies that assess not just what a system recommends, but how well those recommendations align with varied interpretations of responsible and effective financial planning, ultimately fostering trust and improved outcomes for users.

Existing financial recommendation systems are often evaluated solely on quantifiable metrics, overlooking a critical dimension: alignment with established principles of sound financial advice. Current methodologies struggle to determine whether a recommendation, while perhaps technically ‘accurate’ based on historical data, actually reflects the considered judgment of financial experts. This gap arises because ‘good’ financial advice isn’t monolithic; it’s a spectrum informed by varying risk tolerances, investment horizons, and individual circumstances. Consequently, a recommendation deemed optimal by an algorithm may diverge significantly from the counsel a seasoned professional would provide, highlighting the need for evaluation frameworks that incorporate and weigh diverse expert perspectives. Bridging this disconnect is crucial for building trustworthy systems that genuinely serve user financial well-being, rather than simply optimizing for statistical performance.

Conv-FinRe: Mapping the Landscape of Financial Intelligence

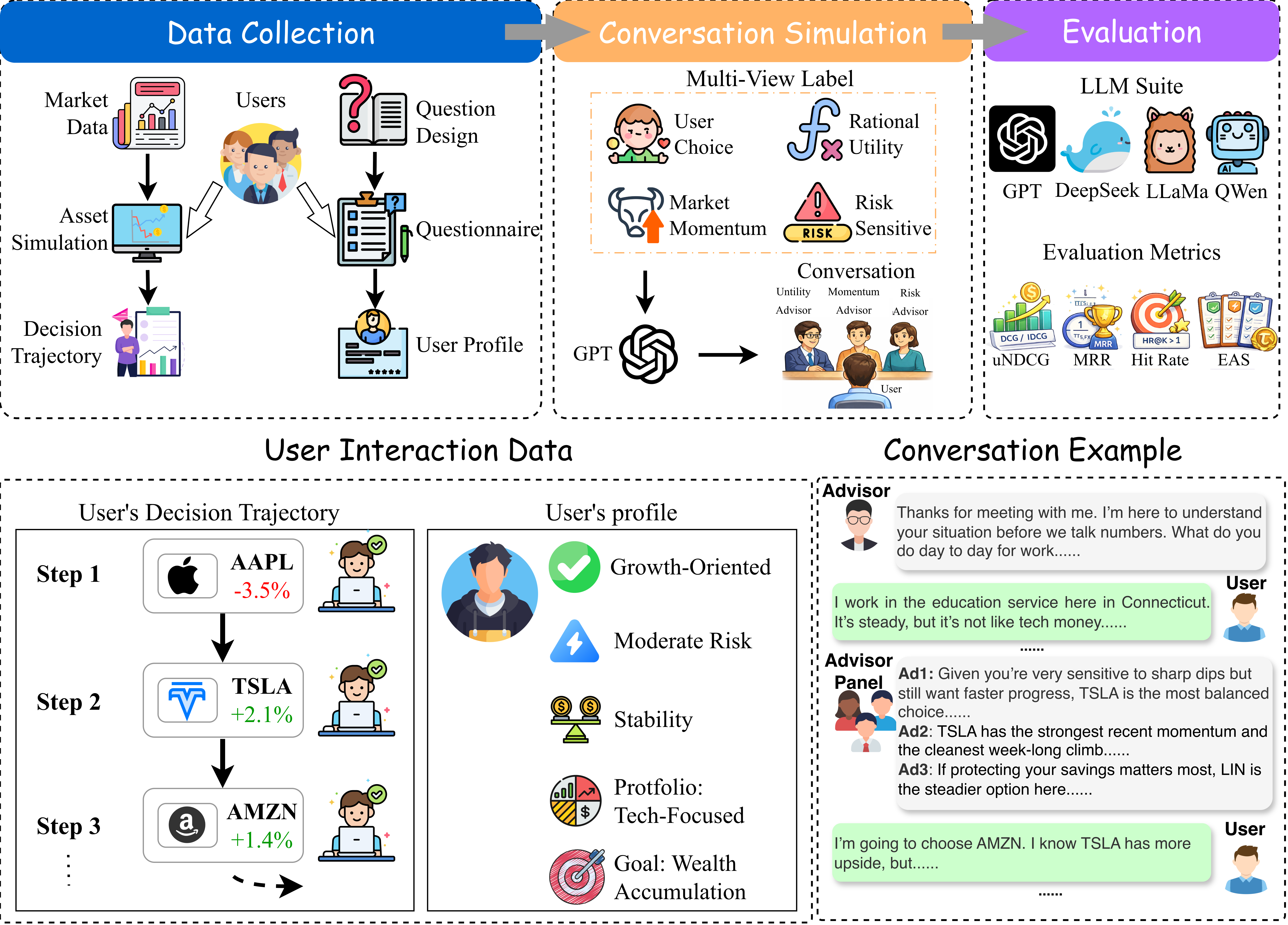

Conv-FinRe represents a novel evaluation benchmark specifically designed for financial recommendation systems. Unlike traditional benchmarks focused on static prediction accuracy, Conv-FinRe assesses performance through simulated, extended conversational interactions with users over time – a longitudinal approach. This framework necessitates that evaluated models not only provide recommendations, but also maintain coherence and adapt to evolving user behavior and market conditions across multiple turns of dialogue. The benchmark aims to move beyond assessing whether a system predicts correctly, to evaluating its ability to provide consistently useful recommendations within a realistic, interactive financial advising context.

Conv-FinRe distinguishes itself through Multi-View Alignment, a comparative evaluation methodology that assesses model-generated recommendations against four distinct reference points. These viewpoints include user choice, representing actual selections made by individuals; rational utility, indicating economically sound decisions based on established financial principles; market momentum, reflecting prevailing trends and market behavior; and risk sensitivity, quantifying the degree to which recommendations align with an investor’s tolerance for potential losses. By comparing model rankings across these multiple perspectives, Conv-FinRe provides a nuanced and comprehensive evaluation of financial recommendation system intelligence, moving beyond simple accuracy metrics to assess alignment with diverse, crucial factors.

Conv-FinRe utilizes Inverse Optimization techniques applied to longitudinal user interaction data to estimate individual risk preferences. This process analyzes a user’s historical portfolio choices – specifically, the assets selected and held over time – to infer the underlying utility function that best explains those decisions. Rather than relying on explicitly stated risk tolerance, the benchmark derives a quantitative risk profile for each user. This inferred utility function then serves as a grounded signal for evaluating the quality of financial recommendations, allowing for assessment of whether the model’s suggestions align with the user’s demonstrated risk-adjusted preferences and long-term investment behavior.

Conv-FinRe moves beyond traditional financial recommendation system evaluation, which primarily focuses on predictive accuracy, to assess the alignment between model decisions and demonstrable user utility. This is achieved by evaluating recommendations not solely on whether a user acted upon them, but against established financial principles – rational utility maximization, market trends, and risk tolerance. The benchmark infers user risk preferences from longitudinal behavioral data and uses this to establish a utility signal, allowing for a nuanced assessment of whether model recommendations are genuinely beneficial to the user given their individual circumstances and financial goals. This utility-grounded approach provides a more holistic measure of model intelligence, emphasizing the quality and appropriateness of decisions rather than solely their predictive power.

Decoding Performance: LLMs Under the Conv-FinRe Lens

The performance evaluation encompassed a range of leading Large Language Models (LLMs), specifically GPT-5.2, GPT-4o, DeepSeek-V3.2, Llama-3.3-70B, and Llama3-XuanYuan3-70B. These models were assessed utilizing the Conv-FinRe benchmark, a dataset designed to evaluate their capabilities in a conversational financial recommendation context. This benchmark provided a standardized platform for comparing the models’ performance across a defined set of tasks and metrics, enabling a quantitative analysis of their strengths and weaknesses in generating relevant and coherent financial recommendations.

Model performance was evaluated using several key metrics to provide a detailed understanding of their capabilities. ‘Utility-Based Normalized Discounted Cumulative Gain’ (uNDCG) assesses the ranking quality of assets based on rational utility principles, while ‘Hit Rate’ measures the frequency with which the correct asset appears within the top-ranked results. The ‘Expert Alignment Score’ quantifies the degree to which model recommendations align with multiple expert perspectives – specifically, Rational Utility, Market Momentum, and Risk Sensitivity – offering a comprehensive view beyond simple ranking accuracy. These metrics, used in conjunction, allow for a nuanced comparison of model strengths and weaknesses across different evaluation criteria.

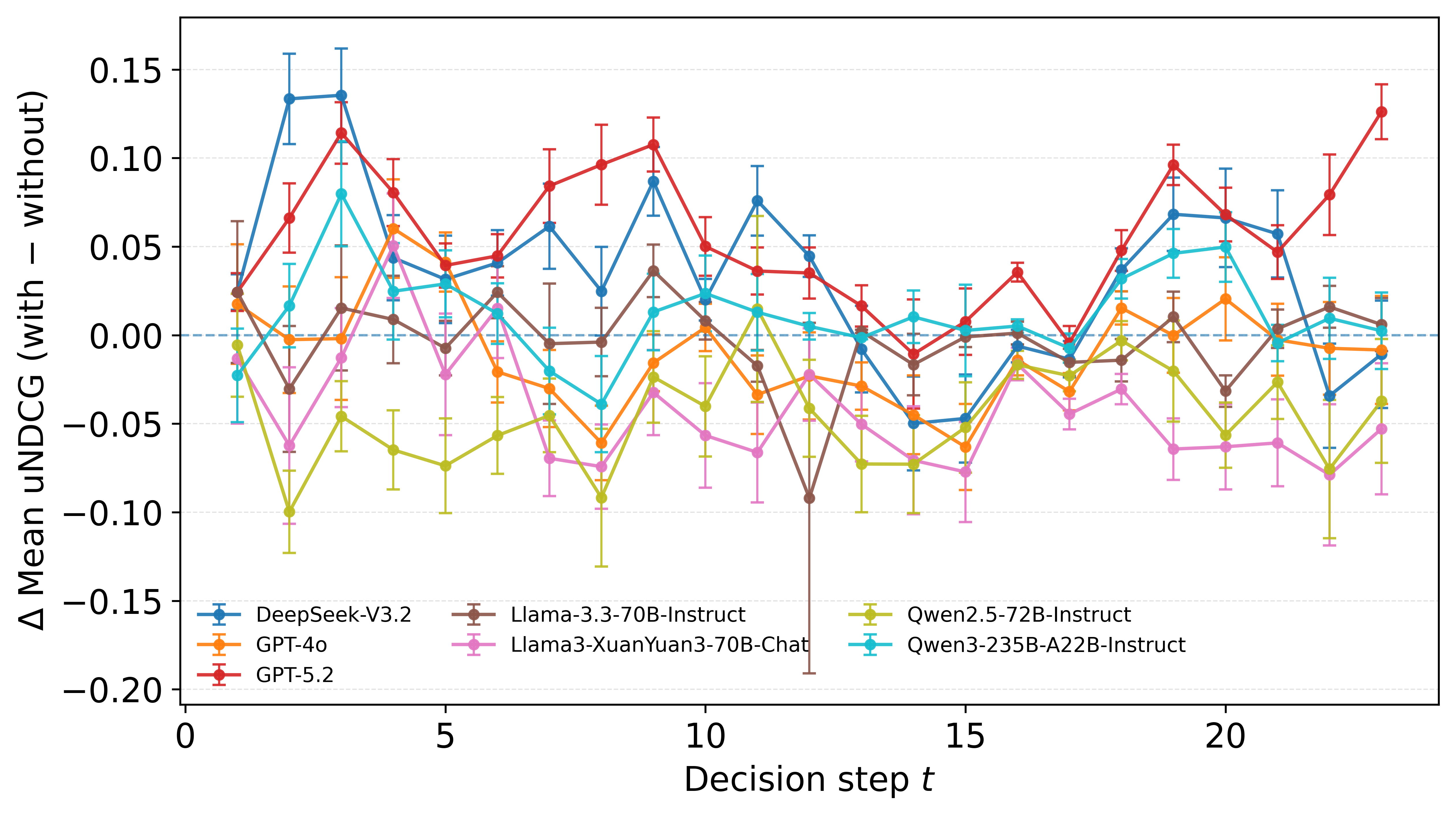

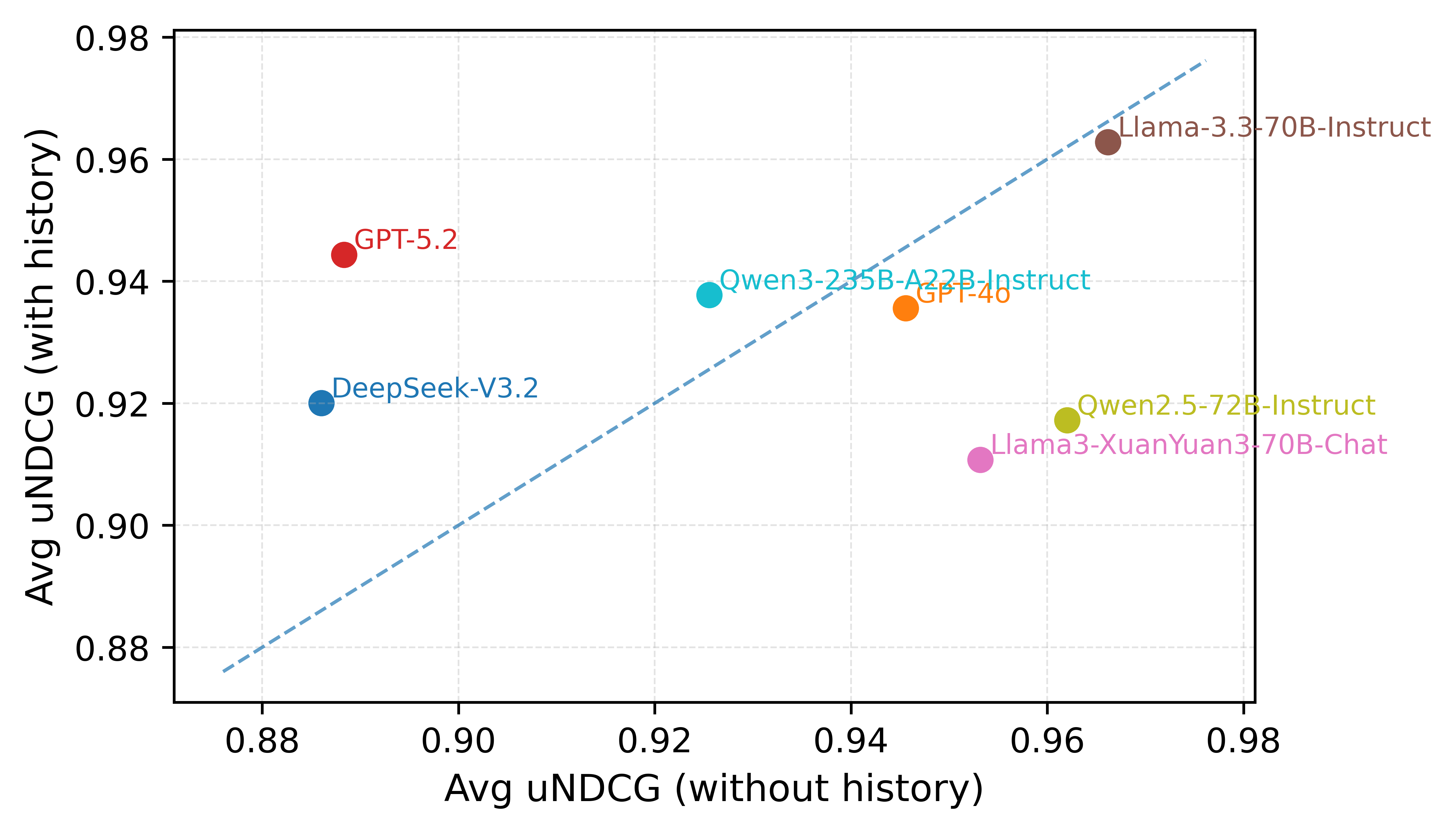

Evaluation using the Conv-FinRe benchmark indicates that leading Large Language Models consistently achieve a Utility-Based Normalized Discounted Cumulative Gain (uNDCG) score ranging from 0.92 to 0.97. This high uNDCG performance demonstrates a robust capacity to rank financial assets in alignment with the principle of Rational Utility – a metric reflecting logically sound and preference-consistent asset ordering. The consistently high scores across the evaluated models – including GPT-5.2, GPT-4o, DeepSeek-V3.2, Llama-3.3-70B, and Llama3-XuanYuan3-70B – establish a strong baseline for assessing the quality of asset ranking produced by these models, indicating a generally high level of agreement with rational economic principles.

Evaluation using the Conv-FinRe benchmark indicates that while large language models demonstrate overall strong performance, achieving complete alignment with multiple expert perspectives remains a challenge. Specifically, models often fail to consistently satisfy all expert criteria simultaneously when generating recommendations. However, certain models, notably Qwen2.5-72B-Instruct and Llama3-XuanYuan3-70B-Chat, exhibited improved performance in recovering user choice, as evidenced by their higher ‘Hit Rate @ 1’ and ‘Mean Reciprocal Rank’ (MRR) values. These metrics suggest these models are more effective at identifying the single, correct asset preferred by the user, even when faced with conflicting expert opinions.

The ‘Expert Alignment Score’ metric, used in the Conv-FinRe benchmark evaluation, indicates that DeepSeek-V3.2 exhibits a comparatively balanced performance profile across three distinct expert perspectives: Rational Utility, Market Momentum, and Risk Sensitivity. This score assesses the degree to which a model’s recommendations align with the judgments of experts representing each of these financial analysis approaches. While other models may excel in one or two areas, DeepSeek-V3.2 demonstrates a more consistent ability to generate recommendations that satisfy the criteria of all three evaluated expert viewpoints, suggesting a broader applicability across diverse investment strategies and risk tolerances.

Beyond Prediction: Shaping the Future of Financial AI

Conv-FinRe emerges as a significant resource for advancing financial artificial intelligence by establishing a standardized platform for evaluating conversational agents. This benchmark moves beyond simple task completion, instead emphasizing the crucial aspects of long-term utility and robust risk management – qualities essential for real-world financial applications. By providing a rigorous testing ground, Conv-FinRe actively encourages developers to build models that not only respond accurately to immediate queries but also demonstrate consistent, responsible behavior over extended interactions and varying market conditions. The availability of this tool is poised to accelerate innovation, fostering a shift towards AI systems that prioritize sustainable financial well-being rather than short-term gains, and ultimately building greater trust in algorithmic financial advice.

The Conv-FinRe benchmark is poised for significant expansion, moving beyond simple interactions to encompass more nuanced and challenging conversational scenarios. This includes simulating complex financial discussions, incorporating ambiguities, and demanding more sophisticated reasoning from AI models. Crucially, future iterations will also integrate a wider range of user profiles, reflecting diverse financial literacy levels, risk tolerances, and investment goals. By exposing AI to this greater variability, researchers aim to build systems that are not only technically proficient but also adaptable, empathetic, and capable of delivering personalized financial guidance to a broader audience. This emphasis on realistic user diversity is essential for validating the robustness and fairness of financial AI applications before widespread deployment.

The development of truly reliable financial AI hinges on mitigating behavioral overfitting, a phenomenon where models learn to exploit spurious correlations in training data rather than generalizing to real-world scenarios. This isn’t merely a technical challenge; it’s a fundamental requirement for fostering user trust and ensuring responsible deployment. Models susceptible to behavioral overfitting may perform exceptionally well on historical data, but falter – and potentially cause significant financial harm – when faced with novel market conditions or user behaviors. Consequently, researchers are prioritizing techniques like robust optimization, adversarial training, and careful data augmentation to build systems that prioritize genuine understanding and adaptability over superficial pattern matching. Addressing this issue is paramount, as the long-term viability of AI in finance depends on demonstrating consistent, reliable performance even in the face of unforeseen circumstances and evolving financial landscapes.

The true potential of artificial intelligence in finance hinges on aligning its decision-making processes with genuine human utility. Current AI models often optimize for narrow metrics, potentially leading to outcomes that, while statistically successful, fail to address broader financial well-being. Prioritizing utility-grounded decision alignment means designing AI systems that demonstrably improve financial outcomes – fostering savings, responsible investment, and effective debt management – as perceived by the individual. This requires a shift from solely maximizing profit or efficiency to a more holistic evaluation of impact, incorporating user goals, risk tolerance, and long-term financial health. Successfully implementing this approach promises not simply more sophisticated financial tools, but AI that actively empowers individuals to achieve greater financial security and overall well-being.

The pursuit of truly intelligent systems necessitates moving beyond mere behavioral replication. Conv-FinRe highlights this beautifully, revealing the complexities inherent in aligning recommendations with genuine utility-a user’s underlying goals, not simply their past actions. This echoes John McCarthy’s observation: “The best way to predict the future is to invent it.” The benchmark doesn’t seek to predict financial behavior, but to actively shape it toward rational outcomes, acknowledging that a system isn’t a mirror reflecting choices, but a garden cultivated with intention. The observed trade-off between rational advice and behavioral mimicry underscores the difficulty of this cultivation, where achieving long-term financial health requires a delicate balance between guidance and respecting individual agency.

The Long Game

Conv-FinRe, in its attempt to measure alignment with underlying financial goals, reveals a truth often obscured by metrics of simple behavioral prediction: every dependency is a promise made to the past. To optimize for stated preference is to presume a static self, a dangerous fiction in the face of longitudinal data. The revealed trade-off between rational advice and behavioral mimicry isn’t a bug, but a feature of any system attempting to model a human. It is a testament to the fact that systems don’t solve for utility, they interpret it, and interpretation is always colored by the lens of the interpreter.

The focus on multi-view alignment is a step toward acknowledging the inherent ambiguity of financial wellbeing, but it also highlights the limitations of inverse optimization. To infer goals from actions is to build a shadow of a self, constantly chasing a receding horizon. The future lies not in perfecting this inference, but in accepting its inherent imperfection.

This benchmark doesn’t offer control – control is an illusion that demands SLAs – it offers a mirror. And in that reflection, the field may finally begin to understand that everything built will one day start fixing itself, and the most skillful architectures are those that anticipate, even embrace, their own eventual obsolescence.

Original article: https://arxiv.org/pdf/2602.16990.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-20 16:57